In a country where your country of residence has nearly been ostracized from using some of the popular payment channels to receive payment for your services because of the bad behaviour of a few persons, that is when Geegpay Virtual accounts by Raenest come in handy, particularly for someone as me, who earns a living by creating content.

Although not a bank, Geepay is a digital platform designed for freelancers, contractors, content creators, and employees across Africa.

Why Geepay over banks’s Dorm Accounts?

I have a domiciliary account with one of the banks in Nigeria, but most of my international clients, especially in the United States and The UK are not comfortable sending payments directly to freelancers based in Nigeria via dorm account except in a few cases because some of them feel that Nigeria is among the high-risk countries.

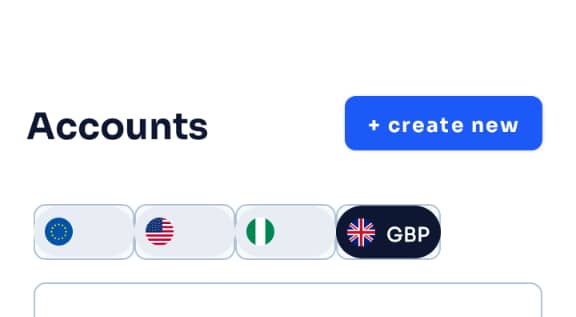

The moment Geepay came on board, I knew it was time for African content creators to connect with the rest of the world and get paid in US Dollars, Pounds, and Euro. What even makes it easy for me is the fair conversion rate that uses the prevalent market rate and sends to local bank accounts.

Currency conversion

On a particular occasion after completing a task a client requested, “If you need payment in bank transfer, share the bank invoice” and share my US virtual bank account, I was credited in less than 24 hours, which I converted to Naira and transferred to my local bank account. That’s how payment should work in a digital space.

Processing fee

2.5 per cent is charged as a fee. For instance, if you receive $60 for your service via your Geepay virtual US account, a $1.5 fee would be deducted as a service charge while you’d receive $58.50. I have no problem with the fee.

Creating an invoice

Similar to how users can create an invoice on PayPal and other other payment processors, Geepay also makes it easy for its users to send invoices to their clients by:

- Entering the billing address for your customer

- Choose the invoice currency

- Issue Date

- Invoice due date

- Then, you need to add a product you want to receive payment for

- Then click on “Continue” to preview the details of your invoice

- When you click on “Send Now” your client receives a payment request containing the payment link in their inbox.

Even with the payment link, the payment request would still contain the virtual bank account of whatever currencies you selected when generating your invoice.

Ability to create a Virtual Dollar card

I already wrote on how to topup your virtual USD card on Geepay and how to withdraw from it in my earlier articles. The virtual accounts have solved lots of global payment issues faced by most of us working online.

You know the hurdles content creators pass through in the hands of Nigerian banks even with their USD Payment cards. When it’s time to make online payments like paying for services, renewing hosting service, purchasing a new theme and plugins among other payments, that’s when you realize that your card is limited or is rejected by the other parties.

For instance, my GTB USD card was rejected the last time I wanted to subscribe to X Premium (formerly Twitter) for one of our business accounts. It was rejected several times until I used a Geepay virtual USD card. Its major competitor in the market right now is Grey Virtual USD card.

To make payment with the card is easier for the creator, who has been credited by a client. You pay more if you top it up with your Naira.

You will use the virtual USD card as you would the physical MasterCard or VISA card issued by your financial institution. The major difference is that it isn’t something you can hold, yet you can see it right on the app and use it as you wish to connect with the global market.

To use the card, you have to get the details of the card for you to use it for purchases online

- Click on cards in the menus

- Click on “View card details” to see card number, expiry date, CVV, and billing address

- You can use the option “add fund” anytime you want to use it online

- You can freeze your card and unfreeze and completely terminate the card.

For me, Geepay Virtual Accounts is all you need to connect with the global market.

Customer support

The only delayed support I had so far was during the weekend, but during the weekend, support has been fantastic even within the app.

Limitations

Geepay doesn’t allow conversion that is less than $5.

Also, users cannot add less than $5 to their virtual USD card.

However, you can send money from your virtual account balances directly to your local bank, it will automatically convert them into local currency.

I’m looking forward to seeing the payment link to support card payment instead of redirecting the payer to make the manual payment when using the invoice link.