A Japanese Bitcoin treasury firm, Metaplanet, has issued JPY 2 billion (approximately $13.4 million) in 0% bonds to fund additional Bitcoin purchases, adding to its existing BTC reserves.

The BTC treasury firm announced this on its X handle (formerly Twitter) on Thursday, February 27, 2025, marking its latest move in a series of purchases that began in May 2024.

Metaplanet’s statement indicates that this is its seventh acquisition aimed at building up its BTC reserves at a time when Bitcoin was trading below $87K.

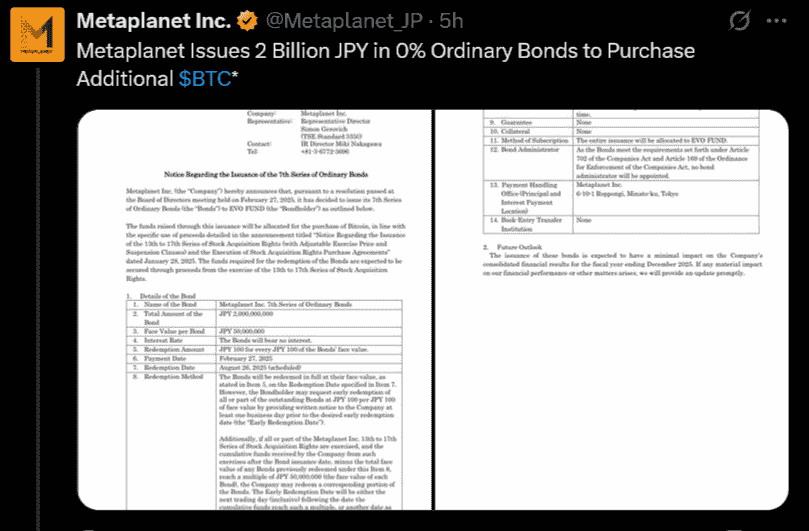

The company stated that the issuance of its 7th series of ordinary bonds was backed by a resolution “passed at the Board of Directors meeting held on February 27, 2025.”

Details of the Bond

The company disclosed that the JPY 2 billion bond has a face value of JPY 50,000,000 per unit. The bond will bear no interest and has a redemption date set for August 26, 2025, at which point it will be fully redeemed at face value.

Not Metaplanet’s First BTC Acquisition

The firm has been actively purchasing BTC since 2024. On December 20, 2024, it made its largest acquisition to date—buying 619.7 BTC when Bitcoin was priced at $92,175 per unit. Currently, the company holds 2,235 BTC in its reserves, data from Bitcoin Treasuries say.

Metaplanet’s move into BTC acquisition is similar to Michael Saylor’s Strategy, which pioneered Bitcoin treasury investments. Inspired by bullish predictions on Bitcoin’s price, more companies are now adopting a similar approach.

Formerly known as MicroStrategy, the U.S. software firm co-founded by Michael Saylor set the precedent for corporate Bitcoin holdings.

What’s Metaplanet’s Stock Performance Saying?

Founded long before digital currency became mainstream, Metaplanet’s performance on the Japanese stock market had been underwhelming since 2013. However, things have shifted since the company started accumulating BTC. In less than a year, its stock price surged from 200 yen to 6,650 yen in early 2025.

Although its stock has since slid to 4,000 yen at the time of publication, this is still a significant improvement compared to its performance a decade ago.

Earlier, the company revealed that it is on track to acquire 10,000 BTC by Q4 2025 and aims to increase its holdings to 21,000 BTC by the end of 2026.