Loan applicants under the Agri-Business Small Medium Enterprises Investment Scheme (AGSMEIS) since the beginning of August 2021, started receiving messages from the Nirsal NIRSAL microfinance bank about the status of the fund applications.

What is Loan Decline?

Loan decline is a situation whereby a lender feels your application for a credit facility doesn’t meet the required eligibility criteria and therefore slams you with rejection.

Top with reasons why your loan can be declined are:

- Failure to meet Risk Acceptance Criteria

- Low credit score

- Unemployment

- Missing information

- Low income

- Temporary job

- Unverifiable application

- High debt-to-income ratio

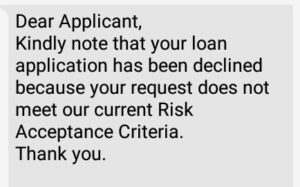

The message read:

“Dear Applicant, kindly note that your loan application has been declined because your request does not meet our current Risk Acceptance Criteria. Thank you”

Some of the applicants receive the above message after waiting for approval for more than a year, some applications had been pending close two years

Technically, the application wasn’t absolutely FREE as claimed by the officials of the Federal Government who are in charge of the funds.

Hundreds of business owners spent N15, 000 each to qualify for submission of application.

Indirect Application Fee

| Category | Price |

| EDI training | N10,000 |

| Business Plan | N5,000 |

| TOTAL | N15, 000 |

Why your application was declined

According to a message seen by InfomediaNG, your loan was declined because of the new directive by the Central Bank of Nigeria (CBN) regarding risk management.

“Please be informed that we are aware of the messages been circulated by NIRSAL microfinance bank informing some of you that your loan application has been declined because of “Risk acceptance criteria”, Nirsal said in an email

So, what’s next after AGSMEIS Loan Decline Message?

If you are one of the hundreds of applicants who received the message, don’t lose hope because you can still get up to N3, 000,000.

Here are the three practicable solutions and actions you should take immediately to get your loan approved:

- Login back to the improved portal of the Nirsal-AGSMEIS

- Review your application by changing the loan amount to N3M or less if you had previously applied for more than three million naira

- Hit submit and you should get a message in less than a month

Note: This guide applies to former applicants who had already done EDI training and already have their business plan uploaded on the portal)

If you are a fresh applicant, our guide would definitely be of help, you can find it at: https://infomediang.com/easiest-ways-to-access-cbn-agsmeis-loan-documents-and-designated-banks-to-access-the-loan

Takeaway:

If your AGSMEIS LOAN was rejected, you can immediately review your fresh application and get up N3M.

This means all former applications should review their application downwards to 3million naira or below to avoid another rejection.

No, I did not get the message about the payment of #15000. Naira at all. In my email or phone number.

I actually received a decline message after waiting for so long. However, I’ve login back to the improved portal of NIRSAL-Agsmeis,reviewed my application and reduced the loan amount to less than ₦3,000, 000 and submitted it for over months yet I’ve not received a response