The Financial Conduct Authority (FCA) has unveiled plans to accelerate the use of tokenisation in the UK’s asset management industry, aiming to spur innovation, boost efficiency, and strengthen the country’s position as a global financial hub.

- The FCA will issue guidance on operating tokenised fund registers under existing rules using the UK’s “Blueprint” model.

- It plans to introduce a streamlined dealing model for fund managers to process transactions in both traditional and tokenised funds.

- A roadmap will be developed to tackle barriers such as using public blockchains and enabling full on-chain settlements.

- The regulator will also open discussions on how regulation may evolve as tokenisation models mature.

The move, announced in a statement on Tuesday, includes new guidance designed to give firms greater clarity and confidence in adopting distributed ledger technology (DLT). The regulator said the initiative aligns with its broader strategy to support growth and modernization across financial markets.

The UK currently hosts around 2,600 asset management firms overseeing £14 trillion in assets for domestic and global clients. According to the FCA, embracing tokenisation could help firms remain competitive as investment patterns evolve, while giving consumers more choice and access to diversified products.

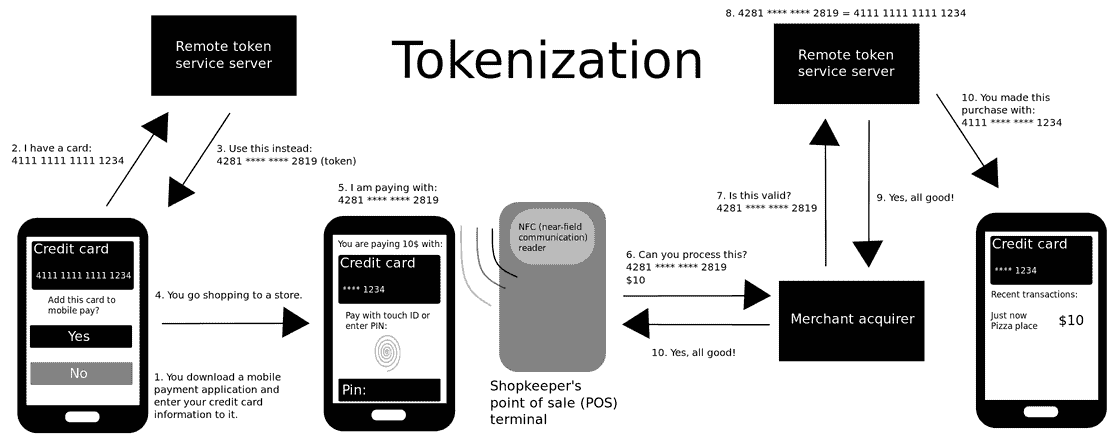

Tokenisation, the digital representation of assets on a blockchain, is expected to reduce operational costs and improve efficiency in fund management. It could also make private markets and infrastructure investments more accessible to retail investors.

Simon Walls, Executive Director of Markets at the FCA, said the technology could transform the industry:

“Tokenisation has the potential to drive fundamental changes in asset management, with benefits for the industry and consumers. There are many things that firms can do under our existing rules and more that become possible with the changes we propose enacting now. The UK has the opportunity to be a world-leader here and we want to provide asset managers with the clarity and confidence they need to deliver.”

The FCA has been working closely with industry players to explore how DLT can streamline fund operations, lower reconciliation costs, and enhance transparency.

With this initiative, the regulator said it hopes to position the UK as a frontrunner in responsible tokenisation, one that balances innovation with investor protection and market integrity.