Last updated on March 30th, 2022 at 04:50 pm

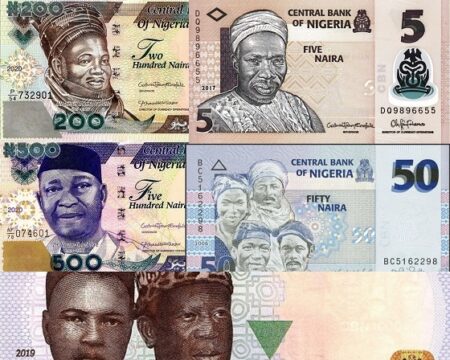

The naira is showing an improvement at the exchange market as it gained against the US dollar early morning of Thursday, November 11, 2021

On September 30, USD traded NGN580 while it went for NGN575 on October 6, five days after the Central Bank of Nigeria (CBN) postponed the launch of its digital coin dubbed eNaira which eventually launched on October 25.

Since the launch of eNaira, the first Central Bank Digital Currency (CBDC) in Africa, the fiat currency (naira) has been making a significant gain against foreign currencies at the exchange market. A few days ago, InfomediaNG Business Solutions (IBS) reported how eNaira is effecting change in exchange at the forex market.

Exchange Rate on November 11, 2021

As of 8:40, 1$ was exchanged at NGN540 (sell) and NGN550 (buy) in parts of Lagos. It closed at NGN535 (sell) and NGN545 (buy) on Wednesday, November 10, 2021

In Osogbo, Osun State capital, the black market exchange rate was NGN525 (sell) and NGN535 (buy) at the close of business on Wednesday, November 10, 2021, a BDC operator told IBS

“It closed at NGN525 yesterday (Wednesday), but I’m yet to get the update this morning. Even throughout yesterday we’re very careful about buying because no one knows what the next moment will be,” a BDC operator in Osogbo revealed to us

Speaking on what may have led to the appreciation of naira against other currencies, he said, “No one can specifically say, but we’ve noticed that since the launch of eNaira, the dollar has been losing value against the naira. When there is ow demand, dollars go down, when there is more demand, the price goes up,” our source says.

The spark in the depreciation of the naira at the FX market was majorly caused by the decision of the CBN that stopped the sales of FX to Bureaux De Change (BDCs) operators in July 2021

The implications of such CBN FX policy were expressed by the financial and international trade analysts that there would be scarcity in the market which would trigger desperation among buyers who couldn’t access FX at commercial banks.

At a time when the management of CBN was at crossroads about what could have caused the continuous depreciation of the naira against USD, Godwin Emefiele stunned Nigerians and the world that “sharp” practices by abokifx caused the poor performance of NGN/USD and threatened to arrest and prosecute its founder Olumide Oniwinde, a UK-based financial blogger.

But some analysts say Emefiele was chasing shadows, posited that boosting local productions, revitalising local companies, high reduction in foreign-made goods were some of the measures that could naturally reduce the demand for dollars which could cause the downward movement of foreign currencies against the naira.

Some people even called for the resignation of the troubled apex bank boss, a former university lecturer who resigned to join Zenith Bank Plc on inception in 1990.

Just like President Muhammadu Buhari, Emefiele is on his “second term” as the head at Nigeria’s no.1 bank.