The imposition of excise tax on foreign exchange transactions outside the official market is one of the recommendations of the Presidential Fiscal Policy and Tax Reforms Committee which submitted its recommendations Wednesday in Abuja.

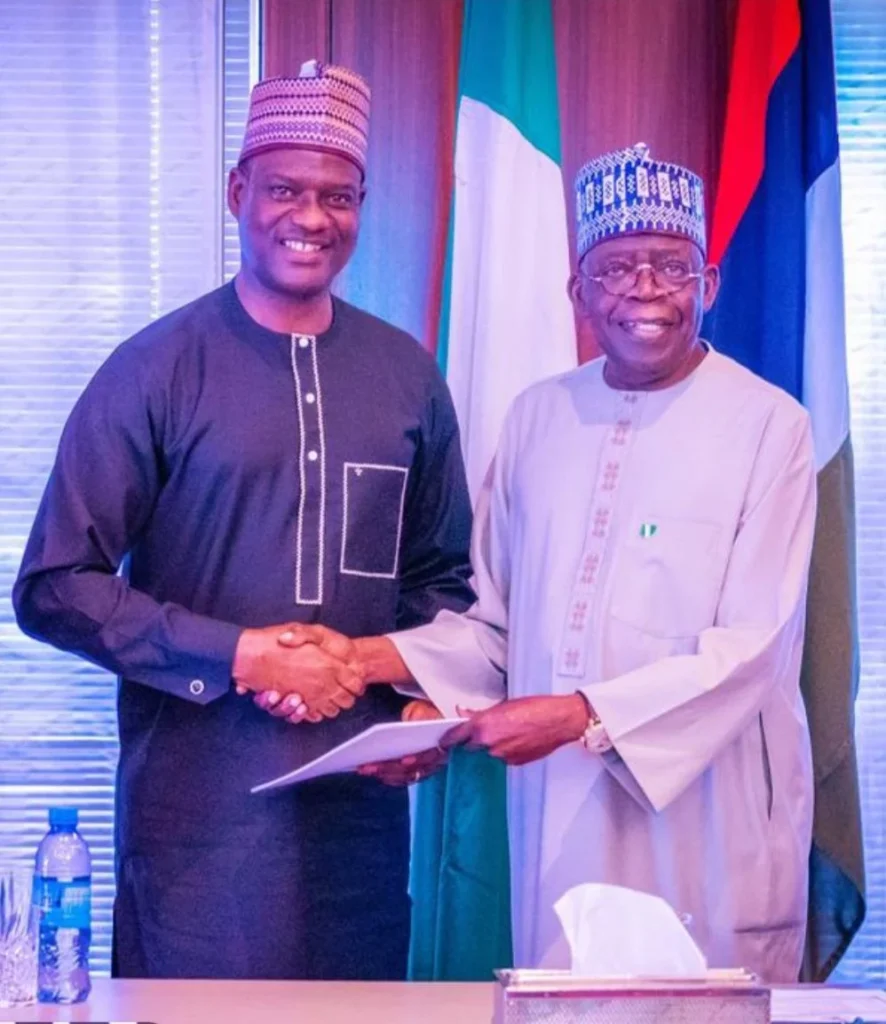

In a report titled “Quick Wins”, the committee head and a tax expert, Taiwo Oyedele led his members to submit its report to President Bola Tinubu at the Presidential Villa.

Implications of taxing transactions at the parallel market

If the recommendations are completely implemented by the government, it means that the government is now ready to discourage the buying and selling of FOREX at the black market by imposing “heavy” taxation on transactions and operators of the unofficial market.

The crisis in the foreign exchange market heightened after Tinubu announced the floating of Naira and collapsed the multiple exchange regime a few days after he was sworn in.

The CBN in a communique said FOREX trades would be held at the Importers’ and Exporters’ Window, which signalled the end of the official rate set by the apex bank.

Tinubu’s predecessor Muhammadu Buhari was accused of committing $1.5billion monthly to defend the naira against its pairs at the Forex market.

But Tinubu said he would not continue to subsidize exchange, which sparked the domino effect at the FX market against the Naira.

Dollar against the Naira jumped from N750 at the parallel market to $/N1,290 at the time of publication. A day earlier, it closed at $/N1,285 on the black market.

At the official rate traded at NAFEM, the exchange fell to N847.77 against the US Dollar.

The quick win report on FOREX

In what looks like a move to make transactions unfavorable to the operators of the unofficial market, the tax committee says taxing the Forex transactions at the parallel market would reduce their volume of transactions.

What happens if operators of the parallel market adjust to the new FX tax regime?

Well, it’s going to be a win-win for the government. For instance, the heavy taxation on imported cars has not stopped the importation of cars for those who can afford them.

As for taxing transactions at the parallel market, the final consumers (FX buyers) are definitely going to bear the tax burden.

However, the operators of the parallel market should not be too happy as the head of the tax reforms committee is a tax expert who knows how people might want to explore loopholes and has put in place mechanisms to minimise such audacious moves.

He also advised the government to expand the official foreign exchange market to incorporate the operators of the black market popularly known as Bureau De Change operators.

Allow forex apps and retail FX dealers in the expanded FOREX market to allow for healthy competition. By this move, transactions in the black market will be outlawed, making transacting at the black market punishable.

The committee also recommended that the Tinubu-led government should digitalise Nigeria’s fx regime so as to discourage speculative demands and hoarding of FOREX in cash.

Taxing FX-denominated transactions

The committee didn’t leave any stone unturned as it also advised the government to allow payment of taxes on foreign currency-denominated transactions in Naira for Nigerian businesses.

In recent times, some businesses, especially the real estate sector used the dollar as a means of transactions instead of the Naira, this recommendation, if implemented, would cater for this aspect.

Other recommendations regarding FOREX include a “comprehensive review of tariffs on the 43 items unbanned from accessing forex in the official market and fiscal policy review of other items prohibited for imports”

“Discontinue with the fx verification portal and requirement for Certificate of Capital Importation and export proceeds restriction.”

@taiwoyedele

Above all, the committee wants the government to abolish its multiple taxation regime so as to give businesses a breathing space.

And called on the government to deploy technology, which it called “Data4Tax” to expand its tax net.

The highlight of the recommendations is the plan to grant tax holidays for the private sector in respect of wage increases to low-income earners, transport subsidies and net increase in employment.