What is NGX Invest?

NGX Invest is a digital platform that allows users to purchase rights issue and public offers of publicly traded companies right on their mobile device. The platform allows everyone who is 18 years and above to invest in companies that are listed on the Nigeria Exchange (NGX).

The platform was launched on Thursday, July 11, 2024, to streamline public offerings in the Nigerian capital market.

Approved by the Securities and Exchange Commission (SEC), the NGX Invest gives you access to the capital market right on the go irrespective of your location, putting investment in the hands of Nigerians and others around the world who want to participate in the Nigerian capital market.

How to buy public offers on NGX Invest

Create an account by first signing up. All you need to sign up are your name, email address, and your phone number and click on “get started”

A 6-digit code will be sent to your phone number and your email address. Enter the code in the space provided on the account creation page to verify.

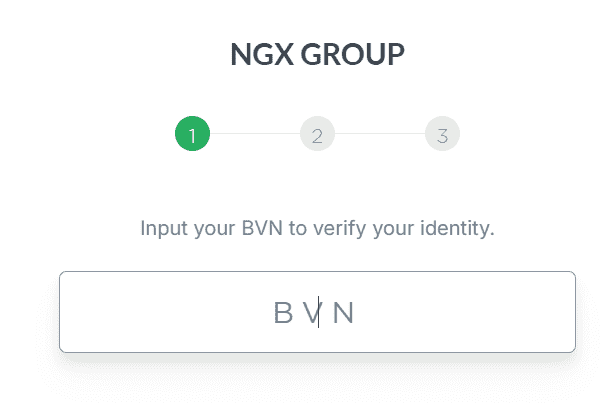

Give consent to your Bank Verification Number (BVN). By allowing this process, you allow the NGX invest platform to accurately profile your account as an investor.

Then enter your BVN to verify your identity. By entering your BVN the platform will automatically. In some cases, your BVN may fail to verify. Head back to the homepage to try to verify it again.

Enter your current banking mobile number to get a code to verify you.

On the next page, NGX GROUP will request to view and download your information, including your local government of residence, state of origin and biological information

Click “allow” to give consent to proceed to the next page.

Enter your CSCS or CHN Number (if you already have a broker). As for me, I already have a brokerage account with Chapel Hill Denham Securities Limited.

So, if you don’t have this, skip to the next page, you can get it later, but if you do, enter it

The final stage is to complete your profile page by filling in your National Identification Number (NIN), home address, phone number, and next of kin

Click on the submit button

Time to buy and take part in the rights issue

Login to your dashboard to see the list of the available Shares.

At the time of this publication, three offers were listed. They are Fidelity Bank PLC Rights Issue, Fidelity Bank PLC Public Offer, and Access Holdings Plc Rights Issue.

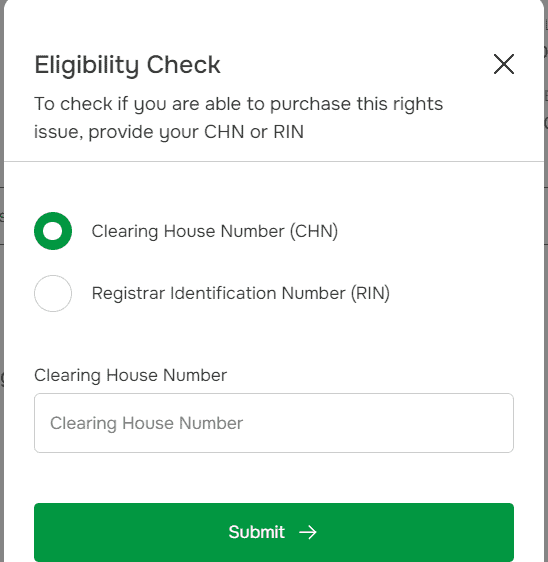

As for the “Rights Issue”, you have to check with your Clearing House Number (CHN) or Registrar Identification Number (RIN) to be sure you’re qualified to purchase the rights issue.

If you get an error message, “You are not a participant to this rights issue. Please check your input and try again”, it’s better to move over to the Public Offer. Check below on how to purchase the public offer

How To Buy Public Offer on NGX Invest Platform

Before you proceed, it is important to check the details of the shares. For instance, the Fidelity Bank Public offer has a deal size of 10,000,000,000 at N9.75 per unit.

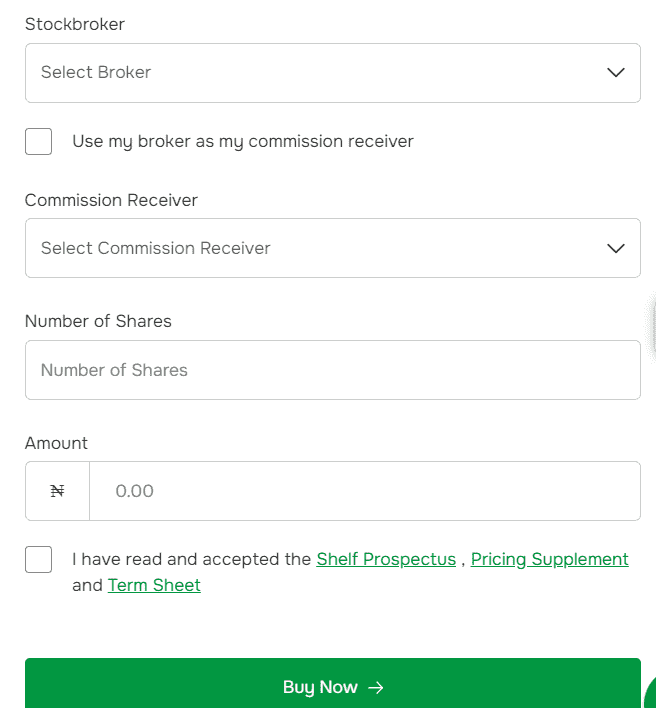

Select your preferred broker, for the purpose of this guide, I’m choosing Chapel Hill Denham Securities Limited

And I prefer my broker as my commission receiver, so I’m going to tick the next box

Enter the number of shares you want to purchase. The minimum unit you can buy is 1,000

Click on buy now

And proceed to make payment using Paystack checkout

Understanding the NGX Invest Platform

Unlike in the 90s, where investors would have to visit stockbroker offices, this new platform makes it easy to buy shares in Nigeria.

When you create an account (which we cover below), you can explore the available shares and make a purchase.

After you’ve subscribed, and shares have been alloted to you, you can access the NGX Invest platform to trade your shares on the NGX or you can sell such through your stockbroker.

Your dashboard has three menu:

- Offers

- Subscriptions, and

- Settings

Offers

Under “Offers” you will see the list of companies that are utilizing the platform to get investors on board. So, at a time when the Central Bank of Nigeria (CBN) has prescribed capital base for Nigerian banks: N500 billion for international authorisation; N200 billion for national; N50 billion for regional and merchant banks, and between N10 and N20 billion for non-interest banks with March 2026 as the deadline, we will most likely see the financial institutions go to the capital market to raise funds.

Subscriptions

To check which of the public offerings you subscribed for, click on the “subscriptions” menu. This will show you the date the shares were bought, the offer name, type of offer, number of shares etc.

Settings

This gives access to your profile, your brokerage information. You can head straight to this section whenever you want to change your password.