If signed into law, the bill will empower U.S. banking regulators to oversee stablecoin issuers, which could potentially extend the U.S. dollar’s influence in the cryptocurrency market.

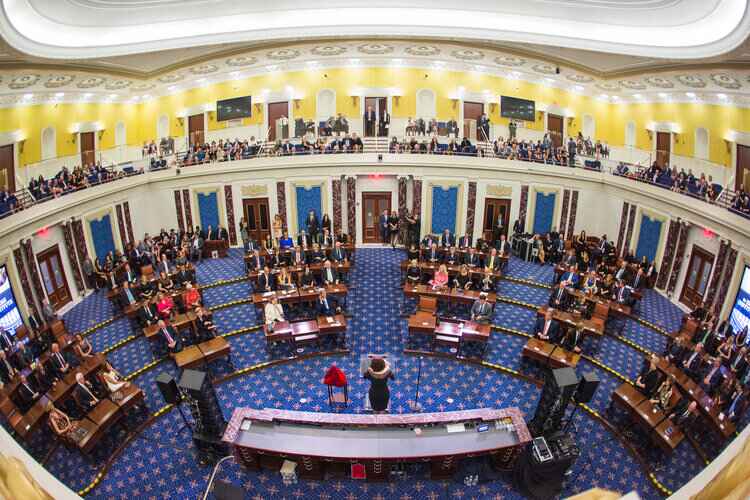

The U.S. Senate has passed the GENIUS Act, aimed at regulating and making stablecoins more appealing. The bill was approved by a vote of 68 to 30 lawmakers.

Stablecoins are a type of cryptocurrency typically pegged to fiat currencies such as the U.S. dollar or other assets, and are considered less volatile than other digital assets.

It was gathered that the move is intended to make stablecoins more attractive to investors, as cryptocurrency continues to gain popularity worldwide—especially among business-focused users.

At the time of publication, stablecoins had a market capitalization of $255.5 billion. USDt, issued by Tether, leads the market, followed by USDC, Ethena USDe, and Dai.

What’s in the GENIUS Act?

The Act sets out regulatory rules for stablecoin issuers. One such rule requires issuers—such as Tether (USDt), Circle (USDC), and Stablemint—to maintain sufficient reserves of liquid assets equal in value to their outstanding stablecoins.

The value of stablecoins is tied to fiat currency, which makes them less volatile compared to other cryptocurrencies. However, problems can arise if an issuer lacks adequate reserves to back its digital assets—an issue highlighted in 2022 when the TerraUSD stablecoin collapsed after falsely claiming sufficient reserves.

Lawmakers stated that the Act is necessary to promote confidence in the stablecoin sector and to prevent a repeat of the TerraUSD incident.

Secondly, if signed into law, the bill will empower U.S. banking regulators to oversee stablecoin issuers. This oversight could potentially extend the U.S. dollar’s influence in the global cryptocurrency market.

Since their introduction, dollar-backed stablecoins have become the most widely used digital assets among investors and business owners.

Reports from the U.S. indicate that the bill is now headed to the House of Representatives.

Recall that another cryptocurrency-related bill, the STABLE Act, is also progressing through the House. Analysts suggest that both Acts could be merged by Congress, given the similarities in their provisions.