Terraform Labs is not relenting in its effort to revive Terra coin (LUNA) which crashed from $64.13 to $32.00 on May 9, 2022, and dipped to further to nearly $0 in less than four days

Since the LUNA crash, the coin has not recovered and more than $40 billion of investors’ monies have been wiped out of its market capitalisation, thereby putting pressure on its CEO and co-founder Do Kwon who updated the community that a recovery plan was underway to regain the trust of the community.

First, Kwon through Terraform Labs – the firm behind UST and LUNA – proposed to fork the Terra blockchain which was put into voting for major LUNA investors.

One of such plans is a hard fork with the majority of the LUNA holders voting, “YES” for the proposal which spurred recovery plans.

The recent crash affected the cryptocurrency market where digital coins investors have lost billions of US dollars.

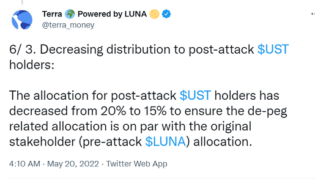

On the Twitter Page of Terra Friday, May 20, 2022, Terraform Labs disclosed that an amendment to Proposal 1623 that include the LUNA community’s feedback since its publication to include the following changes:

1. Focus on increasing genesis liquidity aimed at protecting the small wallet holders.

“For pre-attack $aUST holders, post-attack $LUNA holders, & post-attack $UST holders, the initial liquidity parameters have been modified from 15% to 30% to increase token supply at launch & mitigate future inflationary pressures.”

2. Introducing a new liquidity profile for pre-attack $LUNA holders.

This means that wallets with less than 10k $LUNA will have the same genesis liquidity as the small wallet holder (i.e., 30% unlocked at launch), and “have the remaining 70% vested over 2 years with a 6-month cliff.”

Introducing the new liquidity profile will ensure that small $ LUNA holders have similar initial liquidity profiles.

“This would cover 99.81% of $LUNA wallets while only representing 6.45% of total $LUNA at the Pre-attack snapshot,” Terra team said in a series of tweets.

3. The last amendment is to decrease distribution to post-attack $UST holders.

It decreases the allocation of UST holders after the attack from 20 to 15% “to ensure the de-peg related allocation is on par with the original stakeholder (pre-attack $LUNA) allocation.”

The latest revival plan raises lots of questions among holders whose coins are on third party crypto exchange platforms.

@LaarniMay27 asked:

“I hold Luna on my Binance account, do I need to transfer it to terra station?”

Other questions that have been asked by community holders include:

Since all tokens will be distributed, what tokens will be used for Liquidity pools?

How will $LUNA holders on exchange wallets be treated? Do I need to transfer all the LUNA in the terra wallet or I will get an airdrop in my Binance wallet.

My #Luna is on #uphold @UpholdInc. What should I do?-

@arashbhatti

Another user @Geek who is worried wants to know, “What happens to people who had terra on exchanges like Binance and kucoin? We lost most of our funds.

Will LUNA recover from the crash?

A lot of blockchain experts – including the founder of Binance Changpeng Zhao who has also lost almost his entire LUNA holdings says he’s poor again – have expressed pessimism about the LUNA recovery plan.

Even at the time of this update, hundreds of holders are doubtful that the revival plan would work, saying, “LUNA is dead”.

Kwon has been under pressure since the crash. In his home country South Korea, local media reported that investors are warming up to sue him and his company Terraform Labs.

The market price of the troubled coin beginning from April 19 to May 19, 2022, shows how LUNA went from its All-Time High of $119.18 on April 5, 2022, to $0.0001349 on April 19, 2022.

See the price below:

| Day | Open | Close | High |

| April 19 | $91.03 | $95.62 | $95.82 |

| April 20 | $95.57 | $94.96 | $97.25 |

| April 21 | $94.94 | $90.80 | $99.24 |

| April 22 | $90.78 | $93.68 | $96.71 |

| April 23 | $93.67 | $89.53 | $93.90 |

| April 24 | $89.44 | $90.56 | $92.18 |

| April 25 | $90.47 | $97.04 | $97.25 |

| April 26 | $96.96 | $88.55 | $97.28 |

| April 27 | $88.53 | $89.09 | $90.55 |

| April 28 | $89.10 | $88.96 | $92.31 |

| April 29 | $88.98 | $85.12 | $89.59 |

| April 30 | $85.07 | $78.34 | $86.29 |

| May 1 | $78.32 | $82.24 | $82.65 |

| May 2 | $82.24 | $84.31 | $85.11 |

| May 3 | $84.31 | $82.59 | $85.48 |

| May 4 | $82.58 | $86.17 | $87.96 |

| May 5 | $86.16 | $82.58 | $87.78 |

| May 6 | $82.55 | $77.46 | $82.94 |

| May 7 | $77.47 | $68.25 | $77.49 |

| May 8 | $68.25 | $64.08 | $68.27 |

| May 9 | $64.13 | $32.00 | $65.14 |

| May 10 | $31.98 | $17.52 | $39.47 |

| May 11 | $17.45 | $1.07 | $19.17 |

| May 12 | $1.07 | $0.003559 | $1.28 |

| May 13 | $0.003549 | $0.000102 | $0.01281 |

| May 14 | $0.0001147 | $0.0004588 | $0.0007658 |

| May 15 | $0.0004608 | $0.0002151 | $0.0004608 |

| May 16 | $0.0002153 | $0.0001956 | $0.0002793 |

| May 17 | $0.0001961 | $0.0001867 | $0.0002181 |

| May 18 | $0.0001866 | $0.0001472 | $0.0001971 |

| May 19 | $0.0001471 | $0.0001349 | $0.0001564 |

Officially launched in April 2019, LUNA is the native token of Terra used to stabilize the price of the protocol’s stablecoins.

Terra is a blockchain protocol that uses fiat-pegged stablecoins to power price-stable global payment systems.

Terra is a blockchain protocol that uses fiat-pegged stablecoins to power price-stable global payments systems.

How possible is it for Terra LUNA to recover from the recent crash?

As the crash is historic in the cryptocurrency world, recovering and gaining its lost value would be another history, if that ever happened.

“What I see here is people still could not accept the fact that it is dead.. Community and builders invested so much money and time already in the chain that they have no choice but to continue the effort. Give time and they will realize there is no point.”

@Frazen01

Another Twitter user, possibly an investor says:

“Right now @terra_money feels like a sports team that’s lost its star player. Could they still play well? Sure, but they need a good look at how they can reinvent themselves. I don’t feel this reflection from the leadership team.

0x_armin

At the time of publication, LUNA is $0.0001385 on the coin price aggregator website, CoinMarketCap.

Featured image

- By Mariia Shalabaieva