The coast is now clear for former NYSC members to submit their applications for the Tertiary Institutions Entrepreneurship Scheme (TIES).

The programme is a brainchild of the Central Bank of Nigeria (CBN) in pursuant to the CBN Act, 2007 to reduce unemployment among young graduates by supporting their creative and innovative ideas financially.

Recalled that the governor of the apex bank Godwin Emefiele at the 35th Conference of Vice-Chancellors of Nigerian Universities, at the Kano State University of Science and Technology (KUST) stated that their is need to support the entrepreneurship spirit of fresh graduates in Nigeria.

CBN said, “The proposed scheme will be targeted at graduates of tertiary institutions, including universities, polytechnics, monotechnic and colleges.”

Statistics reveal that an estimated 600,000 graduates from Nigeria’s tertiary institutions annually enter the labour market after their one year mandatory National Youth Service Corps (NYSC) programme.

“There is need to re-orientate youths from waiting for white-collar jobs to entrepreneurship, the scheme would be developed to support the development of entrepreneurial culture.”

Objectives of Tertiary Institutions Entrepreneurship Scheme

1) Through the scheme, there will be accessibility to affordable finance which will be provided by the CBN

2) The scheme will create employment opportunities for Nigerian youths.

3) The government wants the youths to make contributions to the GDP through Micro, Small & Medium Enterprises.

4) To provide enabling environment

5) To promote gender balance in entrepreneurship development through capacity development and improved access to finance

Who Can Apply for TIERS?

The scheme is specifically designed for those whose ideas are capable of creating jobs and adding value to Nigeria’s economy.

You can submit your application if your ideas fall under Agribusiness, Science and Technology, Information Technology, and Creative industry

The following businesses can apply for the Tertiary Institutions Entrepreneurship Scheme:

- Production unit of agribusiness

- Logistics in agric-related business

- Application/software development expert

- Business process outsourcing

- Robotics expert

- Publishing

- Medical innovation

- Robotics

- Ticketing systems

- Waste management

- Data management specialist

- Entertainment

- Artwork

- Culinary/event management

- Fashion

- Traffic systems

- Renewable energy

- Photography

- Beauty and cosmetics

- Processing aspect of agrobusiness

- Storage unit

Three Components of the Scheme:

TIERS has three components which are:

- Term Loan Component

- Equity Investment Component

- Developmental Component

Term Loan Component

This is divided into tiers:

- Tier 1: For individual projects

- Tier 2: For company or partnership projects

Requirements for Tier 1

- Your business must have evidence of business registration with CAC (Check our guide on business name registration in Nigeria)

- You have CAC-certified true copies (CTC)

- Bank Verification Number (BVN)

- First degree certificate (BSc/HND or its equivalent)

- NYSC discharge or exemption certificate

- Certificate of Participation issued by polytechnics and universities evidencing entrepreneurship training

Terms of Loan (Tier 1):

- Loan Limit: N5,000,000

- Tenor: 5 years

- Interest Rate: 5% per annum (9% effective from March 1, 2022, or as may be prescribed by the CBN)

- Moratorium: Maximum of 12 months on principal and interest

Tier 2 – Partnership / Company projects

- Loan Limit: N25,000,000

- Tenor: 5 years

- Interest Rate: 5% per annum (9% effective from March 1, 2022, or as may be prescribed by the CBN)

- Moratorium: Maximum of 12 months on principal and interest

Requirements for TIERS Tier 2 Loan

- Evidence of CAC company registration (Check our guide on registration for Incorporated company)

- Certified true copies (CTC) of relevant forms submitted

Each member of the partnership or company shall also submit the following:

- BVN

- First degree certificate (BSc/HND or its equivalent

- National Youth Service Certificate (NYSC) discharge or exemption certificate

- Certificate of Participation issued by polytechnics and universities evidencing entrepreneurship training.

General Requirements

- Not more than 7 years post-NYSC

- First degree certificate (BSc/HND/or its equivalent)

- NYSC discharge or exemption certificate

- Certificate of Participation issued by polytechnics and universities evidencing entrepreneurship training

- Letter confirming the applicants’ deposit of required certificates from PFI

- Projected Statement of Income

- Statement of Affairs

- Cash flow projections for start-ups and businesses with less than 3 years of operations

- Business plan outlining details, financials, and economic benefits of the projects

Note:

Submitted applications and certificates shall be transmitted directly to the PFI for evaluation and documentation

Application process:

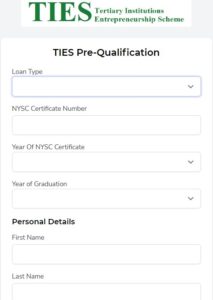

- Head straight to TIERS application portal at: https://cbnties.com.ng/register

- Under the loan type choose tier 1 if you’re a sole proprietor

- Fill in your NYSC certificate Number (You can check the difference between Call-Up number and certificate number in one of our guides)

- Choose year of NYSC certificate

- Year of graduation

- Fill in your personal details

- Click “Submit”

- Check the inbox for further directives!

You can Download the CBN TIERS Implementation Guidelines before submitting your application

Is the CBN serious about this?

We can see the seriousness on the part of the government considering the numerous startup financing programmes that were rolled out during the COVID-19 pandemic to support businesses that were greatly affected.

On the proposed TIES, Emefiele promised that the apex bank will increase its development finance interventions to further support the benefits of start-ups and Small and Medium Enterprises (SMEs) in Nigeria.