Companies that source at least 50 per cent of their raw materials locally, have the potential to contribute to Nigeria’s foreign exchange, and have export value potential among other requirements can apply for the 100 for 100 Policy on Production and Productivity (PPP).

It is an initiative of the Central Bank of Nigeria (CBN) to encourage local production and a gradual economic step to eliminate over-reliance on imported goods which have put forex in serious jeopardy. Already, the CBN has released names of successful applications on February 2, 2022.

In this guide, we’ll talk about the basic requirements for the loan, terms, and conditions, who can apply, the application process, and how you can track status of your application.

Idea Behind It

Basically, the objective of the PPP initiative is to reverse the nation’s over-reliance on imports, by creating an ecosystem that targets and supports projects with the potential to transform and catalyze the productive base of Nigeria’s economy.

No country builds its economy by relying on imported goods and products. Unfortunately, that the path Nigeria economy has been toeing in the last three decades has collapsed hundreds of local manufacturing companies most especially the textile industries.

The CBN says it’s changing the narrative to a productive economy by financially boosting the capacity of Nigerian industries with as much as NGN5billion for each of the 100 companies in 100 days.

Meaning of 100 for 100 CBN Policy

100 companies will be selected within 100 days after passing through the stringent verification process that will be done by globally recognised auditing firms beginning from November 1, 2021.

“We will take the next 100 companies/projects for another 100 days beginning February 1, 2022, and then another 100 companies for another 100 days beginning from May 1, 2022.”

It simply means CBN will be giving out NGN500billion loans to 100 manufacturing companies in every 100 days.

The targeted companies should have the potential to contribute to Nigeria’s economic growth, create jobs, and contribute to the foreign exchange performance

Who Can Apply?

This loan isn’t designed for everyone. CBN is trying to put its monies into the sectors that will impact Nigeria’s economy.

If your production falls under the listed sectors below, then the PPP CBN loan is designed for you.

The sectors are:

- Agribusiness

- Manufacturing

- Agro-processing firms

- Extractive Industries

- Trade-Related Infrastructure

- Petro-Chemicals

- Renewable Energy

- Healthcare

- Pharmaceuticals

- Logistics Services

- Exports that fall under non-oil products

Terms of PPP CBN Loan

- The PPP loan is a long-term credit facility with a period of 10-year. The T&C are:

- The projects for consideration shall be new projects in existing companies

- Interest rate: 5percent per year (all inclusive) up to February 28, 2022

- Interest on the credit facility shall revert to 9percent par yea (all-inclusive) beginning from March 1, 2022. You can check our guide on how to calculate loan interest rate

- Tenor: The loan shall have tenor of 10 years which must not exceed December 31, 2021

- Moratorium: two years moratorium.

- Collateral: The PFIs shall determine collateral under RSSF-DCRR.

RSSF-DCRR means Real Sector Support Facility-Differentiated Cash Reserves Requirement

- Repayment: Monthly interests on the facility shall be amortised and transferred quarterly with principal repayments to the CBN.

- PFIs: Application can be submitted through CRR contributing Deposit Money Banks there are 37 of such banks in Nigeria.

How Applicants Would Be Selected By CBN Financing Committee

While the loan amount in the review could catapult successful companies into the global market and be major stakeholders in the international trade, CBN has its selection criteria which it called Key Performance Indicators (KPIs)

Key Performance Indicators or KPI is “a quantifiable measure used to evaluate the success of an organization, employee among others in meeting objectives for performance of a particular activity in which it engages”

This will be based on 7 KPIs as follows:

- Percentage increase in production output of financed companies

- Percentage increase in capacity utilisation

- Percentage increase in export volume and value

- Percentage decrease in import volume and value of industrial raw materials;

- Increase in number of jobs created of which 80 percent should be Percentage for Nigerians

- At least 50percent of raw material input should be sourced locally

- Integration into the Global Export Value Chain

Transparency in the selection process

To know if you’ve been selected for the credit facility, CBN says it will release the approved sum to your banks for onward disbursement.

To show transparency in the credit facility, the apex bank says successful beneficiaries would be published in National dailies for Nigerians to verify and confirm with details of facility granted, operating sector, manufacturing activities financed, and PFI.

Required Documents for Application

The loan is targeting incorporated companies NOT the business names, here are what you should have for you to qualify for the loan:

1) Three years of financial statements from your bank

2) At least two (2) credit reports of the company and the directors

3) Certified true copies of company registration documents as evidence of company registration with Corporate Affairs Commission (CAC)

4) Details of the company’s board of directors

5) The creditworthiness of directors of the company

6) Bank Verification Number (BVN) of directors

7) Business plan of the new project for which the facility is to be applied.

8) Detailed status reports on the project’s capacity utilisation

9) Detailed status of production output, productivity and efficiency level

10) Proof that at least an 80percent of employees are Nigerians

11) Evidence of export capacity and value creation

12) Post-financing economic benefits

How To Apply For 100 for 100 Loan

The application process for the 100 For 100 policy is in two stages:

- Physical application through CRR contributing Deposit Money Banks in Nigeria.

- Online submission of copies of documents on 100For100 PPP Portal

So, let’s get down unto it: Application through banks

1) Submit your application which must include the required documents earlier mentioned at any of the approved Participating Financial Institutions (PFIs) that meet the required Credit Reserve Ration (CRR)

2) And get a copy of the acknowledgement letter from your bank where you submitted your application. It must be a PDF format

3) Photocopy of your business plan must accomplish your application which must also contain an executive summary of your application

What next?

That’s all you need to submit at the participating banks, however, it seems the apex bank has found that some of the applications through the banks either don’t get to them or they not get the required attention, CBN is saying after the physical submission you proceed to the portal dedicated for the 100For100 policy

Documents to upload:

Kindly note that the items listed below are very important for your application to be treated.

Significance of the online submission:

It will also enable you to track the status of application.

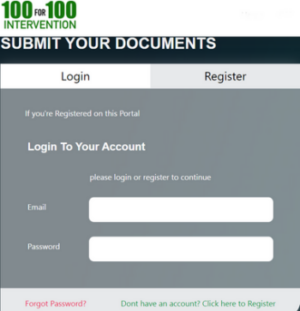

1) Head straight to the official application portal of 100 for 100 PPP to create an account

2) Check your mail to validate your account

3) Upload the following documents:

- Copies of your application documents (scan copies). You’re to do this yourself NOT your bank

- Executive summary of your application in PDF format

- PDF format of the scanned copy of the acknowledgement letter from your bank where your application was submitted

- Scanned copy of your means of ID. The acceptable ones are drivers license, data page of international passport, NIN or National ID card, Voters Card.

4) Click on the “submission button” and a submission slip will be generated. It contains your ID Number, make sure to keep it for reference

That’s it, you’re in for PPP CBN NGN5billion single-digit loan

How to track your application

From time to time, you can log in to your account, click your name to access the menu, and check the status of your application.

Note:

Please check and cross-check your information before hitting the submission button. And most importantly, ensure that your company details like Tax Identification Number and Company registration number (RC) are accurate

28 Companies Receives CBN’s 100 for 100 Loan

On Monday, January 31, 2022, CB governor Emefiele announced in Abuja that 28 have successfully benefited from the 100 for 100 policy

The apex bank boss disclosed that the 28 selected companies met the requirements and went through rigorous screening.

Application for the next cycle of the 100 for 100 policy programme would kick off from February 1, 2022 and ends by April 30, 2022

Emefiele said:

“These projects are to create over 20,000 direct and indirect jobs across all sectors of the economy as well as generate close to $125.8 billion foreign exchange. It is important to note that 5 of the projects are greenfield projects trying to explore the huge opportunities in key sectors of our economy.

Recap:

100 for 100 PPP CBN loan is the boost the production of local manufacturing companies that have the capacity to contribute to Nigeria’s GDP

It’s designed for companies that have the potential to contribute to foreign exchange through exports.

We’ve already discussed how the 100 For100 CBN policy can make naira to appreciate against US Dollar and other major foreign currencies in Nigeria if the apex bank can sustain its latest policy which is targeted at companies that can source at least 50 per cent of its raw materials locally.

Above all, the 100 for 100 policy of the CBN will select 100 companies in 100 days.

Hi admin, thank you for the guide, mine was successful.