After SALT Lending, the world’s first crypto-backed loan launched in 2016, other digital asset-backed loan platforms have launched. Interestingly, the new ones bring to the table decentralized finance (DeFi) to transform how individuals interact with financial systems. One of them is Aave, formerly known as ETHLend, which offers users the ability to lend and borrow cryptocurrencies without traditional intermediaries like banks.

For beginners that want to explore the complex landscape of cryptocurrency lending platforms and DeFi, understanding Aave’s structure, benefits, and risks is very important to make informed decisions. This article traces Aave’s origins, its founder’s background, and the key details new users need to know about this innovative crypto lending platform, including its advantages and potential drawbacks.

Stani Kulechov: Founder of Aave

Aave was founded by Stani Kulechov, a Finnish entrepreneur and lawyer with a deep interest in blockchain technology. Kulechov’s journey in the digital asset space began as an early adopter of Ethereum, where he recognized the potential for decentralized systems to disrupt traditional finance.

Kulechov developed a passion for programming and blockchain innovation, which led him to explore solutions for lending in the cryptocurrency ecosystem. His vision was to create a platform that allowed users to leverage their digital assets for liquidity without relying on centralized institutions.

In November 2017, Kulechov launched Aave under the name ETHLend, a peer-to-peer lending platform focused on Ethereum-based assets. ETHLend raised $16.2 million through an initial coin offering (ICO), selling one billion LEND tokens at $0.0162 each, with 23% allocated to the founding team and project development.

The platform initially connected lenders and borrowers directly, but Kulechov and his team soon identified limitations in this model, such as inefficiencies in matching loan requests. In September 2018, ETHLend rebranded to Aave, to reflect a broader vision of providing a seamless, innovative lending experience.

The rebrand marked a shift to a liquidity pool-based model, which launched as Aave V1 in January 2020. Today, Aave operates under Avara, a parent company based in London, and has expanded to support multiple blockchains and services beyond lending.

What Is Aave?

Aave is a decentralized, non-custodial crypto lending platform built primarily on the Ethereum blockchain, with support for additional networks like Polygon, Avalanche, and Arbitrum.

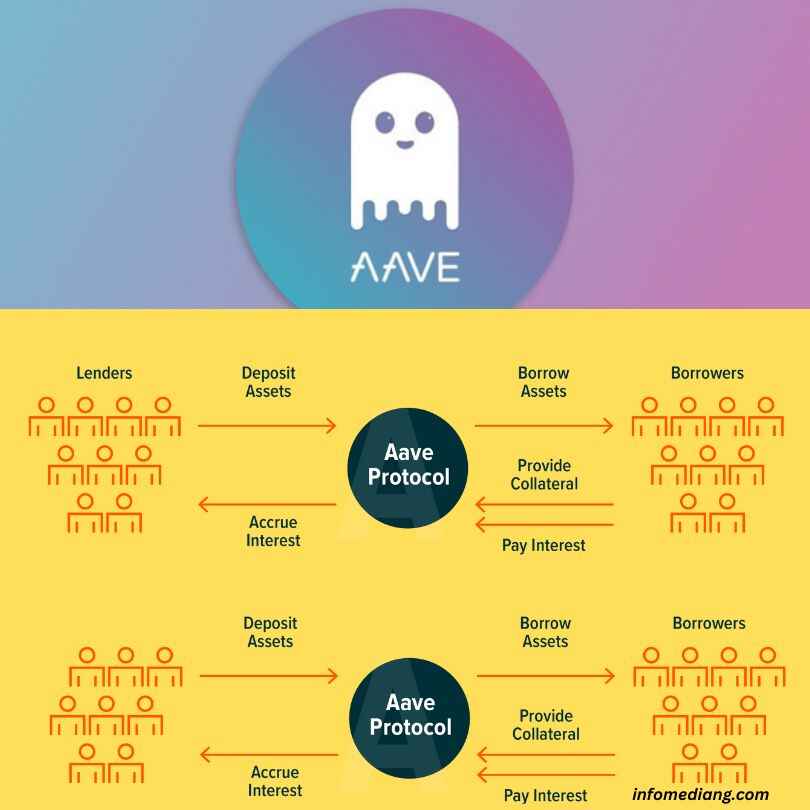

Unlike traditional financial systems, Aave uses smart contracts, self-executing code on the blockchain, to automate lending and borrowing processes, eliminating the need for intermediaries. This allows users to lend digital assets to liquidity pools and earn interest or borrow assets by posting collateral, all managed transparently on-chain.

For beginners, Aave operates as a money market where users can deposit assets like Ethereum (ETH), stablecoins (e.g., USDC, DAI), or other supported tokens into liquidity pools. Lenders earn interest based on the pool’s utilization rate, which fluctuates with supply and demand.

Borrowers, meanwhile, can access loans by depositing collateral, typically worth more than the borrowed amount (overcollateralization), and repay with interest over time. Aave’s native token, AAVE, plays a dual role: it provides discounted fees for users and enables governance, allowing token holders to vote on protocol upgrades, such as adding new assets or adjusting risk parameters.

One of Aave’s standout features is its “flash loans,” a unique tool in the DeFi space. Flash loans allow developers to borrow assets without collateral, provided the loan is repaid within the same blockchain transaction (approximately 15 seconds). This feature is particularly useful for arbitrage opportunities or complex trading strategies but requires technical expertise, making it less relevant for most beginners.

Pros of Using Aave

Aave offers several advantages that make it an attractive choice for those new to crypto lending platforms:

Accessibility and global reach: Aave is open to anyone with an internet connection and a compatible cryptocurrency wallet, such as MetaMask. There are no geographic restrictions or Know Your Customer (KYC) requirements, unlike traditional banks, making it accessible to a global audience.

Diverse asset support: Aave supports over 20 cryptocurrencies, including popular stablecoins like USDC and DAI, as well as volatile assets like ETH and Chainlink (LINK). This variety allows users to diversify their lending or borrowing strategies.

High liquidity: With over $11 billion in total value locked (TVL) as of mid-2025, Aave is one of the largest DeFi protocols, ensuring deep liquidity pools. This reduces the risk of insufficient funds for borrowing and supports competitive interest rates for lenders.

Flexible interest rates: Aave allows borrowers to choose between variable and fixed interest rates. Variable rates adjust based on market conditions, while fixed rates provide stability during volatile periods, offering flexibility for different risk profiles.

Flash loans for advanced users: Flash loans are a pioneering feature that demonstrates Aave’s innovation in the crypto lending space, attracting developers and increasing the platform’s utility.

Community governance: AAVE token holders can propose and vote on protocol changes, such as adding new assets or upgrading to Aave V3, which launched in March 2022. This decentralized governance ensures the platform evolves with user needs.

On July 14, 2025, in an interview with Hilmar Orth (founder of Gelato & Arrakis), Aave founder Kulechov spoke on Aave v4, which has been described as the company’s biggest updates compared to v3.

Robust security: Aave has undergone 13 audits by leading firms like Trail of Bits and OpenZeppelin since 2019, enhancing trust in its smart contracts. The Safety Module, where users can stake AAVE tokens, acts as a liquidity backstop, protecting against potential deficits.

Multi-Chain expansion: Aave’s presence on multiple blockchains, including Polygon, Avalanche, and Optimism, reduces transaction costs and improves speed compared to Ethereum’s base layer, making it more cost-effective for users.

Cons of Using Aave

Despite its strengths, Aave has risks and limitations that beginners must understand before participating:

Overcollateralization requirement: To borrow on Aave, users must deposit collateral worth more than the loan amount, which can tie up capital. For example, borrowing $1,000 in USDC may require $1,500 in ETH as collateral, limiting accessibility for those with fewer assets.

Risk of liquidation: Due to cryptocurrency volatility, if the value of a borrower’s collateral falls below a certain threshold (the “health factor”), the protocol automatically liquidates the collateral to repay the loan. This can result in significant losses during market downturns.

High transaction fees: While Aave’s expansion to layer-2 networks like Polygon reduces costs, transactions on Ethereum’s mainnet can incur high gas fees, especially during network congestion. Beginners with small portfolios may find these fees prohibitive.

Technical complexity: Aave’s interface is user-friendly, but understanding DeFi concepts like liquidity pools, collateral ratios, and flash loans requires a learning curve. New users may need to watch YouTube videos to be able to use the platform effectively.

Smart contract risks: Although Aave has a strong security record, smart contracts are not immune to bugs or exploits. A vulnerability could lead to loss of funds, as seen in rare DeFi hacks across the industry.

Limited regulation: Aave operates in a decentralized environment with minimal regulatory oversight, which can create uncertainty. Beginners accustomed to traditional financial systems may find this lack of regulation unsettling.

Market volatility: Interest rates on Aave are algorithmically determined based on pool utilization. High demand can lead to elevated borrowing rates, while low demand may reduce lender returns, which can lead to unpredictability.

Flash loan risks: While innovative, flash loans have been exploited in past DeFi attacks, potentially affecting platform stability. Although Aave has mitigated these risks, they remain a concern for the broader ecosystem.

How beginners can get started with Aave

For those new to crypto lending platforms, here are practical steps to begin using Aave:

Set up a wallet: Download a wallet like MetaMask and fund it with Ethereum or a supported asset. Ensure you secure your private keys and seed phrase.

Choose a network: Select a blockchain like Ethereum, Polygon, or Avalanche based on transaction costs and supported assets. Layer-2 networks like Polygon are often cheaper for beginners.

Deposit assets: Connect your wallet to Aave’s official website (app.aave.com), choose an asset to lend (e.g., USDC), and deposit it into a liquidity pool. You’ll receive aTokens (e.g., aUSDC) that accrue interest in real-time.

Borrow wisely: If borrowing, deposit collateral and select an asset to borrow. Monitor your health factor to avoid liquidation, and choose between variable or fixed interest rates based on your risk tolerance.

Research and monitor: Stay informed about Aave’s governance proposals and market conditions. Tools like DeFi Llama and Nansen can provide insights into TVL and pool performance.

Start small: Begin with a small deposit or loan to familiarize yourself with the platform. Avoid over-leveraging to minimize the risk of liquidation.

Why Aave stands out

Aave’s evolution from ETHLend to a multi-chain, pool-based protocol, which makes it one of the leaders in the DeFi space. Its founder, Stani Kulechov, leveraged his legal and technical expertise to build a platform that prioritizes user control, transparency, innovation, and he continues to rub minds with key stakeholders and players in the crypto and Blockchain sector, particularly in the United States.

For instance, in June 2025, its founder Kulechov met with Bo Hines, the Executive Director- President’s Council of Advisers for Digital Assets, in White House on how to protect DeFi innovation in the U.S.

With over $11 billion in TVL and support for diverse assets, Aave offers unmatched liquidity and flexibility compared to competitors like Compound Finance (which currently have approximately $2.877 billion) and MakerDAO (with approximately $8.76 billion). Features like flash loans and multi-chain expansion further distinguish it, while its governance model empowers users to shape its future.

However, beginners must exercise caution when using Aave, understanding the risks of overcollateralization, liquidation, and market volatility. By starting small, researching thoroughly by watching user guides on YouTube, and using cost-effective networks, new users can harness Aave’s potential to earn yields or access liquidity while mitigating risks.

Takeaway

Aave has grown into a decentralized powerhouse, enabling users to lend, borrow, and earn interest on digital assets without intermediaries. Beginners can confidently explore this leading crypto lending platform and participate in the future of decentralized finance.