There are several ways government agencies or private organizations check whether a business or company is compliant. One of them is through the Company Information Sheet (CIS).

What is CIS?

The Company Information Sheet (CIS) is not only used to verify if a business is still active or operational, but it also serves as a form of identity verification. It contains personal details of business owners and their partners, and can be used to prevent money laundering.

The government agency responsible for issuing such documents or maintaining company/business registration databases varies across jurisdictions and is known by different names.

As such, it is important that companies and businesses regularly update their records with the appropriate agency. While businesses in Nigeria are expected to file annual returns with the Corporate Affairs Commission (CAC), Companies House performs this role in the United Kingdom (UK).

This process is known as return obligations. In the United States, for example, businesses are only required to start filing returns once they begin operations. In contrast, Nigeria’s CAC grants only a one-year moratorium—after that, businesses must file annual returns every year, whether they have commenced operations or not. Failure to do so will result in several years of accumulated returns, which must eventually be cleared.

From Africa to Asia, here is the full list of agency that you are required to file CIS document?

Africa

Nigeria: All companies whether Private Limited, Private Unlimited Companies, sole proprietorship, or Limited Liability Partnerships (LLP) are required file annual returns with the Corporate Affairs Commission (CAC) every year. They only enjoy a year of moratorium, after which they are mandated to start filing to keep their business record up to date. No exempt.

Kenya: In Kenya Registrar of Companies is in charge of keeping record of registered companies and businesses.

South Africa: Public and large private companies must file with the Companies and Intellectual Property Commission (CIPC).

Namibia: Business and Intellectual Property Authority (BIPA) handles all forms of registrations and intellectual property rights for businesses and companies.

Egypt: Public companies and larger private enterprises are required to file with the General Authority for Investment and Free Zones (GAFI).

Ethiopia: Ethiopia Investment Commission (EIC) is a one-stop for registration of businesses and companies, especially for foreign investors.

Uganda: The The directorate of Business Registration, a division of the Uganda Registration Services Bureau (URSB) handles business registration matters, including registration for intellectual property registrations etc.

Côte d’Ivoire: Centre de Promotion des Investissements en Côte d’Ivoire (CEPICI)

Gambia: In the Gambia, the Companies Department which is under the Ministry of Justice is responsible for registering businesses, companies, including charitable bodies, associations and foundations.

Angola: In Angola, the issuance of what other countries cal CIS odcument is done by the National Agency for Private Investment (ANIP).

Zambia: Patents and Companies Registration Agency (PACRA) provides business registration services and protecting intellectual property.

Mauritius: Corporate and Business Registration Department (CBRD) is responsible for registering businesses and companies

Ghana: All forms of registration and issuance of certificate of business registration is done by the Office of the Registrar of Companies (ORC).

Malawi: The Department of the Registrar General (DRG) is responsible for registering businesses and companies and issuing CIS document sheet.

Liberia: The Liberia Business Registry (LBR) or Liberia Company Registry handles company incorporation, name reservations, and ensures compliance with regulations.

Tanzania: The Business Registrations and Licensing Agency (BRELA) is in charge of issuing CIS Document because they handle both pre and post incorporation matters.

Europe

United Kingdom: All limited companies (private and public) must file with Companies House.

Italy: All companies with limited liability, including SRLs and SpAs, must file with the local Chamber of Commerce.

Germany: Public companies, large private companies, and GmbHs (limited liability companies) must file with the Bundesanzeiger (Federal Gazette).

Ireland: Limited companies must file with the Companies Registration Office (CRO), while sole proprietorships and partnerships are exempt unless they are LLPs.

Finland: Finnish Patent and Registration Office is responsible for issuing CIS document.

France: All companies file with the Commercial Court registry. Filing is required for sociétés anonymes (SAs), sociétés à responsabilité limitée (SARLs), and other corporate forms.

Spain: Public and private limited companies (SAs and SLs) must file with the Mercantile Registry.

Sweden: Swedish Companies Registration Office.

Denmark: Danish Business Authority.

Belgium: Central Balance Sheet Office.

North America

United States: The U.S. Small Business Administration (SBA) is in charge of business registration..

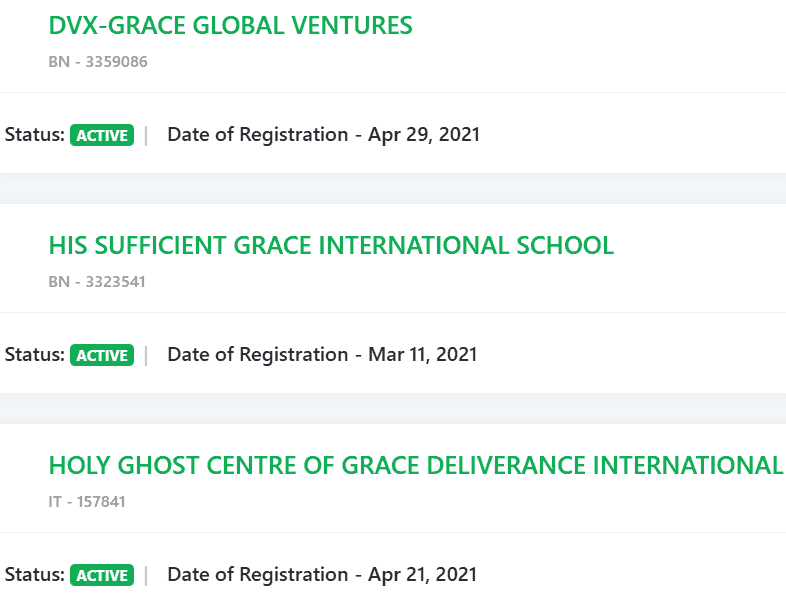

Canada: Companies file with provincial registries or the Canada Business Corporations Act (CBCA) if federally incorporated.

Guatemala: Registro Mercantil (Commercial Registry) is the agency that handles business and company registration matters. It is also known as Registro Mercantil General de la República.

South America

Brazil: Publicly listed companies must file with the Brazilian Securities Commission (CVM). Only companies registered as S.A. (Sociedade Anônima) for public offerings are required to file.

Chile: Public companies and businesses are required to file with the Superintendencia de Valores y Seguros (SVS).

Argentina: All S.A. companies must file with the Inspección General de Justicia (IGJ). Private limited companies (SRLs) may be exempt if they meet specific criteria.

Asia

India: Ministry of Corporate Affairs (MCA).

China: State Administration for Market Regulation (SAMR).

South Korea: Financial Supervisory Service.

Malaysia: Companies and businesses are expected to file with the Companies Commission of Malaysia (SSM).

Hong Kong: Companies Registry

Saudi Arabia: Publicly listed companies must file with the Capital Market Authority.

Singapore: Accounting and Corporate Regulatory Authority (ACRA).

Oceania

Australia: Australian Securities and Investments Commission (ASIC).

New Zealand: Companies Office.

Wherever your business is legally registered, you must endeavour to be compliant to avoid penalties.