Decentralized Finance (DeFi) is transforming how we manage and interact with money in the areas of investment, insurance, derivatives, and other financial activities on centralized finance.

Key Takeaways:

- DeFi is powered by blockchain smart contract protocol.

- With DeFi, you can do most of the things you do on centralized finance (banks) such as earning interest on your investment, borrowing, lending, and trading derivatives.

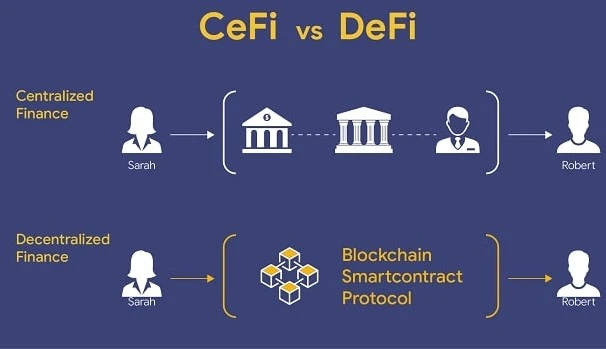

- While there are intermediaries in centralized finance (traditional banks), decentralized finance relies on blockchain tech, with no middlemen.

What benefits will DeFi bring to the financial sector? And will it disrupt the traditional banking norms? We’ll explore several ways DeFi is revolutionizing the financial sector, its benefits, risks, and its use cases.

What is DeFi?

Defi is a form of blockchain-based finance that does not rely on intermediaries, it relies on blockchain technology for its effective operation.

Simplifying How Decentralized Finance Work

Blockchain is the foundation on which DeFit is built. Blockchain is like a digital ledger, a record book that keeps track of transactions.

But unlike traditional ledgers, it is distributed across multiple computers around the world, making it impossible to alter past transactions. DeFi allows for financial transactions to be open, secure, and direct.

Imagine a world where you don’t need a bank to keep your money safe or a broker to buy stocks. In a nutshell, DeFi takes the middleman out of finance.

Its essence, DeFi is the power shift from institutions to individuals. With DeFi, financial power is in your hands, especially when the Ethereum upgrade is fully deployed to change the financial space.

DeFi will make financial services more accessible, transparent, and democratized. It’ll change how we see and use money.

Examples of DeFi Platforms

There several DeFi platforms in the financial world today, some of them with high volume of transactions include:

- Instadapp

- Convex finance

- JustLend

- Lido

- Compound Finance

- MakerDAO

- Curve Fi

- Pancake Swap

- dYdX DeFi Platform

- Uniswap

How DeFi Takes Middleman Out The Picture

DeFi does this by using programs known as smart contracts. A smart contract is like a digital vending machine.

You put your request in, and the contract automatically fulfills it, without the need for a bank or a broker.

Use Cases of DeFi in the Financial Sector

One of the most prevalent applications of DeFi is peer-to-peer (P2P) lending and borrowing.

With DeFi, you can lend or borrow funds directly from others on the platform. You can choose the interest rates, eliminating the need for banks or other intermediaries.

Stablecoins

Stablecoins are a type of cryptocurrency that is pegged to a stable asset like the U.S. dollar. They aim to combine the benefits of cryptocurrencies, like security and transparency, with the stability of traditional currencies.

Stablecoins play a crucial role in DeFi applications, providing stability in a highly volatile crypto market.

Decentralized Exchanges (DEXs)

Think of a stock exchange, but without the middleman. That’s what a Decentralized Exchange (DEX) is.

DEXs allow users to trade cryptocurrencies directly with each other, bypassing brokers or other intermediaries. This means you have more control, and transactions are quicker and cheaper.

Derivatives and Prediction Markets

DeFi is also reshaping derivatives and prediction markets. Derivatives are contracts that derive their value from an underlying asset.

Prediction markets allow individuals to bet on the outcome of future events. Both of these are now possible in a decentralized way, opening up new opportunities.

Insurance

Insurance is another significant use case of DeFi. Thanks to smart contracts, it’s possible to create decentralized insurance platforms.

These platforms can provide coverage for various risks, including smart contract failures, price volatility, and more.

DeFi versus CeFi or Traditional Finance

Traditional finance includes banks, investment firms, insurance companies, and other financial institutions.

Centralized finance gives room for intermediaries, facilitating financial transactions, storing your money, granting loans, and more.

While traditional finance relies on intermediaries, DeFi takes an innovative approach by removing these intermediaries, and instead, technology plays their role.

With the help of smart contracts on the blockchain, DeFi offers a peer-to-peer financial system. It promises an open, inclusive financial ecosystem that is transparent and secure.

Differences Between DeFi and Traditional Finance

Control: In traditional finance also known as centralized finanace, institutions such as banks have control over transactions.

With DeFi, control shifts to the users, giving you more power over your financial activities.

Accessibility: Banks and financial institutions usually operate in specific geographical regions and during set hours. DeFi, being a technology-based solution, is accessible anytime, anywhere.

Transparency: centralized finance often involves complex processes that lack transparency. DeFi, powered by blockchain, provides a transparent system where every transaction can be traced and verified in any part of the world.

Security: While banks are generally safe, they can be prone to breaches. DeFi, built on secure blockchain technology, offers robust protection against fraudulent activities.

Benefits of DeFi

According to World Bank data, about 1.7 billion adults globally don’t have access to a bank account as of 2017. DeFi is capable of changing this narrative.

Internet connection is all you need to access DeFi platforms. No need for a physical bank or a face-to-face meeting. No need for a banking hall.

It’s finance that’s truly inclusive, here are the advantages of DeFi to financial ecosystem:

Transparency and Security

Trust is hard to build but easy to break. In traditional finance, trust is a significant issue.

With DeFi, however, transactions are transparent and traceable. Blockchain technology makes this possible. It adds a level of security and transparency that’s hard to find elsewhere.

High-Interest Rates

Your money should be working for you, not the other way around. With DeFi, you can earn high-interest rates on your deposits, often much higher than what traditional banks offer. And the best part? It’s available to everyone, not just the ultra-wealthy.

Flexibility

In DeFi, smart contracts automate transactions. They can be programmed to trigger transactions when certain conditions are met.

This programmability brings flexibility and efficiency to financial processes, a feature that is unique to DeFi.

Making Finance User-friendly

In traditional finance, switching between different services can be cumbersome. DeFi changes this by creating an open and interoperable ecosystem.

This means you can seamlessly switch between different DeFi services. It’s finance made user-friendly.

Risks

Smart contracts are the backbone of DeFi. However, they are also one of its biggest risk factors.

A flaw in a smart contract can lead to significant losses. While audits and testing can reduce these risks, they cannot completely eliminate them in the following ways:

Liquidity Risks

In DeFi, liquidity – the ease with which an asset can be converted into cash – is a key concern.

If there are not enough lenders or borrowers on a platform, it can become illiquid, creating challenges for users trying to withdraw their funds.

Lack of Regulatory Oversight

One of DeFi’s main attractions is its decentralized nature, free from governmental control. However, this can also be a risk.

With no central authority to oversee operations, DeFi users are mostly on their own when it comes to resolving disputes or recovering lost funds.

Complexity and User Errors

Using DeFi platforms can be complicated, especially for those not familiar with blockchain technology.

A single mistake could result in losing access to your assets. User-friendly interfaces and educational resources are essential for mitigating this risk.

DeFi’s Potential Impact on the Financial Sector

Reshaping Banking and Financial Services

DeFi has the potential to reshape the banking and financial services industry. It provides a blueprint for a more inclusive, efficient, and transparent financial system.

Banks and other financial institutions may have to adapt to stay relevant in this rapidly changing landscape.

Regulatory Developments

As DeFi grows, so does the attention it receives from regulators. Governments around the world are beginning to explore how to regulate DeFi without stifling innovation.

The United States, Canada, Australia, Germany are some of the countries that are trying to regulate the DeFi.

These regulatory developments will play a crucial role in DeFi’s future and its broader adoption.

Conclusion:

Despite these risks associated with decentralized finance, its benefits outweigh its challenges. It is better than centralized finance in several ways.

As with any emerging technology, it’s expected to evolve and improve over time, making it more secure and user-friendly