Death, accidents, and natural disasters are some of the devastating events that could happen and no one has absolute control over them even after taking all precautions. Of course, they can destabilize one financially and emotionally when they happen.

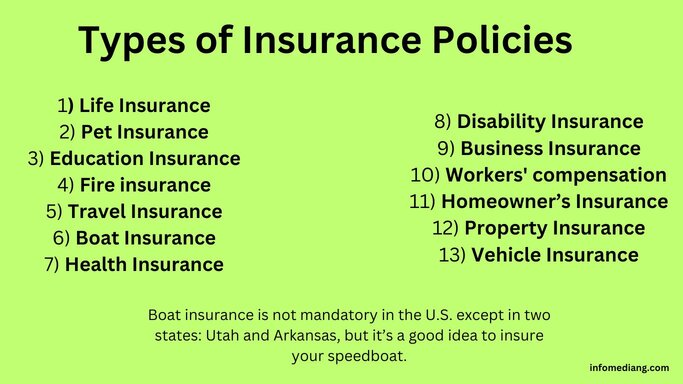

That is why there are various types of insurance policies in the U.K., Australia and other countries that help you to manage and cover the financial losses – in part or in whole – that come with natural or man-made disasters.

However, some insurance policies such as pet insurance, are more popular in animal-friendly countries such as the United States, Canada, and Germany than in developing countries such as Ghana and Nigeria.

Generally, there are two types of insurance coverage- life and general insurance. Non-life insurance is classified as general insurance policy such as health insurance, pet insurance etc.

Life Insurance

Life insurance is a contract between an insured and an insurer, where an insurance company promises to pay a certain amount to the designated beneficiary a sum of money upon the death of an insured person.

There are more than 10 policy plans under life insurance you can choose from to protect not just yourself, but your family or your dependents.

Depending on the contract, the essence of life insurance is to protect the family of the insured when the insured, who is the breadwinner of the family, dies. Life insurance provides the family of the insured with financial support if he dies.

Equitable Holdings, Inc., Amica Mutual Insurance Company, John Hancock Life Insurance Company, U.S.A, and New York Life Insurance Company are some of insurance companies that extensively cover life-related insurance policies.

Education Insurance

Education insurance is to cater for the academic training of the policyholder’s child or children. This way, the policyholder pays premiums for the education of their child when he’s 18 years of age or a certain age as decided by the policy and contracts.

Education insurance has lots of benefits for the children of the policyholder. It is one of the most popular insurance policies among the wealthy class who do not want the education of their children to be truncated as a result of death.

Health Insurance

Health insurance is designed to cover the hospital bills of the insurance policyholder or their dependents when they are ill.

As an employer, you can buy health insurance for your employees. As the breadwinner, you can buy health insurance for yourself, your wife, your children, and your domestic staff, depending on the policy.

In the U.S, for instance, some employers have provision for their employees, but if your employer has no provision for this or you are unemployed, there are various health insurance plans you can access through the U.S. federal health insurance marketplace to check the one that best fits into your status.

Alternatively, you can contact some of the insurance companies in the United States that are synonymous with health insurance such as Coventry Health Care, Elevance Health, Health Markets, and United Health Group among others.

The contract of health insurance depends on the kind of subscription the policyholder buys. So, the kind of illness the policy covers depends on the subscription.

Some policies only cover minor illnesses such as malaria, typhoid, and minor injuries. When it involves critical medical conditions such as operations, the beneficiary or the policyholder may have to bear a certain percentage of the cost.

Disability Insurance

This is a plan whereby the insurer pays some of the insured’s income when the insured is disabled from an illness or injury and unable to work. It insures the policyholder’s earned income against any form of risk that could render the insured unable to work.

Business Insurance

Even with the top cybersecurity measures to protect your business, it isn’t immune to other hazards. Also known as commercial insurance, business insurance covers various aspects of business hazards, including lawsuits, loss of income, customer injury, theft, property damage, and property damage etc.

Business insurance is a form of risk protection and management against your business. Your insurance company comes to your aid when there is a loss or damage to your business due to a disaster. This, however, depends on the terms.

Pet Insurance

In some countries, dogs, pigs, cats, and other pets are part of the family, their owners protect them from risk the way human beings are protected.

The most popular pet insurance policies in the U.S. are dog insurance and cat insurance. The policy only covers the pet that is insured. You can’t use a dog insurance policy to cover for your cat. The basic idea behind this policy is to ensure that your furry friends are covered by an insurance policy.

The policyholders insure their pet for them to get paid partly or in total, depositing on the policy, when the policyholder’s pet falls sick or dies or is stolen.

Fire insurance

This insurance policy covers damage caused by fire. In some cases, property insurance may cover fire incidence, but it is advisable to ask questions when in doubt.

Workers’ compensation

Workers’ compensation is a type of insurance enacted by each state in the U.S., which makes it mandatory for workers to be compensated either by cash or medical care by their employers if they are injured or become ill in the course of discharging their responsibility at a workplace.

If the worker is the breadwinner of his or her family and dies, then his or her dependents can file a compensation claim.

Workers’ compensation providers in the U.S. include Accident Fund Insurance Company of America, Missouri Employers Mutual Insurance, and State Compensation Insurance Fund etc

Property Insurance

Property insurance is to cover losses due to man-made disasters such as deadly attacks or bomb blast or natural calamities such as landslides that damage your insured property.

Vehicle Insurance

In most countries auto insurance policy is mandatory. It is an insurance policy that protects your vehicle.

Travel Insurance

Travel insurance policy is common among frequent international travelers. It is meant to cover for baggage loss, trip cancellation or delay in flight.

Homeowner’s Insurance

This policy covers your home or house and the belongings therein in the event of damage.

Boat Insurance

Like auto insurance, the insurance policy that covers damage or loss to your boat or vessel on the waterways is called boat insurance.

Boat insurance is not mandatory in the U.S. except in two states: Utah and Arkansas, but it’s a good idea to insure your speedboat.

The popular insurance companies with boat insurance policies in the U.S. include Progressive Boat Insurance, Foremost Insurance Group, and Chubb Boat Insurance. You can also find boat insurance companies in the United Kingdom and Canada.

Conclusion

Most of the insurance policies covered in this article may further be broken into categories. For instance, in some countries, you can find dental insurance and vision insurance, which should ordinarily be under health. The purpose of it all is to cover losses and risk management.