Thousands of Nigerians are interested in purchasing U.S stocks such as Tesla shares, Apple, Duolingo, access stocks within The Vanguard S&P 500 and many other shares that were once difficult for non-U.S. citizens to access. But with the coming of companies such as Bamboo Investment into the investment landscape, it is possible to buy foreign stocks while you resident in Nigeria by using the Bamboo App.

This article covers every information you need to begin your investment journey in the U.S. stocks via Bamboo App. There are other investment apps that allow you to buy U.S. stocks, but I will focus on Bamboo in this article.

Most importantly, one question that most Nigerians who are interested in foreign stock keep asking is: Is it Bamboo a registered and regulated investment company? It is important I address this fear.

Yes, Invest Bamboo is registered by financial regulatory bodies in Nigeria and in the U.S. It is registered with Nigeria’s Securities and Exchange Commission (SEC) and partners with Lambeth Capital for Nigeria stocks. As for the stocks in the United States, your account is protected by the Securities Investor Protection Corporation (SIPC) and Financial Industry Regulatory Authority (FINRA). And your investments are insured up to $500,000.

Disclaimer: The writer of this guide or InfomediaNG Business Solutions is not affiliated to Invest Bamboo. And we do not get any compensation from the information shared in this article. This is for informational purposes. However, we want you to know that all investments involve risk and the past performance of a security or other financial product does not guarantee future results or returns. This article is not investment advice, and individual investors should make their own decisions or seek independent advice.

Here is the step-by-step guide on how to purchase U.S. stocks, access Nigeria’s stocks through the Bamboo App

Stage 1: Download the app

- Download the app

- Click on “start building wealth” if it’s your first time of using the app, it means you have to set up an account. But if you already have one, click on sign in

- Choose your country. Bamboo investment app supports almost every African countries

- Fill in your details, including your name, date of birth, and phone number, email address

- And then create a password, which must contain 1 small letter, 1 capital letter, I number, I special character, all in 8 characters in all.

- Click the acknowlegement to continue

- Enter the CAPTCHA, note that it is case sensitive

- Enter the OTP sent to your phone number

- Then create 4 digit transaction PIN

- Don’t forget to check your inbox to verify your email address to get access to all functionalities.

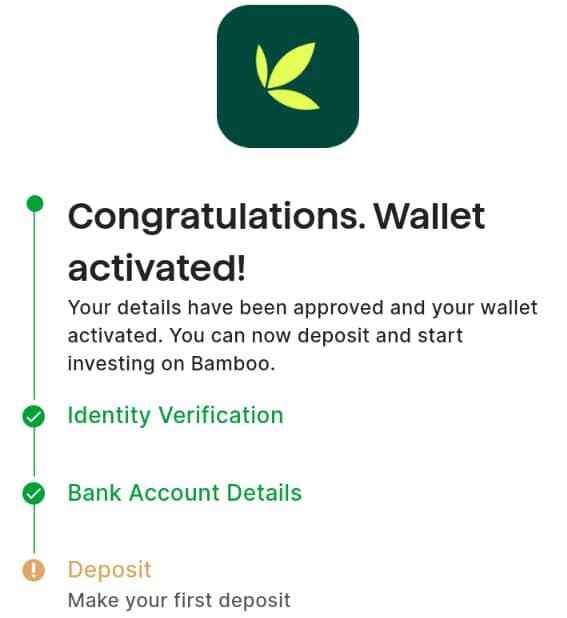

Stage 2: Know Your Customer (KYC)

- And proceed to the KYC area to gain access to a dedicated wallet and start your investment journey

- Enter your BVN

- After entering your BVN, it will automatically take you to a page where you need to provide your bank details.

- If your bank and bank account number is correct, the app will automatically fetch your full name, click on submit.

Stage 3: Make your first deposit

- Make a deposit into your wallet to begin buying stocks in the United States and from other tier 1 companies around the world.

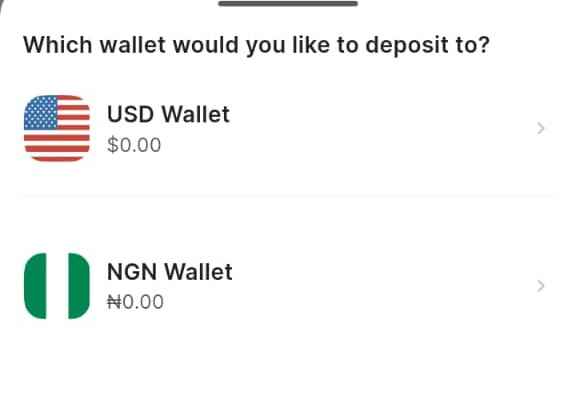

- The app automatically assigns two wallets to your account: the USD wallet and NGN Wallet, choose your preferred choice.

- Minimum deposit is $1 which is equivalent to N1,554.00 at this time of publication. Based on the prevailing exchange rate, this can change depending on the market forces.

- Through this, you can make a deposit either through direct bank transfer from your bank or via third party like Flutterwave.

- We choose direct bank deposit, copy the assigned Naira wallet and make a deposit

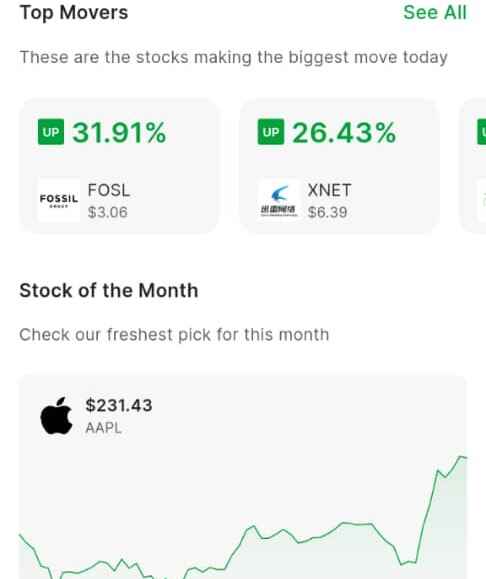

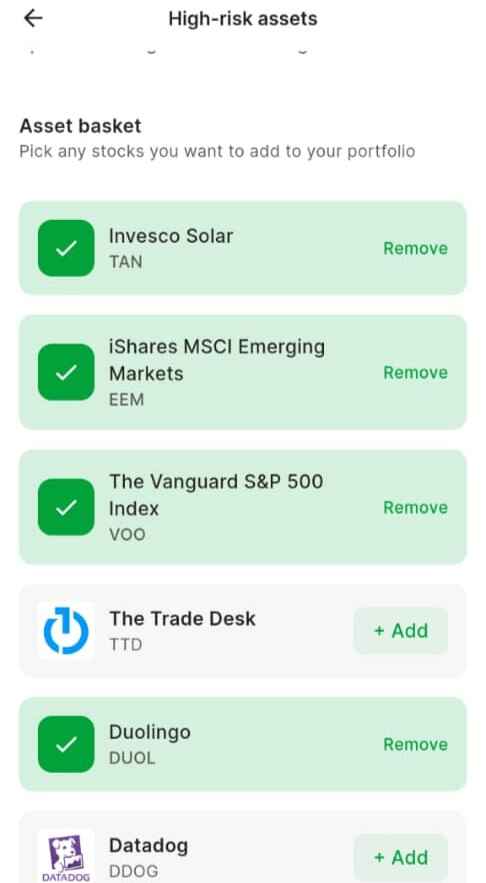

- Then choose which company’s stocks to buy and start investing

Stage 4: Start your first stocks

- Click buy, enter the amount, and confirm the transaction.

- Track and manage your investments

- Monitor your portfolio in real time once in a while. It could even be once a month.

- Receive dividends if the stocks you hold pay dividends.

- You can sell anytime and withdraw to your bank.

Stage 5: Withdraw funds

Withdraw to your local (Naira) account or USD account. Note that processing time usually within 1–3 business days.

Note: You need to maintain a minimum balance of N1,000 or equivalent in any of your wallets to activate your Naira stocks trading account.

What I like about Bamboo investment app

They don’t request much detail from you, your basic details and your Bank Verification Number (BVN) are what is required to get access their investment hub. They don’t need you’re your ID card, NIN nor your driver’s licence

They have more than 3,000 stocks, meaning you have a wide range of options to pick from.

You can join their WhatsApp Channel via the app to get first-hand info about new listed stocks and performance updates about stocks, so I will advise you to join this channel to stay updated.

Bamboo is regulated in Nigeria by the SEC and partners with DriveWealth LLC (a U.S. brokerage) for U.S. investments.

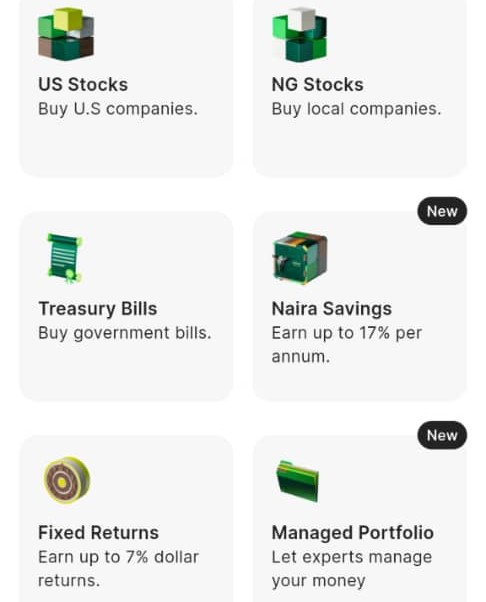

Apart from the fact that the Bamboo App gives you access to U.S stocks like Apple, Tesla, and Amazon among others, you can also invest in Naira and earn up to 17% interest per annum (I will cover this part extensively in my next blog post because we already have an existing guide on banks in Nigeria where you can earn more than 15% interest on fixed savings)

It is a one-in-all investment hub for Africans who would have ordinarily found it difficult to access global stocks.

It isn’t just about U.S stocks, you will also be able to purchase Nigerian stocks via the Bamboo NGX portal, ETFs (Exchange-Traded Funds), and Fixed-income products such as Bonds and Treasury Bills.

You are immediately allocated a US stocks ID when your account is set up.

Bonuses

It’s time to put everything in order, such as entering the details of your next of kin in case an unforeseen event occurs (no one prays for that, but it is inevitable), so you must do this.

Setting up details of heritage

- Click on heritage, otherwise known as the beneficiary designate

- Enter his/her details, including name, DOB, relationship, address, email address and phone number and save.

Notifications

If you are keenly interested in upscaling your investment journey, I would advise that you set up the notifications for breaking news for trades such as market general news about stocks, general makret news about the stocks on your watchlist, breaking news about the stock you own etc.

Deposit from Card

If you like to make direct deposit from your debit card, you can click on the saved card to link a card to your wallet to make it easy whenever you want to make a deposit. But this isn’t compulsory since you can always make a deposit through a third party.

Investment profile

You want to make sure that your investment profile is in order. Now, click on KYC status. Click the investment profile to answer some questions. This is the section where you can set a goal, marital status, risk tolerance, and source of wealth, net worth, and yearly income, among others.