Bureaux De Change operators are not backing down despite the decision of the Central Bank of Nigeria (CBN) to stop the sales of forex to them.

They stated this Thursday, July 29, 2021, in Abuja after Godwin Emefiele-led CBN declared that some of the operators are conduits for money laundering and diverted the forex meant for the BDCs to commercial banks.

After the announcement of the CBN on July 27, we looked at the possible implications of such a decision on Nigerians and the economy, which can be found at: https://infomediang.com/implications-cbn-stops-forex-sales-to-bdc-operators

They are also encouraging potential customers to even patronise them more as their licenses were still valid with the apex bank.

The action of the apex bank is seen as the toughest one ever, but some say it could render the BDCs irrelevant in the forex market.

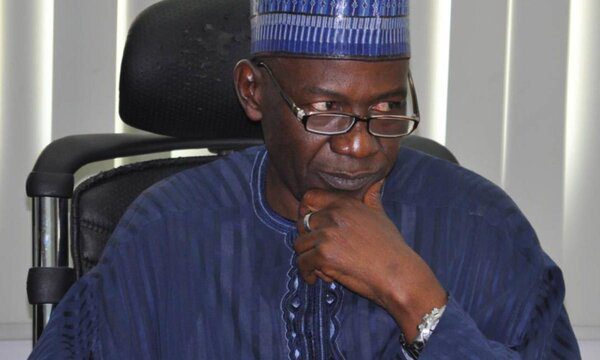

But the President of Association of Bureaux De Change Operators of Nigeria Alhaji Aminu Gwadabe said operators are still providing foreign exchange services.

He said that BDCs were empowered to source forex from other sources and to provide various services to members of the public.

He was quoted as saying:

“BDCs are licensed to provide retail FX services, including buying from the public and also selling to end-users for allowable transactions, namely personal travel allowance, business travel allowance, payment of medical and school fees.”

Issues will be resolved

Gwadabe who said CBN hasn’t stopped their operating licenses, promised that his association would engage apex bank to resolve the issue.

“While the CBN has stopped dollar sales to BDCs, it has not canceled their operating licenses or banned them from providing FX services to members of the public.

Erring members will be sanctioned

The ABCON president stated that the latest CBN policy on forex is a wakeup call and an avenue to widen their customer base

“While we continue to engage the CBN, we will also put measures in place to identify and sanction earring BDCs, where necessary,” he said.