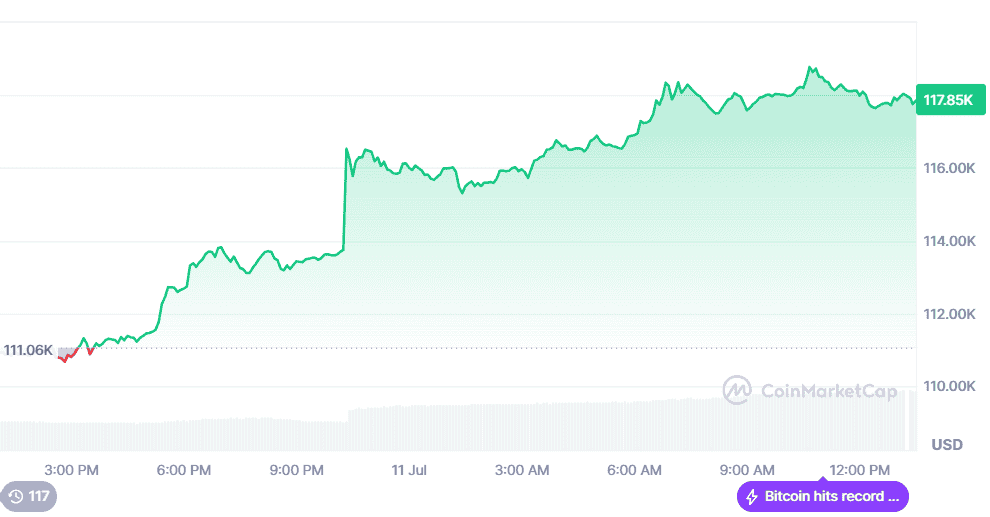

Bitcoin on Friday, July 11, 2025, briefly touched $118,780.89, marking an All-Time High as the U.S. House of Representatives prepares to hold its first major crypto regulation event starting Monday, July 14, 2025.

The July 14 regulation schedule by the lower chamber of the U.S. legislative arm, according to experts, has attracted strong interest from institutional investors.

The U.S. ‘Crypto Week,’ during which lawmakers will debate a series of bills, is expected to shape the regulatory framework for digital assets in the country.

Bitcoin’s latest ATH came a day after an impressive trading session on the U.S. stock markets, where the tech-heavy Nasdaq index also reached a record high.

Analysts say the recent surge in BTC price may have been fueled by a broadly positive trading outlook across risk assets.

A day before the surge

Earlier on Thursday (July 10), the most valuable cryptocurrency reached an ATH of $116,608.78, after Bloomberg data showed that investors pumped an estimated $1.2 billion into Bitcoin ETFs (exchange-traded funds).

Data shows that much of the investments flowing into crypto came through ETFs.

Why Crypto-based ETFs?

Cryptocurrency-based ETFs make it easier for investors to gain exposure to cryptocurrencies without having to buy them directly. These funds have exploded in popularity since Bitcoin ETFs began trading in U.S. markets in 2024.

Meanwhile, Ethereum, the second most valuable digital asset, also saw ETH gaining more than six percent. Other cryptocurrencies experienced similar price surges, though not as significant as BTC’s.

At the time of publication, it was trading at $117,994.93, according to crypto aggregating site CoinMarketCap.