Last updated on December 24th, 2023 at 03:59 pm

As the CBN Governor, Godwin Emefiele operated 593 foreign bank accounts, consented to the withdrawal of over $6 million from the Forex vault of the CBN, and stashed over £543 million in one of his accounts domiciled in the United Kingdom among other financial malfeasance levelled against him by the special investigator of his reign during his nine-year management of the Nigeria’s apex bank.

Profile summary

- Date of birth: August 4, 1961

- State of origin: Delta

- Education: UNN, UNIPORT

- Profession: Banker

- Assumption of office: June 4, 2014

- Reappointment: May 16, 2019

- Wife: Margaret Emefiele

- Children: 2

- Record: First Zenith Bank GMD to become CBN Governor

Here is the biography of a man who served three different presidents and two opposing political parties, and how he won several awards when he was in charge of Zenith Bank before he was appointed CBN Governor.

How Emefiele became so powerful that he had the effrontery to vie for president of Nigeria even while he was in office as head of CBN is a definition of a failed system.

This is the story of the humble beginning of Godwin Emefiele, who started as a university lecturer before changing career to banking, from where he rose to become the most powerful banker in Africa’s biggest economy.

Emefiele’s Audacity

On Friday, June 9, 2023, President Bola Ahmed Tinubu suspended the Governor of the Central Bank of Nigeria (CBN) Godwin Emefiele and ordered a probe into his financial dealings during his reign at the apex ban.

Everyone had expected it since Tinubu assumed office on May 29, 2023, but what was surprising to many was that the former CBN chief had to wait till he was kicked out of office. So, how did it start?

From 1958 to date, no governor of the Central Bank of Nigeria (CBN) dared to come out and purchase a presidential nomination form while still in office until Friday, May 6, 2022, when Godwin Emefiele, the 11th head of the apex bank, broke that jinx.

His predecessors had battles they fought, but Emefiele’s case unceremoniously became unique because the way the value of the naira fell against other major currencies was ridiculous.

From N166/$1 when he assumed office in 2014 to N760/$1 at the black market rate was the worst in the history of Nigeria’s forex market.

Emefiele Presidential Ambition

To the surprise of millions of Nigerians, Godwin Emefiele picked the NGN100 million presidential form on Friday, May 6, 2022, under the ruling All Progress Congress (APC).

A few hours before the news broke about Emefiele picking APC presidential form, a video of masked men who endorsed Emefiele for 2023 presidential election had circulated on social media. The gun-touting men claimed to be from the oil-rich Niger Delta.

The gunmen who claimed to be the Niger Delta Freedom Reserve Force stated that CBN governor is the only credible politician with the capacity to resolve Nigeria’s multi-faceted economic and social crises.

The video which was shared by Professor Chidi Odinkalu showed six men led by their leader read from a script:

“We are tired of recycling politicians in the system. We have settled for the governor of Central Bank of Nigeria, Godwin Ifeanyi Emefiele.

“If he is truly contesting, and the rumours are true, we believe that he will bring meaningful development and help the country get back on its feet.”

Emefiele is the first incumbent CBN governor to pick the presidential nomination form. Nigerians have described his action as what is beyond impunity.

They also said it shows the rascality of ‘Meffy’ and how he messed up Nigeria’s monetary system. “The game plan of these guys is beyond what an outsider can explain. We’re going to see Chief of Army Staff of Inspector General of Police picking a presidential nomination form in future,” a Twitter user said.

Calls for Emefiele Sack

Meanwhile, legal luminaries across Nigeria have condemned the action of Nigeria’s apex bank for picking a presidential form while he’s yet to resign as CBN governor.

One of them is Rotimi Akeredolu of Ondo State. While it was argued that he has the right to belong to any group according to Mr Akeredolu, who is also a Senior Advocate of Nigeria (SAN), it was right for Emefiele to have resigned before joining partisan politicians.

“Consequently, we admonish Mr Emefiele to leave the office, immediately, for him to pursue his interest. He cannot combine partisan politics with the very delicate assignment of his office.

“Should he refuse to quit, it becomes incumbent on the President and Commander-in-Chief of the Armed Forces to remove him forthwith. This is a joke taken too far,” he said.

Emefiele Many Financial Atrocities

No one knew that the former CBN Governor perpetrated such a huge financial mismanagement and misappropriation until a special investigation panel on the Central Bank of Nigeria (CBN) and related entities submitted its report to President Bola Tinubu.

What Nigerians did know was that Emefiele embarked on Naira coloring, which he called Naira redesign, and prevented Nigerians from having access to their monies between December 2022 till early 2023.

Several businesses collapsed during the naira redesign policy many Nigerians lost their lives, and bank facilities were touched by arsonists.

But the atrocities committed by Emefiele were even more than the failed Naira redesign policy. Emefiele took cash from CBN’s vault, sold banks to cronies, and opened almost 600 foreign bank accounts, according to Jim Obazee, the head of the special investigation.

Here is the list of financial mismanagement, corruption, and embezzlement leveled against Emefiele by the Jim Obazee-led investigation

Acquisition of Keystone Bank Without Payment Proof

When Emefiele was in charge of Nigeria’s apex bank, he perfected the “sales” of once troubled Keystone bank without payment proof, according to a report of a panel led by Jim Obazee.

It was reported that Emefiele popularly called Meffy used proxies, using his power as the head of CBN, to acquire the bank.

According to the report, this “deal” was executed through the connivance of the former Managing Director of Asset Management Corporation of Nigeria (AMCOM).

AMCON was said to have moved “N20 billion to Heritage Bank as placement sometime in 2017” while Heritage Bank granted a loan of “N25 billion to the promoters of ISA FUNTUA/EMEFIELE GROUP’S acquisition vehicles to buy Keystone Bank”.

The report read:

“Upon acquisition, Keystone Bank returned the 20 Billion back to Heritage Bank as placement. Thereafter, Heritage bank repaid AMCON from the cash flow so created.

“When the loan granted by Heritage Bank to ISA FUNTUA/EMEFIELE’s acquisition vehicles matured with outstanding balance, the MD of Heritage Bank (which was then in serious liquidity crisis) called for repayment. Unfortunately the shareholders of the bank (ISA FUNTUA/EMEFIELE GROUP) could not repay.”

Due to the illegal deals and pressure from Emefiele, the MD of Keystone and other top management officials of the bank, who were not comfortable with affairs of things at that time, resigned.

Emefiele Used Proxies To Setup Titan Trust Bank

In another part of the report, the panel also uncovered how Emefiele used proxy-run Titan Trust Bank (TTB) to acquire Union Bank.

On top of that, ill-gotten wealth was said to have been used for the setup and acquisition process shrouded in opaque.

The two Dubai-based companies used to set up Titan Trust Bank are Luxis International DMCC (Luxis) and Magna International DMCC (MAGNA). Both companies are owned by Vink Corporation Middle East FZC.

The real owners of the companies are yet to be unveiled at the time of this update, but it was revealed that the two companies do not have a physical presence in Dubai. They however claimed in the acquisition documents that they are UAE-based companies.

Even if they are UAE-based companies, the panel revealed that they are not “supposed to be allowed to operate or acquire a bank in Nigeria”, quoting section 3 subsection 5 of the Banks and Other Financial Institutions Act, 2020.

It was also discovered that there was an unknown shareholder who issued interest-free, long-term loans to TTB with no fixed repayment plan. The unknown shareholder was traced to be Emefiele.

Used Titan Trust Bank to Acquire Union Bank

On October 25, 2021, Titan Trust Bank sent a letter of no-objection to its proposed consolidation with Union Bank excluding its UK operations, the panel revealed.

Consented to Illegal Withdrawal of $6.23 million from CBN Vault

From one financial atrocity to another scandal, Emefiele was said to have also approved the removal of $6.23 million from CBN vault at the Abuja office,“purportedly for foreign election observer missions”.

The panel said the unlawful removal for the dollars was captured on closed-circuit television (CCTV) footage.

The panel said the signature of former President Muhammadu Buhari was forged to back up their illicit withdrawal.

The former secretary to the government of the Federation, Boss Mustapha, has specifically been indicted in this act. It was a connivance between Meffy and the former SGF.

The heist was backed by using a letter, “Presidential Directive on Foreign Election Observer Missions”.

Emefiele invested Nigeria’s money in 593 foreign accounts

The former CBN boss has also been indicted of opening and operating 593 foreign bank accounts domiciled in the United States, the United Kingdom, and China.

He invested the money without authorization by the CBN’s Board and Investment Committee.

Stashed over £543 million in the U.K

Specifically, the Obazee-led panel said it also uncovered 543.4 million pounds stashed in a single UK fixed bank account by Emefiele.

Carried out Naira Redesign Without Legitimate Approval

Part of the report uncovered how Emefiele unilaterally in connivance with some cabals in Buhari’s government redesigned the naira, which “was neither recommended by the Board of the CBN nor approved by the then President, Muhammadu Buhari, in contravention of the provisions of Section 19 (1) of the CBN Act, 2007.”

For instance, the panel said the redesign was only mentioned to the board of the CBN on December 15, 2022, after Emefiele had awarded the contract to Nigerian Security Printing and Minting Plc on October 31, 2022.

Background:

Brought up in Nigeria’s commercial city of Lagos, Godwin Emefiele who hailed from Ika South, Agbor, Delta State, speaks Yoruba like every typical Yoruba man in the South West.

Academic Career:

The CBN governor had his primary and secondary school education in the city of Lagos until he moved to Enugu State for his university education.

After completing his elementary education at the Government Primary School, Victoria Island, Lagos, in 1973, he proceeded to Maryland Comprehensive Secondary School, Ikeja, Lagos, with West African School Certificate (WASC) in June 1978.

His pursuit for university education took him to the University of Nigeria, Nsukka, Enugu State, graduating with a Bachelor of Science in Finance in 1984. And by 1984, he earned a Masters in Banking and Finance in 1986 at the same university.

In 2004, Emefiele proceeded to Stanford University, and Harvard University for an Executive Education.

In the year that followed (2005), he crowned it with another executive education at Wharton School of Business.

With an Honorary Doctorate Degree in Business Administration from the University of Nigeria, Nsukka, Emefiele isn’t just a banker but also an explorer in the educational space.

Board Memberships

- Appointed Chairman, International Islamic Liquidity Management Corp on December 15, 2016 (it’s a rotational position)

- Chairman, Board of Members, Central Bank of Nigeria (CBN) from 2014 till date

- Board Member, Zenith Bank Ghana Ltd from April 2005 till June 2014

- Board Member, Zenith Bank PLC from January 2001 till May 2014

- International Monetary Fund (IMF), Ex-Officio Member of the Board of Governors (since 2018)

- He was also a former Director of ACCION Microfinance Bank Limited

Emefiele As A University Teacher:

At the University of Port Harcourt, the brilliant Emefiele was an insurance lecturer before moving back to the University of Nigeria (UNN), where he was a finance lecturer until he resigned to join Zenith Bank in May 1990.

As An Accomplished Banker:

As one of the pioneer staff members of the young Zenith Bank in May 1990, the ex-university teacher taught it was a time to bring to practice some of the economic and banking theories in class.

He started as a manager in May 1990 till December 2001. He held other strategic positions and member of several committees to help the bank achieve its goals.

By January 2002, he rose to become the Deputy Managing Director, the position he held till 2010 until he was appointed the Group Managing Director in August 2010 till the end of May 2014.

By June 3, 2014, Godwin Emefiele assumed office as the Governor of the Central Bank of Nigeria.

A career full of unforgettable records:

1) He was the first GMD of Zenith Bank to become the governor of Nigeria’s apex bank.

2) Emefiele was the first governor of CBN since 1999 to be reappointed by the government for a second term.

3) He was the first CBN boss to undertake robust microeconomic policies aimed at boosting local production of what Nigerians consume

4) He was also the first head of Nigeria’s apex bank to spark the most controversial crisis in the foreign exchange market

Criticisms Against Him

Mismanagement Allegations of CBN Funds

In May 2019, a few days before the Nigerian Senate confirmed him for a second term, Godwin Emefiele was enmeshed in mismanagement allegations under his watch, he described the leaked audiotape as selective.

An online news platform Sahara Reporters had published an audio conversation of Emefiele’s deputy, Edward Lametek Adamu; Director for Finance, Dayo M. Arowosegbe and an aide to the CBN governor, Emmanuel Ukeje, where they discussed how to cover up for the loss of over N500 billion taken from the CBN vault in a private investment that went awry.

Emefiele threw the allegation behind him in a rebuttal when the apex bank’s Director of Corporate Communications said there was indeed a conversation among the top executives, describing what was published as being “selective conversation” and claimed that no money was lost neither was there any private investment scheme in Dubai as claimed by the online news platform.

The call for his sack wasn’t successful. Instead, President Muhammadu Buhari rewarded him with another five-year term for a job well done at the apex bank.

Cryptocurrency Ban in Nigeria

In February 2020, Godwin Emefiele instructed all financial institutions to stop funding cryptocurrency-related wallets. He described cryptos as a currency from the “thin air”

He said crypto was being used to fund terrorism and concluded that the restriction was part of the government’s plan to cut funding to Boko Haram, a terrorist group that has brought the North-West of Nigeria to its knees.

Hundreds of Nigerian crypto enthusiasts cried out, accusing the government of not providing jobs while it came up with policies to make them poorer.

The Nigerian spirit pushed crypto buyers and sellers in Nigeria to opt for Peer-To-Peer Crypto platforms, a few months after, Nigeria became one of the top 10 crypto adoption countries.

eNaira Project

A few months he banned Nigerians from using Nigerian bank accounts to fund their crypto wallet, he disclosed that the apex bank would be launching eNaira, a digital currency that would be regulated by the CBN.

Known as Central Bank Digital Currency (CBDC) globally, the eNaira will not replace the naira notes but rather explore the digital world.

Some Nigerians criticised him, saying he’s using the blockchain technology he described as a hoax to backup the eNaira project.

He wouldn’t listen to any of their criticisms, rather he said Nigerians should watch out for a formal launch of the project by October 1, 2021.

Penchant for Foreign Contractors

While those who believed that eNaira project wasn’t a bad idea, they, however, queried his decision to hand over the project to a Barbados-based company Bitt Inc.

They accused him of neglecting Nigerian blockchain experts who are spread across the country to contract it out to Bitt, the project is said to be worth millions of US dollars.

They said it was bad for Nigeria’s economy at a time the country is trying to resolve the imbalances in its balance of trade.

Again, the CBN fired back, saying every contractor was given an equal opportunity to bid.

Forex Controversy

Between 2014 to 2019, he supervised an interventionist currency policy by pumping billions of dollars into the foreign exchange market to ’empower’ Bureau De Change operators in Nigeria.

At a time, CBN was selling $50,000 to each of the BDC per week, it was reduced to $30,000 and settled for $20,000 per week when the number of BDCs rose astronomically to 5,500

As more forex licence applications were submitted, Emefiele set out his research team to know how lucrative the foreign exchange business was and what they found was alarming.

On July 27, 2021, he declared that funding BDCs was no longer sustainable, saying such funds would henceforth be diverted to commercial banks that have forex licence.

The decision has sparked the terrible performance of the naira against major currencies in the fx market.

Emefiele, was accused of trying to abolish the same multiple exchange rate regime he invented during his first term in office.

Although the naira was N412/$1 at the official CBN rate, the gap is huge at the parallel market. It was N576/$1 at the time of putting this biography together.

He believed that a legitimate fx buyer shouldn’t patronise the parallel market by saying,:

“When you talk about pressure on the exchange rate, I don’t see it because if you are sure that you’re conducting a legal business and you are authorized; you want to pay medical bills, you want to pay school fees, you know it is legal, you know it’s not something meant to perpetrate graft and corruption – go to your bank. The bank will take your documentation and they will do your transfers for you”.

Threat Against AbokiFX Founder

On September 17, 2021, Emefiele went viral after alleging that the founder of AbokiFX Olusegun Oniwinde Adedotun had manipulated the rate of forex on his tracking website.

He claimed that the rate of USD, Pounds, Euro against the naira on abokifx was an imagination of the Oniwinde.

Most Nigerians who had been following fx market berated him for holding a single entity responsible for the decade-long rot in the forex market.

Some of his critics say, he was chasing shadows and advised him to expose the real faces behind the failure of Naira against other currencies.

He vowed to shut down the website, a check by InfomediaNG as of Thursday, September 23, 2021, showed that abokifx was still live, but without live update and rates of currencies against the Nigerian currency

At the time of this update, it’s NGN750/$1 today March 13, 2023.

Naira confiscation

In October 2022, he announced naira redesign of NGN200, NGN500, and NGN1,000. The idea was for Nigerians to take their old naira notes to banks in exchange for the new notes.

Unfortunately, those who deposited the old notes were either not given the new notes or were given the amount that couldn’t sustain their businesses.

The policy has been described as currency confiscation by financial analysts, at the time of this update, the CBN was yet to release an update days after Supreme Court ruled that old and new naira notes should circulate side by side till December 31, 2023.

Emefiele Achievements

It would be unfair not to take a look at some of the good sides and successes Emefiele recorded at Zenith and the apex bank.

Positioning Zenith Bank for Competition

As the Group Managing Director and the Chief Executive Officer of Zenith, he deployed his leadership skill to compete favourably with the big three: First Bank, Union Bank, and United Bank for Africa (UBA) using Information Technology.

He didn’t only carry out banking services at the financial institution, he also won several laurels

For instance, his early years at Zenith witnessed a rise in the investment portfolio of the bank and began to announce intimidating net profits like the old players in the banking sectors.

The bank continues to build on the legacy he left behind, today, it has more than 500 branches spread across Nigeria.

Giant Strides At Single-Digit Loan

At the time, I was wondering if Nigeria had a Minister of Agriculture until Sabo Nanono was kicked out of office because the CBN under Emefiele-leadership played a prominent role in connecting with farmers more than the minister in charge of the Ministry of Agriculture and Rural Development.

Some of the agro-based policies and enterprising programmes the CBN introduced since he got into the office are:

NIRSAL

The Nigeria Incentive-based Risk Sharing System for Agricultural Lending got more boost under his management through its risk-sharing, insurance, technical assistance, rating, and by providing incentive mechanisms to farmers across Nigeria.

Through this, several billions of Naira of loan has been disbursed to farmers while the Nirsal Microfinance bank (NMFB) monitored the SME loans payment.

NCR

The National Collateral Registry of Nigeria is an initiative of the Godwin Emefiel-led CBN. It was created to improve Micro, Small and Medium Enterprises (MSMEs) access to credit facilities.

CIFI

Known as Creative Industry Financing Initiative, CIFI was designed by the CBN under his leadership in order to provide long-term and low-interest financing for entrepreneurs and business owners whose major challenge is access to soft credit facility most especially the creative industry like music, fashion, movies, and Information Technology.

YEDP

The Youth Entrepreneurship Development Scheme was designed to harness the entrepreneurial spirit of Nigerian youths by supporting them with single-digit loans to bring their business ideas to fruition.

NEMSF

Worried about the complaints by Nigerians that they could not get meters, the CBN under Emefiele’s leadership came up with the Nigeria Electricity Market Stabilisation Facility to support power distribution companies. In March 2021, the apex bank disclosed that it disbursed over N120 billion to DisCos for the project.

The NEMSF credit facility wasn’t designed to import meters, but to majorly concentrate on the local manufacturing and assembly of meters through which jobs could also be created.

AGSMEIS

Over the years, farmers suffered inexcusable neglect from the government. It’s either that the supports from the government do not get to them or such supports were hijacked by selfish politicians.

Emefiele came up with the idea of the Agri-Business/Small and Medium Enterprises Investment Scheme to majorly farmers.

A committee and inspection team were appointed to monitor the disbursement of such credit facilities and to check if farmers were using the loan for the purpose it was meant.

There were some skirmishes about AGSMEIS, but it has recorded success in some states and there are beneficiaries who have testified to the authenticity of the programme.

Other credit facility-induced programme created by the former GMD of Zenith are:

- The Non-Oil Export Stimulation Facility

- The Accelerated Agricultural Development Scheme

- National Food Security Programme

- Export Development Facility

- The Paddy Aggregation Scheme

- Anchor Borrowers’ Programme

Wrapping up

Godwin Emefiele was a successful teacher before venturing into banking, though he once said he would have studied Medicine.

At Zenith, he was a great manager which earned him the highest banking position at the Central Bank of Nigeria (CBN)

He started well, we hope he ends the current crisis in the forex market well so that his name would be written in gold if it requires stepping on toes to clean up shady deals allegedly involving the political class.

References:

- thisdaylive.com/index.php/2021/07/28/emefiele-cbns-intervention-funds-not-national-cake

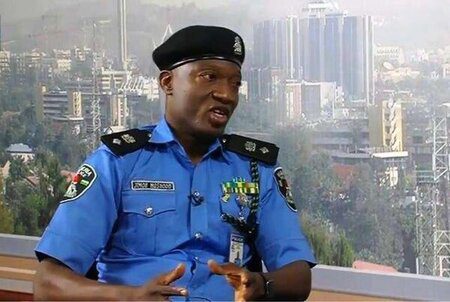

- Featured Image: Nairametrics

- godwinemefiele.com/about

- N500 Billion Rock CBN Under Emefiele Leadership: Officials Accused of Stealing Money From CBN Vault

- bellanaija.com/2016/12/godwin-emefiele-elected-chairman-of-international-islamic-liquidity-management-corporation