Grey, a FinTech that makes it easier for freelancers to open UK, EU, and US virtual accounts, will no longer accept USD deposits from individuals and unknown sources via its Automated Clearing House (ACH) network.

In a communique sent to INFOMEDIANG, the company says the restriction is to add extra security measures as a response to the recent global cybersecurity trends and fraud risk. The restriction begins on Tuesday, May 28, 2024.

However, the restriction doesn’t affect ACH transfers for US dollar deposits into US checking accounts from some pre-approved organizations such as:

- PayPal,

- Deel,

- JPMorgan Chase,

- Citibank,

- ABN Amro,

- Bank of America,

- Barclays,

- Payoneer, and

- Upwork Escrow

The maximum amount you can receive per transaction is $10,000.

It also stated that incoming deposits via ACH from institutions not on the approved list or that exceed the $10,000 limit will be automatically rejected and returned.

Will other virtual accounts be affected by the change?

The latest update doesn’t affect the EU and UK bank accounts.

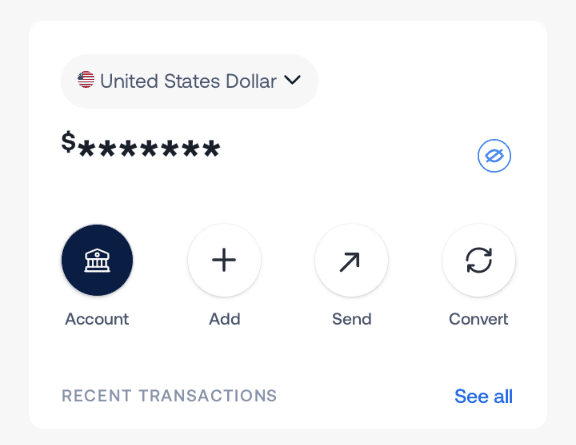

With Grey’s virtual accounts, freelancers can receive payment for their services around the world, send funds, and able to convert funds into local currencies.