What is Crypto Lending?

Crypto lending refers to the practice of lending cryptocurrency assets to earn interest. It operates within centralized finance (CeFi) or decentralized finance (DeFi) platforms.

- What is Crypto Lending?

- Takeaways:

- Types of Crypto Lending

- How Does Crypto Lending Operate?

- Accessibility

- Crypto Lending Promotes Financial Inclusion

- Variety of Assets

- Lower Entry Barriers

- Speed

- Direct Peer-to-Peer Transactions

- Efficient Risk Assessment

- Tax Efficiency

- Collateralized Loans

- Lower Interest Rates

- Transparency

- Decentralized Finance (DeFi)

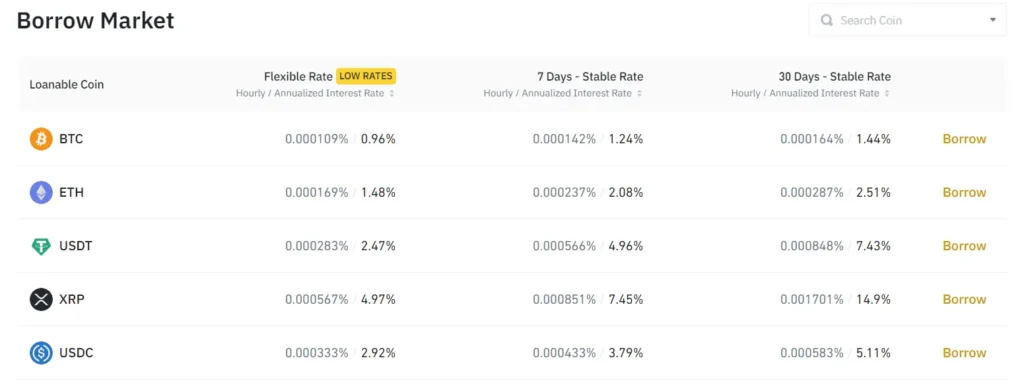

- Crypto Lending Has Low-Interest Rate

- Crypto Lending Has Flexible Terms

- Currency Options

- No Credit Checks

- Tokenization

- Privacy

- Smart Contracts

- Innovation in Financial Products

- Enhanced Security

- Asset Utilization

- Crypto Lending Enhances Increased Market Participation

Takeaways:

- Crypto lending is more accessible and has a global reach

- There are wide range of assets for lenders and borrowers

- It has lower entry barriers

- Crypto loans are fast and quick

- It has a direct Peer-to-Peer transaction feature

- Efficient Risk Assessment

- The use of blockchain technology makes it is transparent

- Crypto lending has a low-interest rate

- Crypto lending platforms such as Nexo, LendingClub, Binance, and crypto.com allow users to either lend or borrow crypto assets, and it involves various tokens and coins such as Bitcoin, Ethereum, Ripple, Cardano, Solana, Litecoin etc. It is not limited to the two most popular coins: BTC and ETH.

Types of Crypto Lending

Centralized Platforms:

Platforms like BlockFi, Celsius Network, and Nexo are centralized entities that offer crypto loans, usually with a more user-friendly experience and customer support.

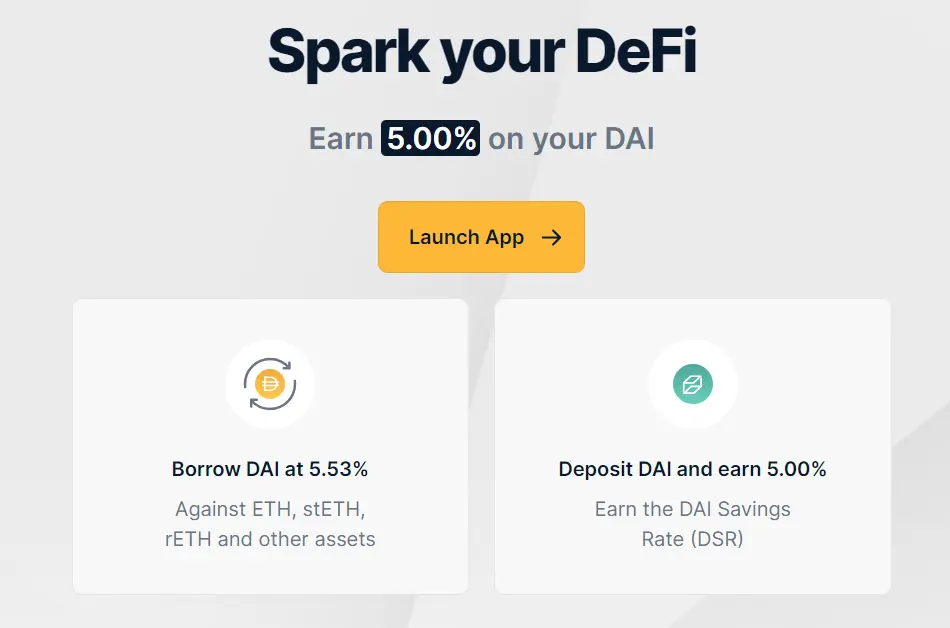

Decentralized Finance (DeFi) Platforms:

Protocols like Aave, MakerDAO, and Compound allow users to borrow and lend in a decentralized manner, using smart contracts on a blockchain, without intermediaries.

How Does Crypto Lending Operate?

Crypto lending operates through a combination of smart contracts, blockchain technology, and liquidity mechanisms. They come with challenges, in case you haven’t used a crypto lending platform before, here is a simplified step-by-step process of how it operates:

Step 1: Choosing a Platform

The lender chooses a crypto lending platform or DeFi protocol. If you choose a centralized one, you can pick between BlockFi or Nexo, if decentralized is your choice, you can choose between Aave or Compound. There are many of them out there.

Step 2: Depositing Assets

Lenders deposit their crypto assets onto the platform to earn interest.

These assets become part of a liquidity pool that other users can borrow from.

Step 3: Setting Terms

Centralized platforms typically set the interest rates, loan terms, and collateral requirements while DeFi protocols usually allow smart contracts to determine interest rates based on supply and demand dynamics and automatically handle the enforcement of the loan terms.

Step 4: Borrowing

Borrowers request a loan, putting up collateral (usually more than the loan value) to secure the borrowed assets.

The collateral is usually in a different asset, such as putting up Ether (ETH) to borrow a stablecoin like USDC.

Step 5: Managing Risk

The smart contracts monitor the collateral-to-loan value ratio. If the collateral’s value drops below a certain level due to market fluctuations, the borrower will need to add more collateral or repay part of the loan to avoid liquidation.

In case of failure to replenish collateral, the smart contract will automatically liquidate enough collateral to cover the loan.

Step 6: Interest and Repayment

Borrowers pay interest on their loans.

Upon repayment of the borrowed amount and interest, borrowers retrieve their collateral.

Lenders earn interest on the crypto they’ve deposited.

Step 7: Yield Farming and Liquidity Mining (In some DeFi Platforms)

Some platforms incentivize lenders and borrowers by distributing utility tokens. This process is known as liquidity mining or yield farming.

Users can earn additional returns by holding or staking these tokens.

Step 8: Withdrawal

Lenders can withdraw their assets along with the earned interest after a specified period, based on the terms of the platform or protocol.

Top Benefits of Crypto Lending

That’s how crypto lending works for lenders, borrowers and the platform, so what are the benefits of crypto lending for both lenders and borrowers?

Accessibility

Crypto lending platforms through the use of blockchain technology enable more people to access loans and other financial products in the following ways:

Universal Accessibility

Unbanked and Underbanked Populations: Crypto loans are accessible to people who do not have access to traditional banking services, thereby unbanked and underbanked populations to access financial services.

Global Reach: It doesn’t “discriminate” based on location, race, or color. People from different geographical locations, even those with limited banking infrastructure, can access crypto loans, breaking down geographical barriers in financial accessibility. And of course, this is its biggest advantage over traditional lending system that cares more about your location rather than the credit facility.

Online Availability:

24/7 Access: Crypto lending platforms operate allow users to access financial services at any time, unlike traditional banks with set operating business hours. When traditional bank closes, customers can only access limited services on their apps.

User-Friendly Platforms: Many crypto lending platforms have intuitive interfaces, enabling users with varying levels of technical expertise to access services with ease.

Crypto Lending Promotes Financial Inclusion

Credit History: Crypto loans, typically being collateral-based, allow people with no or poor credit history to access loans.

Financial Empowerment: By providing access to financial services, crypto lending empowers individuals to participate in economic activities, invest, and manage their finances. Although, this also requires some level of caution.

Variety of Assets

Diverse Collateral Options: Cryptocurrency lending allows users to leverage a variety of crypto assets as collateral, allowing more flexibility and options in accessing loans.

Tokenization: Tokenization of real-world assets such as real estate and art can also expand accessibility, allowing users to leverage them.

Lower Entry Barriers

Minimum Requirements: The requirements to access crypto loans are usually minimal, often requiring only collateral and a compatible wallet, making it easier for a wider range of people to obtain loans.

Low Minimum Loan Amounts: Some platforms will offer you loans with low minimum amounts, allowing you to borrow according to your needs without unnecessary limitations.

Speed

Quick Processing:

You don’t have to wait for days to access “credit facility” on crypto lending platforms. They enable rapid processing of loan applications, approvals, and disbursements due to automated systems and the absence of lengthy paperwork that peculiar to traditional lending.

Real-Time Transactions:

Transactions on a blockchain can occur in real-time or within a few minutes, even across borders, allowing funds to be transferred quickly once a loan is approved.

Direct Peer-to-Peer Transactions

Many crypto lending platforms enable direct peer-to-peer lending. They will quickly match you (in case you’re the borrower) with ready-to-lend users. This reduces the layers of bureaucracy.

Efficient Risk Assessment

Automated risk assessment algorithms are in place to swiftly evaluate the risk levels associated with borrower’s loan applications, allowing for immediate decisions on loan approvals or rejections based on predefined criteria.

Tax Efficiency

In some jurisdictions, borrowing against crypto assets may be more tax-efficient than selling the assets directly, potentially reducing capital gains tax liabilities.

It is also a a great way for countries that have been looking at possible ways of using crypto for economic development, capital gains top their agenda.

Meanwhile, capital gains tax varies from country to country. For instance, capital gains tax is Albania is 15%; in Nigeria and Romania, it is a flat rate of 10%; in Austria: 25% ; in Argentina, it is between 9% to 35% and so on.

Collateralized Loans

Over-Collateralization:

Crypto lending often requires you (borrowers) to deposit more value in collateral than the amount you are borrowing.

This over-collateralization mitigates the lender’s risk, especially given the price volatility of cryptocurrencies. This ensures that the lender can recover the loan amount if the borrower fails to repay.

Collateral Management:

Liquidation: If the value of the collateral falls below a certain threshold due to market fluctuations, lenders may liquidate a portion of the collateral to maintain the loan-to-value ratio agreed upon in the loan contract.

Top-Up: If you are borrowing, you need to top up collateral if its value decreases significantly to avoid liquidation.

Flexibility in Collateral Types:

As the borrowers, there are a range of cryptocurrencies such as BNB, XRP, SOL, SHIB, LINK etc or tokenized assets such as art, commodities, property, and gift cards etc you can choose from as collateral, providing flexibility.

For instance, some platforms accept multiple types of collateral for a single loan, allowing borrowers to manage their assets more efficiently.

Asset Utilization:

Collateralized loans allow you to unlock liquidity from your holdings without selling them. This way, as a borrower, you can still participate in the potential upside of their assets while using the borrowed funds for your needs.

Lower Interest Rates

Given the reduced risk to lenders due to collateralization, interest rates on crypto loans are often lower compared to unsecured loans, making it more affordable for borrowers.

Transparency

Public Ledger:

All transactions are recorded and are accessible to anyone who wishes to see them, thanks to the blockchain technology. This includes loan origination, repayments, and any other related transactions. This promotes transparency, ensuring full disclosure.

Immutable Records:

When transaction is recorded on the blockchain, it cannot be altered or deleted. This immutability ensures that all records are permanent and transparent, establishing a high level of trust and security lenders and borrowers.

Clear Loan Terms:

Crypto lending platforms often display loan terms, interest rates, collateral requirements, and other related conditions openly to borrowers and lenders.

Users can review these terms before engaging in lending or borrowing activities, fostering a transparent environment.

Real-Time Price and Data Feeds:

Crypto lending platforms often integrate real-time price feeds and other relevant data, this is to allow lenders and borrowers to monitor the value of their collateral and the state of their loans real-time.

Risk and Liquidation Protocols:

Most platforms clearly outline their risk management and liquidation protocols. This includes the conditions under which collateral would be liquidated and the process that would be followed, allowing users to understand and manage their risks better.

Decentralized Finance (DeFi)

One of the advantages of crypto lending is that many crypto loans are part of the DeFi ecosystem, which prioritizes transparency and open access.

In DeFi platforms, users can scrutinize protocols, lending practices, and transaction history, allowing them to make informed decisions based on publicly available information.

Crypto Lending Has Low-Interest Rate

Reduced Operational Costs:

Blockchain technology and smart contracts automate many processes, reducing administrative and operational costs, and these savings can be passed on to users in the form of lower interest rates.

Increased Competition:

The continuous growth of the DeFi space has led to increased competition among lending platforms, which often results in platforms offering lower interest rates to attract users.

Flexible Interest Rate Models:

Many platforms employ dynamic interest rate models that adjust based on supply and demand for assets, potentially leading to lower rates when liquidity is abundant.

Global Liquidity Pools:

Another benefit of crypto lending is enhances access to global liquidity through decentralized platforms can lead to better capital efficiency and, consequently, to lower interest rates

Crypto Lending Has Flexible Terms

Most of the crypto lending platforms are more adaptable, customizable, and user-centric terms and conditions in the following ways:

- It has variable loan duration.

- It has dynamic interest rates.

- It enhances flexibility in repayment.

- It offers users flexibility to use a variety of cryptocurrencies as collateral.

- It has customizable collateral ratios, meaning users have the option to select their preferred loan-to-value (LTV) ratio, thereby allowing them to choose how much they want to borrow against their collateral.

Currency Options

Through this, there is the availability of multiple currency options to cater for different user preferences, needs, and risk tolerances. Other benefits inherent from this are:

It allows users to benefit from competitive exchange rates on crypto lending platforms when converting between different currencies, reducing the cost of currency conversion.

The use stablecoin lending and borrowing that helps mitigate the price volatility typically associated with other cryptocurrencies, providing more stability to both lenders and borrowers.

This option has also be upgraded by some crypto lending platforms to allow users to borrow fiat currencies using their crypto assets as collateral. This allows users to spend in the traditional economy without selling their crypto holdings.

It allows for currency swaps, allowing you to swap one currency for another easily, either to manage your loan collateral more effectively or to meet their repayment obligations in the desired currency.

No Credit Checks

Without the necessity for credit checks, crypto loans are more more accessible to a broader range of people, including those with poor or no credit history, enabling financial inclusion and providing access to funds that might otherwise be unavailable.

Tokenization

Through tokenization, a variety of assets can be used as collateral for a loan, including real estate and art, increasing the range of options available to borrowers and lenders alike. It also promotes financial inclusion in the long-run.

Privacy

While transactions are transparent and traceable on the blockchain, users often enjoy a higher level of privacy compared to traditional financial institutions, as they can interact with the platforms without sharing extensive personal information.

Smart Contracts

Smart contracts automatically enforce the terms of the loan agreement, reducing the risk of disputes and eliminating the need for intermediaries, thus reducing costs.

Innovation in Financial Products

Crypto loans have spurred the development of innovative financial products and services, such as flash loans, that are not possible within the traditional financial system.

The invention of crypto loans has put the traditional banking system on the hot seat, pushing them to catch up with the innovative financial products in the blockchain world.

Enhanced Security

Blockchain technology offers advanced security features, such as cryptographic encryption, which secures data and transactions, reducing the risk of hacks (there were cases around compromised data, leading to losses in the past) and data breaches.

Asset Utilization

Crypto loans enable lenders and borrowers to leverage their existing crypto assets to obtain liquidity, allowing them to utilize assets without having to sell them.

Crypto Lending Enhances Increased Market Participation

And finally, by providing access to capital, crypto loans enable increased participation in the crypto market, allowing users to leverage their positions, invest, or trade.