You can access at least N250K and as high as N2.5 million as a business loan to support your business, thanks to the partnership between the Small and Medium Enterprises Development Agency of Nigeria (SMEDAN) and the Sterling Bank.

Application Update

Applicants for the loan who submitted applications in November 2023 have now had their applications null and void. They are mandated to submit their Corporate Affairs Commission certificate and Tax Identification Number.

They are now also mandated to download SMEDAN app where they can reapply. According to the Head of Corporate Affairs, Moshood Lawal, the submission of CAC certificate and TIN was “to identify fake applicants and ensure the funds is given to the right persons.”

“We had to move to an app to avoid human interference because almost everyone had a brother or a sister who tried to influence the process. So, it is better to register via the application, upload the Corporate Affairs Commission certificate, Tax Identification Number and other necessary documents.”

The Punch quoted Moshood as saying.

The loan facility is worth up to N5 billion to support small businesses across Nigeria. On the scale of N250,000, the loan can cover 20,000 SMEs across Nigeria.

It’s a single-digit business loan with a nine per cent interest rate, making it the best financial facility any SME can have access to and the application is FREE.

Here are the requirements and application process for the latest SMEDAN-Sterling loan.

Requirements:

- Your biodata

- Your certificate of business registration with CAC

- Active email address

- Tax Identification Number (TIN)

- State of residence

- BVN

- Registered business name

- NIN

- Business registration number

- Detailed description of residential address

As for evidence of business registration certificate, you can’t use SMEDAN certificate.

Application process:

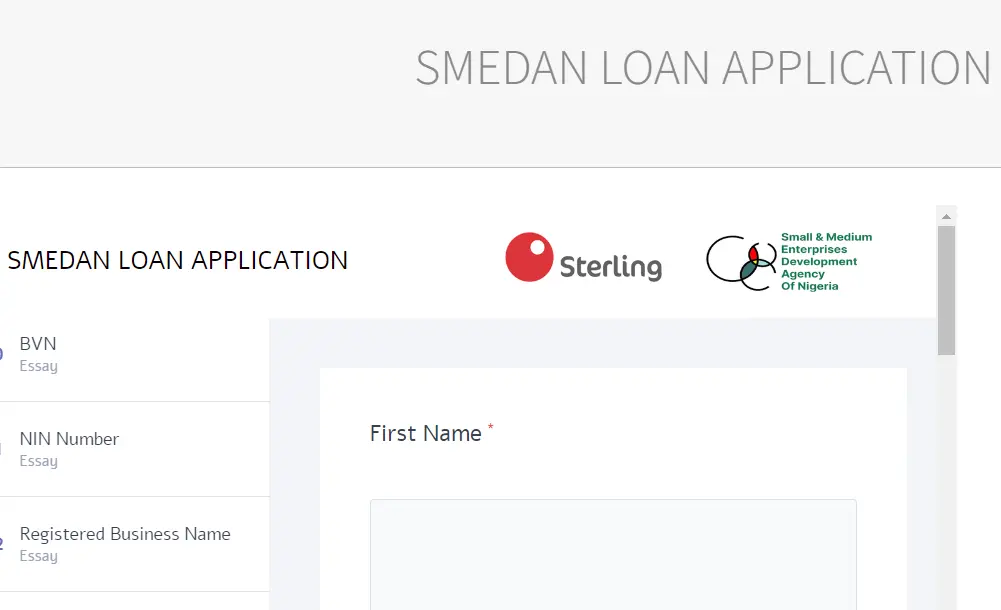

The form is designed to make the loan application process efficient and accessible. Here is how to apply:

- Head straight to download sterling.ng/smedan or download the SMEDAN app

- It is a one-page form and needs no upload of documents at this stage.

- Fill out the details mentioned above and hit the submit button

It is open to everyone regardless of political, or religious affiliations

Terms of the N5 Billion SMEDAN-Sterling Loan

- The SMEDAN loan agreement with Sterling Bank has a duration of 24 months.

- Repayment begins after three months of disbursement

- Disbursement of the loan will start two weeks after the closing of the application.

- To access the loan, small businesses must register with SMEDAN

- The application must be completed via smedan.gov.ng/smedansterling, after which the bank will process the application for disbursement.

SMEDAN is an agency designed to articulate policy ideas for small and medium enterprises’ growth and development in Nigeria.

I need money

I need money please my loan is not pay

when disbursement is going to start after you meetup requirement

I have successfully applied and submitted and a mail has been sent me confirming the successful application.

How do I upload my Business plan and other relevant documents. Which site please?

There are no options to upload Business Plan for now, unless you’re talking about another platform.