Foreign exchange markets move fast, with different currencies traded in various ways to meet the needs of businesses, investors, and individuals. It represents the biggest financial market in the world because of its speed and simplicity, aided by the method called spot transaction.

This article explains what a spot sale is, how it functions in the foreign exchange market, and why it matters to everyone from travellers to multinational corporations.

What Is a Spot Sale?

A spot sale in foreign exchange refers to an agreement where two parties exchange currencies at the current market rate, with the transaction settling within a short timeframe, typically two business days. Unlike other financial deals that might stretch over weeks or months, spot sale prioritizes immediacy. Businesses use it to pay overseas suppliers, travellers rely on it to buy foreign currency, and banks facilitate it to keep global trade flowing.

The term “spot” reflects the transaction’s near-instant nature. It happens “on the spot,” meaning the deal locks in the exchange rate at the moment of agreement, and the actual currency swap occurs soon after. Unlike forward contracts, which delay settlement to a future date, spot sale is immediate.

How Does It Work?

Spot sale relies on a well-oiled system of banks, brokers, and market data. Here’s a step-by-step breakdown:

- Agreement: Two parties, such as a company and a bank, agree to exchange currencies. For example, a U.S. business might swap dollars for euros to pay a European supplier.

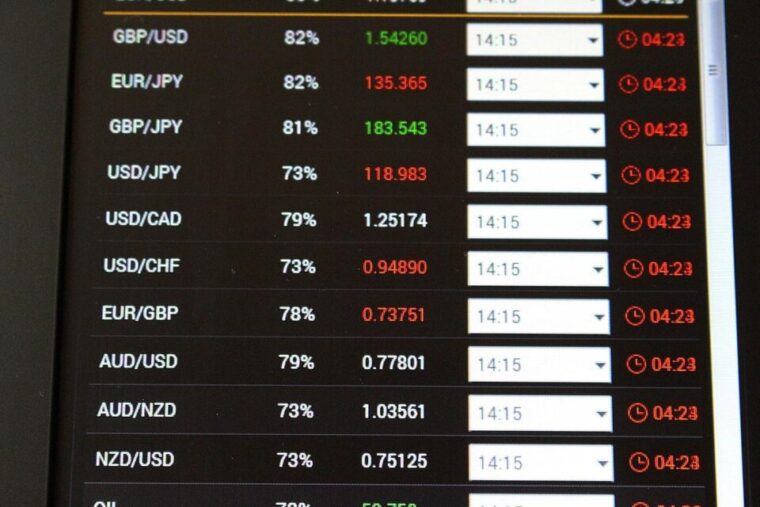

- Exchange Rate: The deal uses the current market rate, often called the spot rate, which fluctuates based on supply, demand, and economic factors.

- Settlement: The currencies are exchanged, usually within two business days (known as T+2). For instance, if the agreement happens on Monday, the swap completes by Wednesday.

- Execution: Financial institutions handle the transfer, ensuring funds move securely between accounts.

This process sounds technical, but it’s something many encounter daily. When you exchange money at an airport kiosk or use a bank app to buy foreign currency, you’re often engaging in a spot sale, even if the provider adds a small fee or margin to the rate.

Why Are Spot Sales Important?

Spot sales play a central role in the foreign exchange market, which handles trillions of dollars in daily transactions. In 2023, according to VT Markets, the United Kingdom has the highest forex traders with 341K, followed by the United States, which has 335,000 active FX traders.

Key Benefits of Spot Sales

- Speed: The quick settlement allows businesses to meet urgent payment deadlines, like paying an overseas invoice.

- Transparency: The spot rate reflects real-time market conditions, giving parties confidence in a fair pricing.

- Accessibility: From small businesses to global banks, anyone can use spot sales, making them a universal tool in global trade.

- Stability: Locking in the exchange rate at the time of the deal shields parties from sudden market swings over the settlement period.

These advantages make spot sales a backbone of international finance, ensuring smooth transactions across borders. In April 2022, the U.S. witnessed $2.1 Trillion spot trade, making it the second highest instrument after foreign exchange swaps.

Spot Sales vs. Other Forex Transactions

To understand the unique role of a spot sale, let’s compare it with other foreign exchange methods. Below is a table outlining key differences:

| Transaction Type | Settlement Time | Purpose | Complexity |

| Spot Sale | 1-2 business days | Immediate currency exchange | Simple |

| Forward Contract | Weeks to months | Hedge against future rate changes | Moderate |

| Futures Contract | Standardized future date | Speculation or hedging | Complex |

| Currency Swap | Custom timeline | Manage long-term currency needs | Complex |

This table highlights why spot sales are favored for quick, no-fuss exchanges, while other methods suit longer-term strategies.

Who Uses Spot Sales?

- Businesses: Companies buying goods or services abroad use spot sales to pay suppliers in the required currency. For example, a Canadian retailer might exchange CAD for USD to purchase inventory from a U.S. wholesaler.

- Travelers: Individuals converting money for a trip abroad often engage in spot transactions, whether at a bank or currency exchange booth.

- Investors: Traders in the forex market use spot sales to capitalize on short-term currency fluctuations, aiming to profit from small rate changes.

- Banks and Financial Institutions: These entities facilitate spot sales for clients and use them to balance their own currency holdings.

No matter the user, the process remains consistent: agree on a rate, exchange currencies, and settle quickly.

Risks and Considerations

While spot sales are simple, they also have their risks. Currency markets can be volatile, and even a two-day settlement window carries some exposure, especially when currencies that are not stable are involved e.g Naira against the USD. If the exchange rate shifts dramatically between agreement and settlement, one party might wish they’d waited. However, this risk is minimal compared to longer-term contracts.

Transaction costs. Banks and exchange services often charge fees or offer slightly less favorable rates, which can add up for large transactions or frequent trades. Comparing providers before committing helps minimize these costs.

Example

Imagine a small U.K. bakery ordering specialty flour from a U.S. supplier. The invoice is $10,000, and the current exchange rate is 1 USD = 0.75 GBP. The bakery agrees to a spot sale with its bank, converting £7,500 to $10,000. Two days later, the bank transfers the dollars to the supplier’s account, and the deal is complete. This quick process ensures the supplier gets paid on time, and the bakery avoids worrying about rate changes.

How to Get Started

Engaging in a spot sale is easier than many realize. Most banks, credit unions, and online platforms offer currency exchange services. For the best rates, compare providers and check the spot rate on financial news sites or apps. If exchanging large sums, consider negotiating with a bank for a better deal. For travelers, avoid airport kiosks if possible, as their rates often include hefty markups because they know that you are in dare need of it, so they might want to the urgency as an advantage.

Conclusion

Spot sales provide a fast, reliable way to exchange currencies in the foreign exchange market. Whether paying an overseas vendor or buying euros for a vacation, this method keeps cross-border transactions smooth and efficient.