Life insurance is a premium contract where an insurance company (the insurer) promises to pay a sum of money to the dependents of an insured person who is also the policyholder, upon his or her death.

Disclaimer: The names used in this post are for illustration, any resemblance is not intentional.

Life insurance creates a sort of future financial hope for your dependents and gives you additional benefits such as savings and wealth creation, especially if you subscribed for the policy that pays an amount called Maturity Benefit at the end of the policy term.

If you are the breadwinner in your family: a wife and three kids -it is a good idea to have life insurance or a form of financial protection so that the claim or payout from your policy could lessen or lift their financial burden after your demise.

Terms Associated with Life Insurance

- Life Assured: The person who is covered under a life insurance policy.

- Nominee: The person the insured appointed at the time of buying the policy to receive the benefits of your insurance policy in case of death. This person is also known as the beneficiary.

- Proposer: The person who buys life insurance policy for a family member or for someone else is called the proposer. For instance, if you purchase an insurance policy for your wife, you’re the proposer while your wife is the life assured.

- But you are both the life assured and the proposer if you bought the life insurance policy for yourself.

- Policy Term: This is the number of years for which the Life Cover continues.

- Life Cover: The amount that the Insurance company will pay to your Nominee or Beneficiary after your death.

- Maturity Benefit: This is the lump sum the insurance company pays you on completion of the policy term, which is also known as the maturity amount (For Protection + Savings policies).

- Premium Payment Term: This is the number of years for which premiums are paid.

How it works

A truck driver Stephen (life assured) pays American Family Insurance (the insurer) an annual amount (Premium) over 20 years (Premium Payment Term) to make sure that his only daughter, Elizabeth (the Nominee) gets a certain assured sum of money (Life Cover) in case of what might happen or any other unexpected event during the 20 years at maturity on survival at the end of policy term.

If Stephen died in the course of his job, Elizabeth can file a claim. That’s how life insurance works.

However, your nominee may not necessarily be your immediate family. It could be a motherless baby home, a society of aged seniors that depended on you when you were alive.

Also, the policy can be changed during the policy term by submitting a written request to the insurer and a lot of factors may determine how much you pay for life insurance coverage in your country.

Importance of Life Insurance

Income replacement

Life insurance is a reliable source of income replacement for the nominee or beneficiary to cover day-to-day expenses which the sponsor used to cover.

Financial security

Before the introduction of what the world now knows as life insurance coverage, dependents were left to fend for themselves when their breadwinner died.

But life insurance has not only created a reason for hope in the future but also a financial security for the beneficiary. The premium charges are in exchange for financial security in case any unfortunate thing happens to the policy buyer.

Return on Investment (ROI)

Apart from insuring your life against uncertainties, life insurance is also a great investment because it offers good returns. It also gives the option to grow your money if you choose the protection and savings plan.

Types:

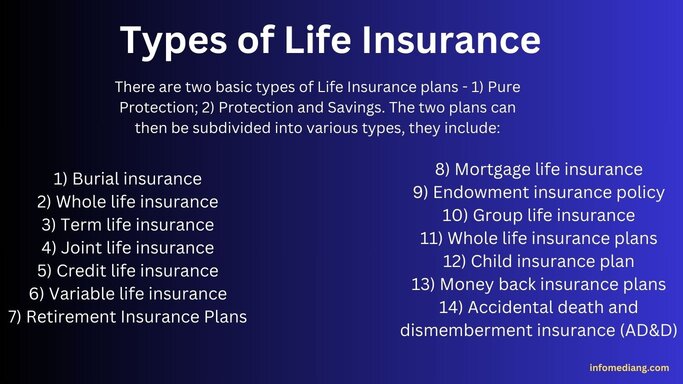

There are two basic types of Life Insurance plans – 1) Pure Protection; 2) Protection and Savings.

The Pure Protection plan is to secure the future for your family or nominee when you bid the world ‘bye-bye’. The beneficiary under this plan can submit a claim to get a lump sum amount.

As for the Protection and Savings plan, it is a two-in-one life insurance policy package. It offers the benefits of a Life Cover while helping you to achieve your long-term goals such as funding your children’s education etc.

The two plans can then be subdivided into various types, they include:

Whole life insurance

Whole life insurance covers you for your entire life provided you don’t default on the premiums. It allows you to get a guaranteed rate of return on the policy’s cash value. Also, the death benefit amount doesn’t change.

The only downside of a whole life insurance policy is that it is costlier than term life insurance.

Term life insurance

Term life insurance is best for people who are looking for an affordable insurance policy. No wonder it is the most popular life insurance policy.

The policy length can be for five, 10, 20, or 30 years, depending on the policy. But in most cases, the proposer buys a length that would be enough to cover their prime years so that their nominee can claim benefits if they die early.

However, term life insurance also comes with its downsides: if the proposer outlives the policy, then the nominee gets nothing as payout.

Variable life insurance

If you have tolerance for a higher risk, the variable life insurance policy is for you because you’d get more control over your cash value investments.

This is a policy that is tied to investment accounts like mutual funds and bonds. So, the variable life insurance premiums are fixed.

The advantage of this policy is that the death benefit is guaranteed. But the cash value can change daily based on the market indexes.

Burial insurance

If you want to cover the funeral expenses of your burial after your death is what you want, then you can ask for more clarifications from your insurance company.

This policy also includes pre-burial arrangements such as clearing of outstanding medical bills and embalming.

In most cases, the death benefit ranges from $5,000 to $25,000. And the policy cost is between $50-$100 per month (on average) for a $10,000 death benefit.

Joint life insurance

Joint life insurance is mostly designed for spouses under one policy, which is split into first-to-die and second-to-die.

If you opt for the first-to-die plan and you’re the first policyholder, your wife would get the payout after your demise and the policy automatically comes to an end. The policy will no longer cover your wife after your death and vice versa.

As for the second-to-die, the person you both agree to be your nominee would get the pay out when both of you are no longer alive.

Credit life insurance

Credit life insurance is designed to help pay off your loan in case you die before the loan is fully paid. In this case, your lender will be the beneficiary and not your family member.

This kind of life insurance policy is popular in the U.S., and Canada, and other jurisdictions where there are well-organized credit facility systems.

Mortgage life insurance

Mortgage life insurance is similar to credit life insurance. The policy covers only the current balance of your mortgage. The mortgage firm is your nominee if you die when you have not fully paid the mortgage. The benefit is paid out to the lender and not your wife or husband or any member of your family.

Endowment insurance policy

An endowment plan is another 2-in-1 policy that guarantees life coverage along with an opportunity to save regularly. Your nominee would receive benefits if you die during the policy term. And if you’re alive on the maturity of the policy, you’d receive a lump sum.

Pros: It is flexible because it allows you to choose a time frame to pay the premium.

Group life insurance

Group life insurance is typically designed for organizations that have a large number of employees as part of workplace benefits. It is similar to a group health insurance plan by organization. Its coverage is limited. If a worker needs more coverage, they can buy supplemental life insurance.

Child insurance plan

Child insurance plan is designed for parents who want a long-term investment for their children. The plan majorly covers child’s education. It is used as a financial tool by parents for the benefit of their children.

It provides maturity benefits, which could be paid in the form of an annual instalment or as a one-time payout after the child attains adulthood.

If the event that proposer passes away during the policy term, there will be immediate payment to cover the child’s expenses.

Money-back insurance plans

In a money-back insurance policy, the policyholder gets a percentage of the sum assured at regular intervals, instead of waiting till the end of the term to get the lump sum amount.

Even as it is designed to meet short-term financial goals, this plan also has a maturity benefit that lets you get a lump sum.

In your absence, that is when you are gone, it allows your nominee to claim the benefit and if you outlive the policy term, you can also get regular payouts along with lump sum benefits.

Accidental death and dismemberment insurance (AD&D)

Accidental death and dismemberment insurance or AD&D is usually offered through the workplace and usually covers you in case you lose your life as a result of a plane crash or car crash.

Retirement Insurance Plans

A retirement plan is designed to help your financial goals in your post-retirement days. It is to cater for your financial needs in your non-working years.

Whole life insurance plans

A whole life insurance plan is a policy that covers your entire life, providing a lifelong protection for you while ensuring that your dependents are also covered after your passing.

Conclusion

The best decision you can take for your loved ones is to secure their future. And it isn’t just about your loved one, it is also about you in case you are planning and saving for the cost of your burial.