With the current dollar spending limit on Naira debit cards, it becomes extremely difficult for Nigerians who pay for foreign services online, especially for bloggers who pay for hosting, domains, and professional tools in foreign currency

If there is a limit on your Naira Card or you can’t use it for international transactions, this guide shows you how to fund your US Dollar Card through a domiciliary account and start spending online.

NB: Guaranty Trust Bank is our case study. The process may be different from other financial institutions.

Note: You CAN NOT apply for US$ Debit Card without a domiciliary (dom account for short).

Requirements for Dom Account

Having a dom account comes with a lot of advantages, to apply for a dom account…

1) Obtain and fill domiciliary application form at a nearby branch of GTbank

2) Your recent passport photograph

3) A recent utility bill not older than three months

4) A copy of a recognised Identification Number e.g Driver’s License, International Passport, INEC’s voter card

Benefits of Prepaid Dollar Card

A prepaid Dollar Card is an international payment card issued in partnership with MasterCard Worldwide or VISA International.

1) The card is available to anyone around the world to meet their various payment needs.

2) It can be used on ATM, POS and Online transactions.

3) A holder of a dollar card in Nigeria can spend at most $1,666USD per month which translates to $20,000USD annually. This enables you to exceed the $20/month on Naira Debit Card. This applies to Guaranty Trust Bank. It may be different in other banks, kindly check our resources below this article

4) The Prepaid Dollar Card gives the holder to access their fund 24-hour from over 2 million ATMs globally.

5) The MasterCard Prepaid dollar card can be used in over 200 countries on major channels like ATM, POS and online purchases.

Caution:

Exercise the utmost precautionary measures when using your dollar card online for purchases. The fact that the card employs the use of Chip and PIN technology doesn’t you should be careless with its handling.

Application Requirements for Dollar Card

- You must be a holder of an existing domiciliary account if not, check the requirements for a dom account above.

- Obtain the card application form and mark the option for a dollar card (MasterCard or VISA).

- Fill and submit

- You may be required to check back at a later date.

- Collect your card and activate it and check the balance on your card on the Automated Teller Machine (ATM).

There is a dedicated USD account number associated with your USD card, note it down because you are going to need it.

How To Fund Dollar Debit Card Using Dom Account

Your dom account must be funded before using the guide below. The source of funding your USD debit card is Dom Account.

This method is one of the alternatives Nigerian parents can deploy to send feeding allowance to their foreign students.

Now it’s time to fund your dollar debit card to start using it online to pay for services or products, follow the steps below to get started:

1) Login to your GT Bank online banking

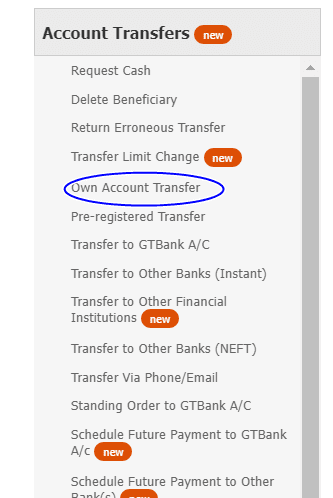

2) Click “Account transfers”

3) Select “Own Account Transfer”

4) Choose your domiciliary account on the “from” option because you can only transfer funds from a dom account to a dollar card

5) Under “to” enter your Dollar Card account number

6) Enter the amount

7) And hit the submit button.

In less than two seconds, the amount will reflect on your prepaid or debit dollar card.

How to Fund Your Dollar Card from Your Dom Account using GTB App

Funding your dollar card is even much easier on GTBank App than using the online method, below is a quick way to fund your dollar card from your domiciliary account

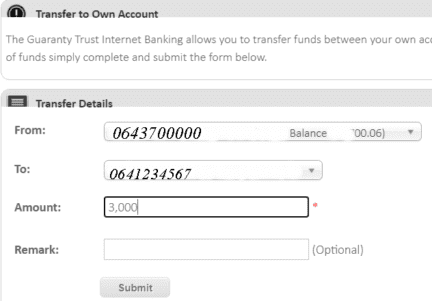

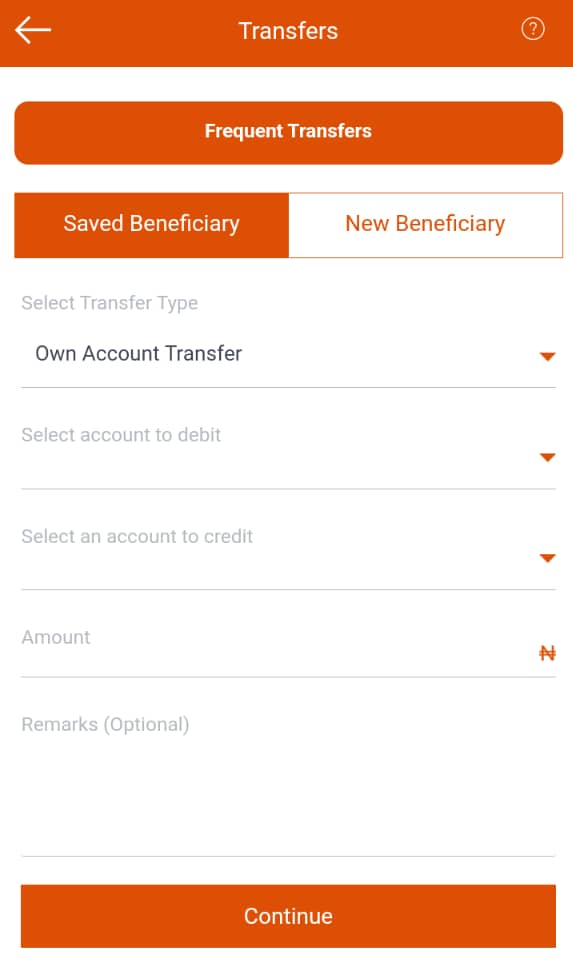

Step 1: Login to the app

Step 2: Click “transfers” and select “own account transfer”

Step 3: Go to the next step under “select account to debit” from the drop-down option, select USD Currency which is your dom account

Step 4: Next, select an account to credit and choose your MasterCard USD (dollar card)

Note: You will notice that the dom account fades at this stage because that is the account to debit.

Step 5: Enter the amount.

The remark is optional.

Step 6: Click continue and enter your transaction PIN to confirm the transfer

That’s all, you just funded your dollar card from your dom account balance.

That’s all.

Prepaid Dollar MasterCard Limit in Nigeria

There are limits to the amount you can spend on your USD/GBP/EUR Card. The limit differs from bank to bank as you can see in the table below:

| Banks | Monthly Limit | Annual limit | Maintenance fee | Validity period |

| GTBank | $1,666 | $20,000 | $10 annually | 3 years |

| FCMB | $5,000 | $60,000 | 3 years | |

| UBA | $10,000 | $120,000 | $21 monthly | 3 years |

Note:

You can not fund your dollar bedit card with your Naira saving account.

Dom account is a prerequisite to obtaining a US$ Card. At Guaranty Trust Bank or any other bank, the first question customer support asks is: Do you have a dom account?.

If you don’t have a dom account, that’s where you have to start.

This is one of the easiest methods for parents and guardians can send funds to their undergraduate or postgraduate kids in foreign universities if they can wait for the bureaucratic approval process that has bedevilled the CBN forex application portal.

A debit dollar card makes it easy for bloggers and professional content writers to pay for themes, plugins, software, and other paid tools online.

Recap:

Obtaining a foreign currency card (USD or GBP domiciliary account is required) is the best solution to the issue of spending limit on Naira Debit and credit cards. Some banks in Nigeria no longer allow international transactions on naira debit cards.

Foreign currency card enables you to spend $5K per month (for FCMB) and $20K (for GT Bank).

You can fund your dollar card account through your dom account balance. Naira account number can’t be used to fund US$ card.

Resources:

- FCMB. “International Debit Card”. fcmb.com

- First Bank. “VISA Debit Multi-Currency”. firstbanknigeria.com

- Access Bank. “Access Card”. accessbankplc.com

- Zenith Bank. “Cards”. zenithbank.com

- Stanbic IBTC Bank. “Corporate Prepaid Card – Dollar”. stanbicibtcbank.com

- Wema Bank. “MasterCard Dollar Debit Card”. wemabank.com.

- Unity Bank. “Platinum Debit Mastercard (USD)” Unitybankng.com.

- UBA Group. “Gold Domiciliary MasterCard“. ubagroup.com.

Thank you so so much, very helpful. Especially the part to add the dollar card number. Excellent!

For those of you who have a Dom account and have received your Dollar Card (and have retrieved the pin and activated it at any ATM) but are still finding it difficult to transfer your money from your Dollar account to your dollar card follow these instructions

log on to internet banking

Go to My Account

Go to Account Profile Maintenance

Click add account

You will see your Naira ACCOUNT, Dollar Account, and Dollar Card account

Click on the dollar card account

Go back and try the process on this page.

hope this is helpful.

Please I can’t seems to fund my dollar card because the account to debit option doesn’t have card account just my naira account and the dollar account which is faded. How do I go about that because it’s frustrating.thanks

Where you able to resolve it? I am having the same problem. With GTBank it’s as though when you think you have solved your problem they find another way to frustrate you.

Pls how do I transfer from my GTB dollar card to a naira account like my chipper account

The fund in your dollar card is used for purchases or make international payment online.

If you want naira in your naira account, you can sell part of your fund in Dom account to BDC operator who in return credit you with naira.

Please, can I fund my Dom account with Naira?

I sent #1000 to my recently opened dom account and it reflected. I don’t understand again.

You cannot effect transfer between accounts of different currencies.

What bank are u using and did it reflect in naira or dollar?

Please which company and at what rate? I want to fund my Dom account to purchase things. Thank you as I anticipate your reply

Hello Philokos,

If you already have a dom account, you buy at the parallel market, pay into your account, and transfer it to your Dollar Card by following the guides in this article.

If you need more help, send us a mail at business (at) infomediang dot com

Thanks For Sharing, but Still Finding it Difficult

Hi Mbam,

What challenges are you having to fund your USD card?

In my case I’m using GTB and each time I try to move my money from the dorm account to the dorm card account it shows “either the source or the target account has restriction”

Hi Uche,

When we had a similar problem, we approached our bank to update our profile.

The problem is most likely from your bank. You might be asked to update your referees

Yes, there is a company that accepts Naira and transfers the dollar equivalent to your prepaid dollar card.

That’s what I have been using and it’s slightly cheaper than BDC.

What’s the name of the company please

Please can u tell the company which u said I can fund my Dom with.

Thank u

If you can’t access FX at the official rate, you can buy from the parallel market and deposit it into your account.

Thank you for sharing. Is there any chance of funding account using naira. I do use it on skrill but the service is unavailable because of CBN policy.