Domiciliary account holders can now convert their dollars to Naira instantly on GTBank internet banking platform.

In a message sent to infomediang.com Monday, June 26, 2023, Guaranty Trust Holding Company Plc (GTCO Plc) said:

“You can now convert US dollars in your GTbank domiciliary account to naira directly on our platform. It’s instant as a regular transfer between accounts. Please note that you can convert up to USD 50,000 daily”

GTCO

Here is how to sell your dollar to GTB, using the prevailing market rate:

- Go to your Internet banking

- Click FX transactions

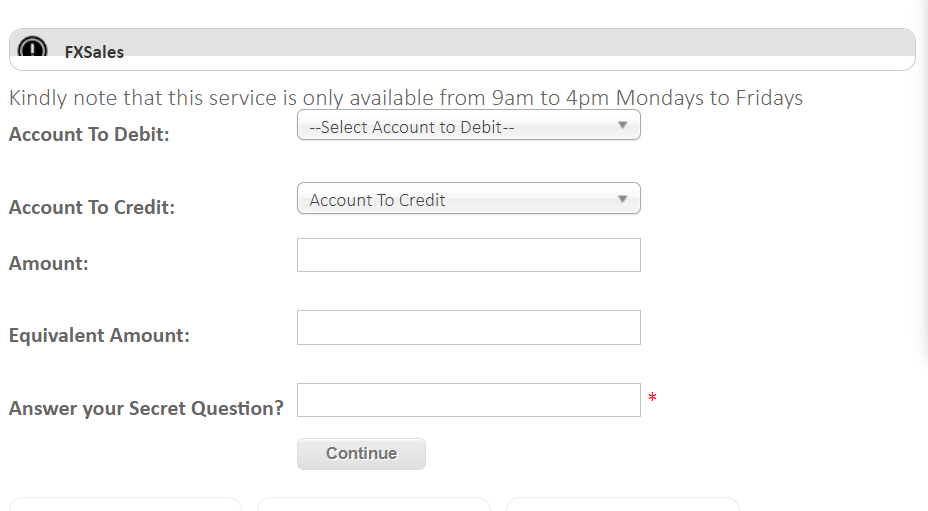

- Select FX sales

- Choose the account to debit

- Account to credit

- Amount of FX you want to sell

- The next space “equivalent amount” will automatically calculate the rate

- Answer your secret question

- Click Continue

At the time of this publication, GTB $/NGN rate was N1,400.

Kindly note that this service is only available from 9am to 4pm Mondays to Fridays

Further guidance on operational changes to the foreign exchange market

In Case You Missed It: Following the Central Bank of Nigeria (CBN) press statements dated June 14, 2023, and June 16th 2023, on the operational changes to the Foreign Exchange Markets, banks in Nigeria updated their customers about changes to FX.

Takeaways from the new guidelines

All market segments have been collapsed into the Investors and Exporters (I and E) window, which is now known as Nigerian Foreign Exchange Market (NFM).

All eligible transactions are permitted to access foreign exchange at this window including visible and invisible transactions (medicals, school fees, BTA/PTA, airline and other remittances etc.)

Eligible customers’ transactions shall be processed at the prevailing rates based on the willing ‘buyers/sellers’ model at the I and E window.

Ordinary domiciliary account holders shall have unrestricted access to funds in their accounts and are permitted to cash deposits not exceeding USD$10,000 per day or its equivalent via telegraphic transfers.

The CBN will prioritize orderly settlement of any committed FX forward transactions as they fall due to further boost market confidence.

Customers are hereby advised to continue to send to the bank their FX requests to either buy or sell and adequately fund their accounts for this purpose.