What is Yellow Pay?

Yellow Pay is a cross-border payment product of Yellow Card Financial Inc. which uses blockchain technology in sending and receiving local currencies across African countries.

I tested it by sending money to a colleague. It’s indeed faster than the conventional transfer system. It is faster and cheaper for cross-border payments in 20 African countries, including Nigeria.

What’s the Idea Behind It?

Yellow Pay was officially launched on August 16, 2022, three years after the parent company began operation in Nigeria.

What’s the idea behind this cross-border payment product?

Several attempts by African countries to remove trade barriers have either failed or remained as mere tea parties that never saw the light of day in terms of implementation.

One such stalled agreement is the African Continental Free Trade Area (AfCFTA), which 44 African countries signed on March 21, 2018, in the Rwandan capital, Kigali.

However, the founders of the Yellow Card App observed that trade barriers persist. Yellow Pay was introduced as a brilliant idea to facilitate transactions among African nationals.

While Yellow Pay isn’t designed to completely replace the objectives of AfCFTA, nor does it have any bilateral agreements with AfCFTA, the payment tool has made it easier for Africans to send money among themselves.

How Does It Work?

Mthembu Njembain South Africa has enlisted the services of Opeyemi Quadri, a Nigerian content writer.

If Mthembu chooses to make payment through the bank, the service charge will be exorbitant, and it will take several hours for the recipient to be credited

To bypass the bottlenecks linked with the centralized financial system, Mthembu registered for a Yellow Card account. He encourages Opeyemi to do the same.

After both of them verify their accounts, Mthembu, the sender from South Africa, can use his local currency (Rand) to pay his Nigerian counterpart.

The recipient, Opeyemi, will receive the payment in his local currency, Naira, through Yellow Pay. Subsequently, he can transfer the funds to his local bank account in Nigeria.

The Yellow Card system facilitates the conversion of one African local currency to another.

To utilize this system, the sender simply needs to fund their Yellow Card wallet with the local currency.

When sending money, the system employs an algorithm similar to blockchain (USDt) to determine the exchange rate.

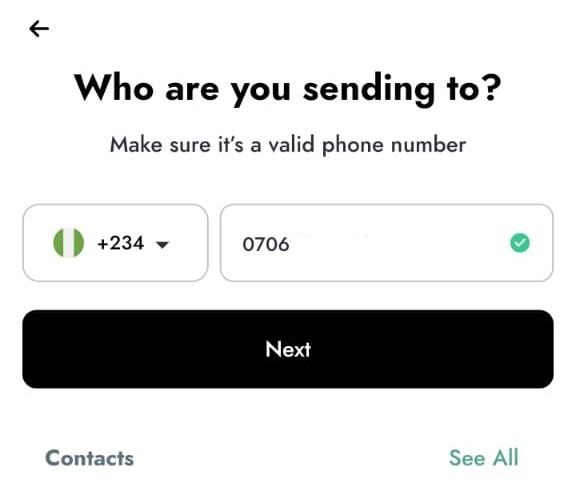

For transactions using Yellow Pay to send money to another user, the phone number serves as the ‘account number.

How I Used Yellow Pay To Send Money To My Friend

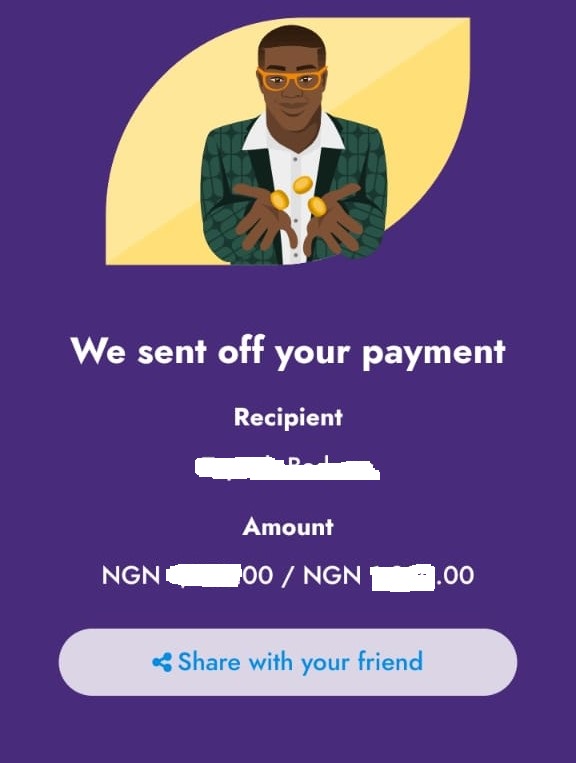

I tried the new payment tool, and the process was seamless. It can also be used for local transactions; for example, I used this payment tool to send money to another Nigerian user within the same jurisdiction.

- Login to the app

- Click “Pay” among the menus

- Click “Send”

- Enter the phone number of the recipient, who must be a verified Yellow Card user.

- Click “Check” phone number. It will show a green mark if the recipient is verified.

- Click next and enter the amount to send.

- Add “Note” , this is optional.

- Click next and choose a reason for sending money.

- Check details of the recipient

- Proceed by entering your transaction PIN

Within a second, the recipient will be alerted that his Yellow Card wallet has been credited with the details of the sender.

NOTE: If the recipient isn’t a Yellow Card user, he’ll receive a message, but he must sign up and verify their account to get access to the credit.

The minimum amount you can send on Yellow Pay must be equivalent to $1, so the algorithm uses the prevalent exchange rate to determine this rate.

What I enjoy about this cross-border payment product

Speed: It operates faster, thanks to blockchain technology. For example, I sent money to a friend at 17:03, and he received it at the same time—almost like the speed of light.

Cost: Sending money within the same jurisdiction is free. I wasn’t charged a dime while sending money to a colleague.

Versatility: It can be used for various purposes, such as sending money for business transactions and paying vendors.

In summary, Yellow Pay is a game changer for Africans in terms of cross-border transactions, marking a significant shift from the centralized financial system