The U.S. government shutdown has rattled global markets, pushing investors toward safe-haven assets such as Bitcoin and gold while stalling key regulatory processes.

Highlights:

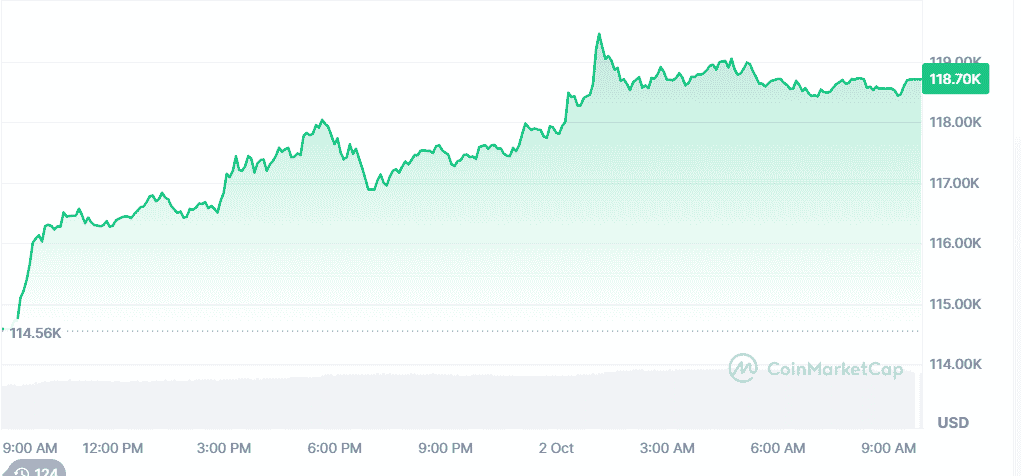

- Bitcoin rose to $119,200, its highest level in two weeks, as investors sought alternatives during the political impasse.

- Gold touched a record $3,895 per ounce, underscoring demand for traditional safe assets.

- U.S. equities were flat, but a sharp decline in private payrolls signaled labor market weakness.

- The SEC furloughed staff, halting spot ETF reviews and delaying crypto-related approvals.

- Market analysts warned of rising uncertainty until the shutdown is resolved.

The shutdown, triggered by a budget standoff between Republicans and Democrats, has disrupted government agencies and delayed regulatory actions. A source at the Securities and Exchange Commission said the halt had left ETF applications “in limbo,” with reviews suspended until normal operations resume.

Industry experts said the uncertainty surrounding ETF approvals has left investors cautious, despite continued demand for crypto exposure. With regulatory processes paused, market participants are bracing for short-term volatility.

Gold and Bitcoin have both benefited from the uncertainty, though U.S. stocks showed only muted moves. Still, analysts pointed to weak private payrolls data as a warning sign for the broader economy.

The episode highlights how political gridlock can ripple across financial markets, shaping both digital and traditional asset strategies. Until Congress resolves the impasse, investors are expected to remain defensive, balancing risk with safe-haven allocations.

It was dwindling to around $118,678.92 at the time of publication. $124,457.12 was the last all-time high it achieved on August 14, 2025.