In Nigeria’s banking sector, where traditional commercial banks often provide fixed savings interest rates between 3% and 7%, savers looking for higher returns have options among licensed fintech platforms. These institutions, regulated by the Central Bank of Nigeria (CBN) and covered by the Nigeria Deposit Insurance Corporation (NDIC), offer fixed savings products with rates starting from 15% per annum.

If you have funds idle for 3 to 6 months, fixed savings accounts lock in money for a set period should be your great option for you to earn interest (without access until maturity).

Here are the six banks in Nigeria where you can earn at least 15% interest on your fixed savings accounts: FairMoney, PiggyVest, PalmPay, OPay, Moniepoint, and Kuda. We’ll also cover the pros and cons of each platforms based on user reviews from credible sources.

OPay Fixed Money

OPay provides Fixed Money savings with up to 18% interest per annum beginning from 365 days maturity upwards. The bank is a licensed mobile money service. Setup involves app download, BVN registration, and phone verification, with fixed deposits starting at N1,000 for 7 to 365 days.

Pros

- Strong network and zero charges stand out. A user stated, “Opay is the best. I’ve not had a situation where I was debited without the recipient receiving the money. Opay’s Network is so strong.” Another noted, “Their network is fast and zero charges.“

- Opay fixed savings has beginner-friendly interface.

Cons

- Opay customer support is still very poor as complaints could remain unresolved for days and takes longer time for complaints to get a response from the customer support team, leading to slow dispute resolution.

- While Opay Fixed Account allows you to withdraw anytime you choose to, but doing so before maturity means losing accrued interest and being charged a fee.

How to use Opay Fixed Savings option

- Login to Opay App on your smartphone

- Check other options and click “fixed” to begin your saving journey.

- Then click on “create fixed”

- Enter the amount you want to start with

- Name the saving if you want for easy identification

- Then set maturity date for your savings, which starts from seven days upward.

- If you religious belief doesn’t support interest, there is an option to disable interest on your savings.

- And click on next to the next page

How it works

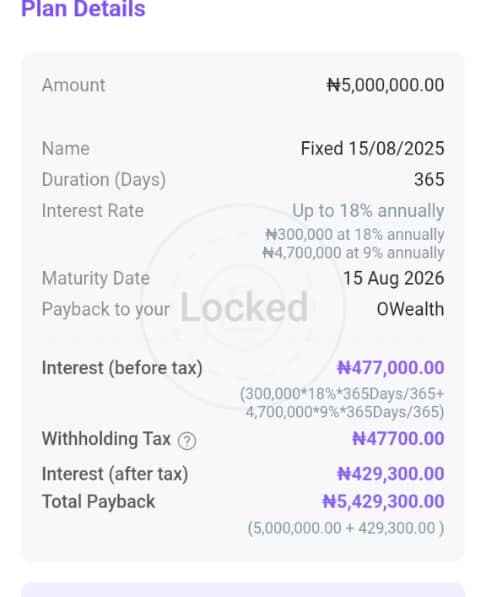

For the purpose of this article, we entered N5,000,000 as saving amount to be locked for 365 days, the interest rate and the amount to the paid out at maturity was automatically calculated by the system. This makes it easy for you to know what you will be expecting or what your interest (pay out) will be at when your locked savings is matured.

This means, if you put N5million in Opay Fixed account from August 15, 2025, by August 15, 2026, you will get N477,000 as interest. However, after tax, it will be N429,300 as you can see in this screenshot.

NOTE: Lock if you won’t need the money before maturity. But note that you cannot withdraw locked funds for free until maturity

Accept the terms and conditions after reading and make payment.

PiggyVest SafeLock

PiggyVest functions as an online savings and investment platform via its PocketApp, with SafeLock allowing users to lock funds for fixed periods and earn up to 20% interest per annum.

- Account opening requires downloading the app,

- Providing BVN, phone number, and email, with no minimum balance but SafeLock starting from N1,000.

- Lock durations range from 10 days to one year, and interest is upfront or at maturity, with penalties for early breaks up to 40% of accrued interest.

Pros

- Interest can be paid upfront or at maturity.

- Tiered structure rewards long-term savings

Cons

- Withdrawal delays and fees frustrate some. One experience detailed, “I trusted Piggyvest with my hard-earned money, only to be met with obstacles and indifference when I needed both my money and their assistance.”

- Penalties for early withdrawal. Reviews also mention, “PiggyVest’s withdrawal fees for breaking SafeLock prematurely or accessing funds before a specific date were inadequately communicated.”

- Structure may be confusing for beginners.

Moniepoint Fixed Savings

Moniepoint, a microfinance bank, features Locked Savings yielding up to 16% interest per annum. Open via app with BVN, ID, and phone; minimum lock is N1,000 for 30 days to a year. Interest accrues daily, paid monthly, with rollover options but penalties for breaks.

There is a minimum of one month and a maximum of 12 months for savings duration.

How it works Moniepoint locked savings

- Login to your moniepoint app

- The app has up to four savings plan, both “locked savings” and “fixed savings” have between 9% – 16% interest rate.

- For testing, we chose fixed savings

- Name your plan and the amount you want to fix

- Choose start and end date, for this guide we chose 365 days

- Proceed to the next page

Pros

- Regulated status ensures safety. The platform states

- Moniepoint Microfinance Bank is regulated by the CBN.

- Users appreciate flexibility: “Moniepoint allows you to open a savings plan that matches your saving needs.”

- NDIC-insured, integrated with personal and business banking.

- Daily interest accrual, monthly payout.

- Locked savings has savings top-up option, meaning you can continue to add to your savings

Cons

- Interest forfeited if lock is broken

- Principal release may take up to 48 hours

Kuda Fixed Savings

Kuda, a digital bank, offers Fixed Savings at up to 15% interest per annum. Register on the app with BVN, phone, and email; fixed pockets start from N1,000 for set periods. Interest is upfront, with locks preventing access until maturity.

Pros

- Convenient for daily use with free transfers. A review said, “The customer service is way better than conventional banks. They don’t destroy you with charges.” Another: “25 free transfers a month.”

Cons

- Not ideal for large long-term savings. One user advised, “Please don’t use it for long term saving..u can save some amount there but not huge amount,“ because of frequent App glitches.

- Rate variability and opacity

- User confusion about calculations

FairMoney FairLock

FairMoney operates as a digital microfinance bank, providing fixed savings through its FairLock feature, which offers up to 28% interest per annum on locked deposits.

- To start, download the FairMoney app from the Google Play Store or Apple App Store,

- Register with a valid phone number, BVN, and ID (such as a driver’s license or passport).

- Minimum deposit for FairLock is typically N1,000, with lock periods from 30 days to one year.

- Interest accrues daily and is paid at maturity, with early withdrawal penalties reducing earnings.

Benefits

- Very competitive returns among Nigerian digital savings products.

- Flexible tenures spanning from short (days) to long (months or 2 years)

- Users also report fast setup and reliable interest payouts on fixed savings. One reviewer noted, “FairMoney App is the best banking app I have ever use, their fixed savings interest rate is top notch and their transfer swiftness, they are very transparent.”

- Another highlighted ease for beginners: “Quick and easy loan application and disbursement… Some users find it helpful for saving.”

Cons

- Mixed user sentiment: some app users feel recent rate reductions diminish value

- “Now you guys wrecked it … after my plan is mature I’m no longer using FairMoney if you don’t put the fairlock plan the way it used to be.

PalmPay Fixed Savings

PalmPay, a mobile money operator, offers Fixed Savings with up to 20% interest per annum on locked amounts. Beginners can open an account by downloading the app, linking BVN and phone number, and verifying with an ID. Minimum for fixed savings is N500, with terms from 30 days to 365 days. Interest is calculated daily and compounded.

Pros

- Free transfers and auto-save features appeal to users. A respondent said, “very easy, fast, with no charges on transfers.” Another review praised, “Palmpay is praised for its free money transfers, diverse savings options, and user-friendly app.”

- Consistent interest payout.

- Simple structure.

Cons

- Some users have raised security concerns. Take time to protect your account.

- Early access incurs a 5% penalty.

Summary:

| Platform | Product Name | Max Interest (p.a.) | Key Strengths | Notable Drawbacks |

| FairMoney | FairLock | Up to 28% | Very high rates, flexible terms | Poor customer reviews |

| PiggyVest | SafeLock | Up to 22% | Upfront interest, long-term tiered yield | Early withdrawals penalized |

| PalmPay | Fixed Savings | Up to 20% | Strong rate consistency | Security & service concerns |

| OPay | Fixed Money/OWealth | 18% | Reliable interface, real-time payments | Customer support issues |

| Moniepoint | Locked Savings | Up to 16% | NDIC-insured, integrated platform | Interest forfeited if broken early |

| Kuda | Fixed Savings | Up to 15% | Convenient digital banking with automation | Rate opacity, user confusion |

NOTE: You can also use Invest Bamboo App to get up to 17% interest on your saving per annum.

A 10% withholding tax would be deducted on every interest earned, this applies to all the aforementioned banks without exceptions. These platforms provide viable alternatives for higher fixed savings rates, but compare fees, terms, and personal needs before committing. Always verify current rates directly, as they can fluctuate with economic conditions.

Regularly verify interest rates and terms via the official app or website, as promotional or introductory rates may change.

For me, PiggyVest, Opay, and Moniepoint are the best in terms of fixed savings accounts despite some negative reviews by some of their users. They have improved over the time, making them my top choice.