A virtual card is a digital version of a bank card that you can use for online shopping or paying bills without needing a physical card. You can create one using your phone through your bank’s app, load it with money, and use it to make payments. This makes it safer and easier to use funds online because you don’t have to carry a real card.

Types of Cards

Virtual Card: This is a card you use online, stored in your phone.

Digital Card: This is a copy of your physical bank card but stored on your phone. It has the same details as your actual card and can be used with Apple Pay or Google Pay.

Disposable Card: A one-time-use virtual card that expires after you use it.

Understanding Virtual Card

Many international payment platforms such as Geepay, Grey, Chipper Cash, and Fundall are making it big in the global transfers space. They allow their users to get a virtual dollar card at a cheaper rate and works in almost where the regular debit cards are restricted in some countries.

For instance, subscribing to X premium is not possible using debit cards of some banks in Nigeria, but virtual dollar card breaks all the barrier and restrictions, making it possible for the user to access global payment and make purchases online. A lot of marketers using Facebook Ads prefer to use virtual card instead of their regular bank card.

How it works

Online Payments: You can use a virtual card to pay for things like subscriptions (Netflix, Spotify, X premium, domain purchase and subscriptions), shopping, and even paying global bills.

No Physical Card: A virtual card exists only on your phone. It has a unique card number, expiry date, and a security code, just like a physical card. The different is that it isn’t something you can hold as you would for a physical card.

Safe and Secure: It’s a secure way to pay because the card details can’t be traced back to your main bank account, and the card can be locked or deleted anytime you want.

The fact that it can’t be traced back to your main bank account makes the money in your main bank account safer whereas the physical debit or credit card are linked to your main bank account unless you deactivate it.

Features of a Virtual Card

Prevents Fraud: Since virtual card numbers are temporary or one-time use, thieves can’t use them to steal money or hack your account. In most cases, users prefer to load the only amount they need to make payment online.

Control Your Spending: You can limit how much can be spent on the virtual card, making it easier to manage your budget or keep employees from overspending.

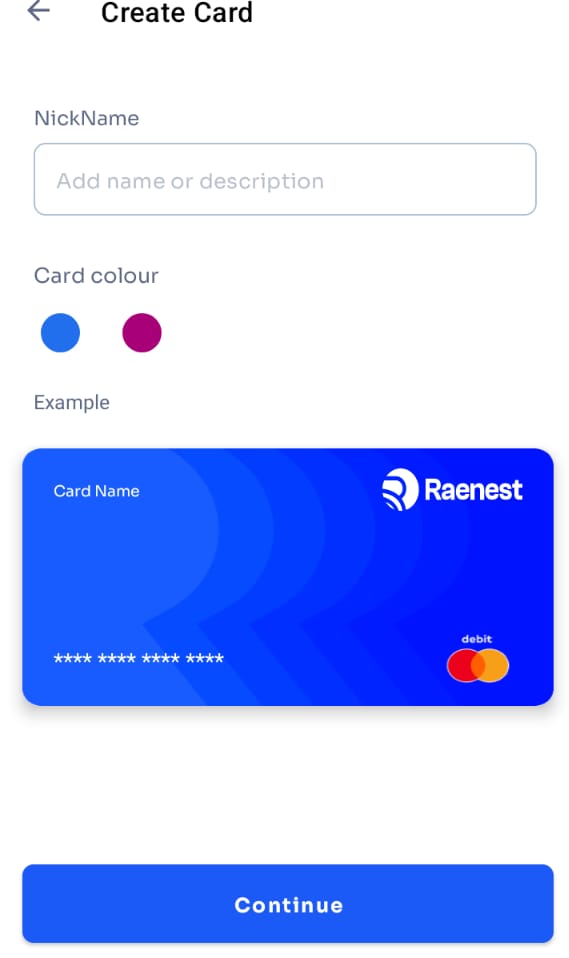

Instant Setup: You don’t need to wait for a physical card to arrive. You can create and use a virtual card almost immediately. For instance, you can create $ Virtual Card on Grey or Geepay within a few second and start using immediately. You will only need to fund your account, load your card and create one for use.

Set It Up: Use your bank’s mobile app to create a virtual card. Load it with money from your bank account. The setup depends on the platform you are using.

Make Payments: You can use your virtual card for online shopping or pay for subscriptions, like Netflix or Apple Music.

Reload Money: If the balance is low, you can add more money to the virtual card through your app.

Control Access: You can lock or delete the virtual card anytime, which adds an extra layer of security.

It is also possible to withdraw balances from your card.

What Are The Benefits of Using a Virtual Card?

Instant Access: No need to wait for a physical card to arrive.

Secure Payments: Safer for online purchases since the card details can’t be used for fraud.

Convenience: You can make payments without needing to carry your physical wallet or card.