Buying a home in the United States is everyone’s dream, but one state that scares an average earner when it comes to acquiring a property is California. It is known as the most expensive state to live in in the U.S.

Don’t forget that California has the highest Gross State Product which is higher than the entire GDP of African countries…PLUS real estate is one of the most profitable investments in California.

The reason for the high cost of living including rent and owning a home in California isn’t far-fetched from the fact that the state is home to first-tier tech companies and many millionaires and billionaires in the U.S.

One might even think Sacramento, the capital of the most populous U.S. states is the most expensive place to buy a home, but NO, it is not despite the concentration of government agencies in the capital.

You would need to earn at least $105,934 annually in Sacramento to consider yourself financially buoyant enough to offset the mortgage at a monthly rate of $2,471.80 compared to San Jose where you would need more than a million dollars, according to Home and Sweet Home (HSH) report.

The HSH data which used the National Association of Realtors’ 2022 first-quarter data for median home prices and two other surveys, reveals the monthly salary and annual salary one needs in some cities in the United States to buy a house.

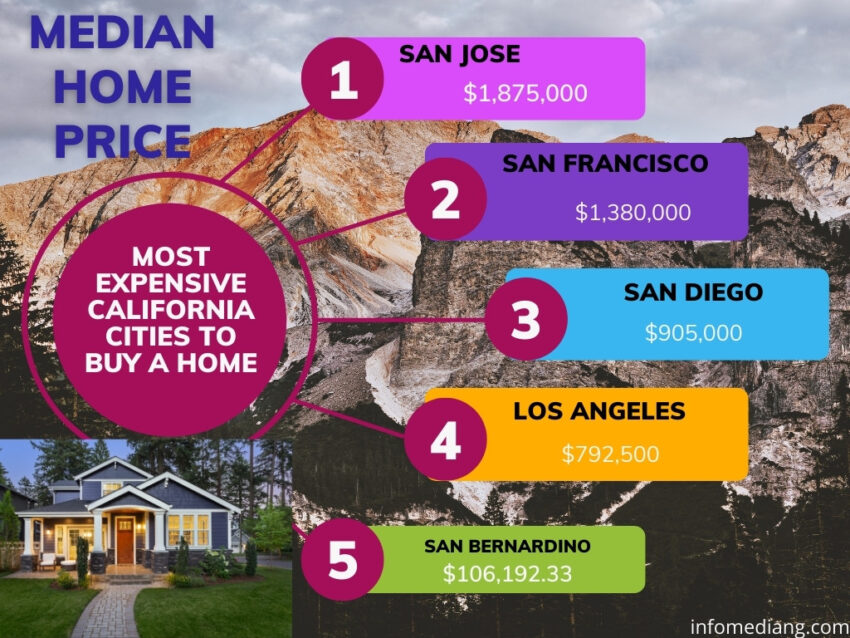

We explored the data and found out that four cities in California are among the top 5 most expensive cities to buy property. San Jose, San Francisco, San Diego, and Los Angeles occupy the top four in that order.

Only San Bernardino and Sacramento occupy 12 and 13th positions. Considering the position of San Bernardino, one might think is quite affordable to own a home in the city when compared to the cost of acquiring the same property in a city like San Diego, but it’s far from it.

You need at least $8,849 as a monthly salary to buy a home in San Bernardino compared to San Diego where you can own your dream home only if you earn at least $13,902 per month to cover $3,892.66 monthly payment of your mortgage covering Principal, interest, taxes and insurance (PITI).

So, why is it so expensive to own a home in these top five California cities?

Let’s take a look…

San Jose

When you have more than a hundred multi-billion dollar global companies concentrated in a city and with hundreds of workers, you can’t expect anything less in the demand for qualitative homes.

Some of the global companies in the city of San Jose are electronic payment global company PayPal, McAfee, Zoom Video Communications, NetIQ, and Neato Robotics among others.

The concentration of high-tech firms has contributed massively to the demand for tech professionals thereby jacking up the demand for housing and rent, thereby having an impact on the housing units in California.

So, it’s not surprising to see San Jose as the most Californian city to buy a home. It is the capital of Silicon Valley with more millionaires and billionaires per capita than other cities in the United States and in the world.

Cost of buying a home in San Jose

The median home price in the city is $1,875,000, meaning a person would need to earn at least $330,000 annually to pay off the mortgage at a monthly rate of $7,718, according to HSH data.

San Francisco

The mortgage market in San Francisco is a big deal and it isn’t designed for average earners courtesy of the concentration of companies like Amazon, Facebook (now Meta Inc), KPMG, Visa, United Airlines, BNP Paribas, Wanda Inc, Salesforce, and the prestigious University of California among others in the city.

For instance, look at the table below for the annual average salaries of different roles at Meta:

| Roles | Average Salary Annually |

| Software engineer | $161,978 |

| Research scientist | $188,655 |

| Production Engineer | $199,779 |

| Product Manager | $170,985 |

| Quality assurance | $125,530 |

| Product designer | $195,303 |

| Policy manager | $146,569 |

| Sourcing manager | $136,197 |

Home in the city is priced at $1,380,000 at $5,825.98 monthly payment, meaning to own a home here, you would need at least $249,685 to buy a home in San Francisco, making it the second most expensive U.S city to buy a home.

San Diego

Authorized by the U.S government to operate a Foreign Trade Zone, San Diego’s commercial port on the United States–Mexico border contributes hugely to the economy of California and the city.

Aside from that, hundreds of tourists from across the U.S and around the world who visit San Deigo do so because of the city’s climate, beaches, attraction centres like San Diego Zoo Safari Park, Balboa Park, SeaWorld San Diego, and Belmont amusement park among others have contributed in the spike in the price of rental.

San Diego a home which attracted more than 32 million visitors from across the world in 2012 generated more than $7 billion. The industry also created more than 160,000 vacancies in the year under review.

That said, highly rated companies located in the city including Sony, Cubic Corporation, Sanyo, Oracle, and Intuit among other global firms, have contributed to the mortgage status of San Diego as one of the most expensive cities in California to buy a property.

In 20015, it cost $520,000 to buy a property, it increased to $558,000 by November 2018 in the metropolitan area. At the time of this report, the median price of a house in San Diego is $905,000 as of August 2022.

Dreaming isn’t enough to purchase a home in San Diego, you need a job that is good enough to be able to afford the $3,892.66 monthly mortgage. What this means is that you need $166,828.39 annual salary to afford a mortgage and pay other bills.

Los Angeles

Welcome to the Southern California City of Los Angeles. Rated as the 5th safest city in the U.S., according to The Broke Backpacker, Los Angeles is the 4th most expensive California city to buy a home in the United States, thanks to the booming entertainment industry, telecommunications, and its global healthcare.

Some of the global firms headquartered in Los Angeles include The Walt Disney Co, Molina Healthcare, Inc., and AECOM Technology Corp and other top coy are contributing to the hike in the price of homes in the city.

All these have contributed to the booming real estate investment in Los Angeles. Renting an apartment or buying a home may no challenging for someone who doesn’t earn well to take care of the bills.

Specifically, you need $149,127.27 annual salary to be able to afford the $3,479.64 monthly payment for a median-priced home.

San Bernardino

While San Bernardino is ranked as the 12th most expensive U.S city to buy a home, you would need $106,192 annual salary to afford $560,000 median home price at $2,477.82 monthly payment to cover Principal, interest, taxes and insurance (PITI).

Recap:

California is not the only state in the United States that has opulence cities where you would need more than the average salary to bear the cost of buying a home, some cities are like that all over the world, but there are always ‘affordable’ or less expensive cities to buy a home.

It is important to point out that the concentration of highly rated global firms in San Jose, San Francisco, San Diego, and Los Angeles makes California the most expensive U.S. State to buy a home. Interestingly, California is the best state for entrepreneurs, according to a report by a team of researchers at Looka, a Canadian-based logo designing firm.

What someone who’s buying a house for the first time in California, maybe living in another country?