If your savings account earns little or no interest, you’re missing an opportunity to grow your wealth. Inflation reduces the value of idle cash over time, but you can protect and grow your money by choosing safe and interest-bearing investment options.

This guide explains how to invest idle money through Mutual Funds, Treasury Bills, and Save–Spend–Earn digital banking products, with clear pros and cons for each option so you can make informed decisions.

Disclaimer: This article is for educational purposes only and should not be taken as financial advice. Always consult a licensed financial advisor before making investment decisions.

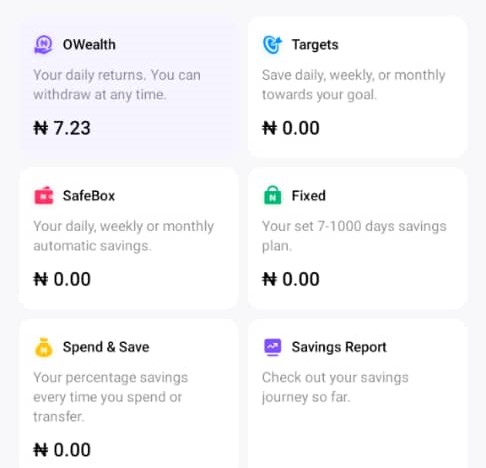

High-Yield Savings on Digital Banks – Flexible and Rewarding

In Nigeria, many licensed digital banks, such as Opay Fixed Savings, PiggyVest Lock, Fairmoney Fixed Deposit, and Moniepoint Fixed Savings, as well as investment apps like Invest Bamboo, now offer savings products that automatically earn interest. The majority of these apps allow you to earn between 15% to 28% as interest on your savings per annum.

In the United States, high-yield savings accounts, often offered by digital banks, are upgraded versions of traditional savings accounts. These online-only institutions keep overhead low, allowing them to pay higher interest rates, typically 4% to 5% annually as of mid-2025, compared to the 0.01% to 0.5% from brick-and-mortar banks. They’re ideal for idle money you might need in the next few months to a year, as they let you save, spend, and earn without locking up your funds.

To get started, research FDIC-insured digital banks like Ally, Capital One, or SoFi. Open an account online by providing your personal details, linking an external bank account, and transferring funds. Most require no minimum deposit, and setup takes minutes via their app or website. Once funded, your money starts earning interest daily, compounded monthly.

The bottom line is that interest by the fintechs or investment apps are often higher than traditional banks, along with cashback rewards for spending.

Pros:

- Higher interest rates compared to regular savings accounts.

- Easy access to your funds through mobile apps.

- Extra rewards like cashback and bonuses.

- Higher returns than standard savings, helping your money grow faster, for example, in the U.S. $10,000 at 4.5% could earn about $450 in a year. If you invest the equivalent of that money (N15,307,055) in Opay Fixed Savings at 18% interest per annum, that’s N2,755,269 as earned interest per year.

- FDIC insurance up to $250,000 per depositor in the U.S, while NDIC does similar thing in Nigeria protecting your principal from bank failure.

- High liquidity, with easy transfers to checking accounts, often via ACH or wire, and some offer debit cards for spending.

- Low or no fees, plus user-friendly apps for tracking balances and automating deposits.

Cons:

- Regulatory checks needed to ensure legitimacy.

- The majority of the digital financial banks have no physical branches, which might frustrate those who prefer in-person service for complex issues.

- Interest rates may change over time.

- Limited deposit insurance compared to traditional banks.

Best For: People who want both flexibility and returns on their savings.

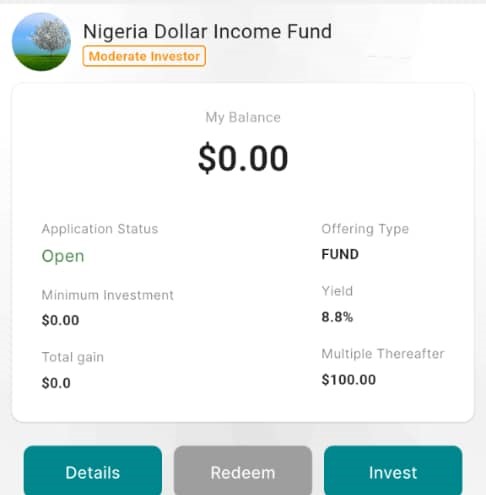

Mutual Funds – Diversified and Professionally Managed

Mutual funds pool money from multiple investors to purchase a diversified portfolio of assets, such as government bonds, corporate bonds, and stocks.

For idle money, focus on low-risk types like money market funds or short-term bond funds, which aim for steady interest around 3% to 5% annually while preserving capital. They’re suitable if you can commit funds for at least a year and want diversification beyond single securities.

If you are in Nigeria, you can talk to your bank, or investment apps such as PiggyVest, InvestNaija (formerly Chapel Hill Denham) and Bamboo among others.

If you are in the States, to start, open a brokerage account at firms like Charles Schwab or E-Trade. Research funds with low expense ratios (under 0.5%) via tools like Morningstar. Invest by transferring money and buying shares, many have no minimums for beginners. Reinvest dividends to compound growth.

Pros:

- Diversification reduces risk by spreading investments across multiple assets, reducing the impact of your asset’s poor performance.

- Professional management removes the burden of choosing investments yourself, where experts handle selections and adjustments, saving you time.

- Daily liquidity, allowing redemptions at the end-of-day net asset value.

- Accessibility with relatively low minimum investment amounts.

- Potential for higher returns than savings accounts (in conventional bank), especially in bond-focused funds during rising rate environments.

Cons:

- Fees, including management expenses that can eat into returns, always check the expense ratio.

- Market risk, as values can dip slightly due to interest rate changes or credit issues, unlike insured accounts.

- Withdrawal restrictions in some funds.

- Taxes on dividends and capital gains, even if you don’t sell, which can complicate your filings.

- No government insurance, though reputable funds from major providers minimize this concern.

Best For: Beginners who want a hands-off, professionally managed investment.

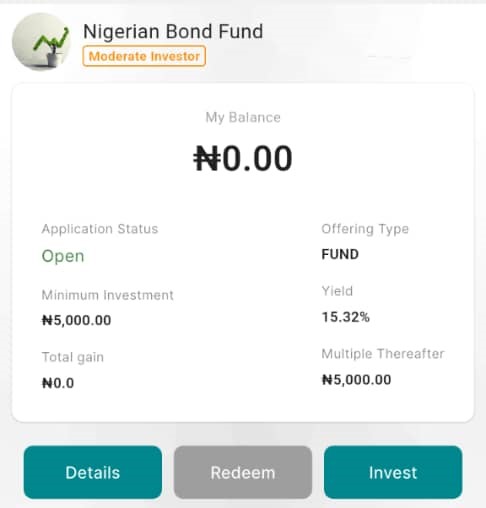

Treasury Bills – Low-Risk, Government-Backed Security

Treasury Bills (T-Bills) are short-term debt instruments issued by the government. They are sold at a discount and redeemed at their full value upon maturity. InvestNaija also gives you access to this and a few other apps, including Bamboo.

It is even made amplifier for U.S. residents as beginners can purchase T-bills directly through TreasuryDirect.gov. Create an account, link their bank, and bid in weekly auctions, non-competitive bids ensure you get the bill at the auction rate. Brokerages like Vanguard or Fidelity also offer them with minimal fees. Decide on the term based on when you’ll need the money back.

Pros:

- Extremely low risk, backed by the full faith of the U.S. government, with no default history.

- Tax advantages, as interest is exempt from state and local taxes, though federal taxes apply.

- Predictable earnings, since you know the return upfront if held to maturity.

- Liquidity on the secondary market if you need to sell early, though prices can fluctuate slightly.

Drawbacks:

- Lower yields compared to riskier investments, potentially missing out on higher returns elsewhere.

- Funds are tied up until maturity unless sold, which might involve a small loss if interest rates rise.

- Opportunity cost if rates increase after purchase, as you’re locked into the initial yield.

Best For: Conservative investors seeking security and guaranteed returns.

Key tips for investing idle money

- Know your risk tolerance before choosing an option.

- Check all fees to understand the real return.

- Diversify your portfolio for safety and better returns.

Conclusion

Idle money loses value over time, but you can change that by putting it into safe and interest-bearing investments. Mutual Funds offer professional management, Treasury Bills provide government-backed security, and digital bank savings products give flexibility with competitive rates. Start small, monitor your returns, and reinvest to build your wealth steadily.