The latest forex middleweight wrestling between the Central Bank of Nigeria (CBN) and abokifx.com isn’t just dramatic but also shows how the inconsistent foreign exchange policies of Nigeria have created a system that benefited some people to the detriment of the Nigerian economy.

Abokifx is a website that tracks foreign exchange rates both at the official and the parallel market popularly known as black market rate in Nigeria.

Millions of Nigeria depended on the fx rate on abokifx than the official rate of banks because, to them, it’s more realistic than what’s obtainable at the financial institutions.

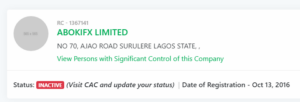

Company Details of Abokifx

- Incorporated Name: AbokiFx Limited

- Founder: Olusegun Oniwinde Adedotun

- Company Type: Private Company Limited By Shares

- Registration Number: 1367141

- Date of operation: 2014

- Date of Incorporation: Oct 13, 2016

- Share Capital: N1,000,000 (one million shares naira)

- Company Address: No 70, Ajao Road Surulere Lagos State, Surulere, Lagos State

- Head Office Address: Nil

- Email: Nil

- Status: Inactive

CBN VS AbokiFx: Background Controversy

In the past three weeks, the Naira has depreciated more ridiculously against the US dollar and two other foreign currencies, trading at N570/$1 as of Friday, September 17, 2021, at the black market rate.

To Godwin Emefiele, head of the CBN, it is ridiculously uncalled for to have a difference of N160 between the parallel market rate as seen on the foreign exchange tracking website and the official rate of N410.

And on September 17, 2021, Emefiele announced that a “tactical unit” would go after Mr. Oniwinde Adedotun, a UK-based Nigerian man, who owns abokifx limited.

The question Nigerians and those who have been following the fx market in recent times is: Can a website unilaterally manipulate the foreign exchange market?

To us, we prefer to ask: Does Abokifx have the market forces to determine the price of the Nigerian Naira against major foreign currencies in there were no loopholes in the FX policy?

We shall provide a few things we know about the controversy and how the CBN created a policy that currently favours the black marketers of Naira and the website that claims to be tracking the rate they buy and sell.

The Advent Of Black Market Rate In Nigeria

The current Exchange Rate Policy in Nigeria can hugely be traced back to the regime of former Military Head of State, General Ibrahim Badamosi Babangida from 1985 to 1994.

Although the policy had evolved due to the decision of the government to remove rigid controls from 1965, the IBB regime played a huge role through its Special Adjustment Programme (SAP), a journal article by Agogo Mawuli entitled “Foreign Exchange Management Policies In Nigeria: 1962 – 1992” says.

IBB’s regime altered the pegged exchange rate with the aim that the naira would find its real value and also “strengthen the internal competitiveness of Nigerian producers” which gave birth to SAP.

How Black Market Came Into Being

The introduction of SAP culminated in a gradual depreciation of the Nigerian currency and two-tier exchange rate markets was introduced by September 1985, a month after Babangida kicked Major General Muhammadu Buhari, the then military ruler, out of office.

As if the regime was experimenting with the value of naira, by March 1992, the CBN governor at the time, Alhaji Abdulkadir Ahmed replaced two-tier rate markets with a free float.

How the two-tier rate worked:

The exchange rate was lowered. There were authorised dealers at bidding sessions. While the first tier market was designed for official foreign transfers and transactions, the second group was designed to auction foreign exchange allocations by the apex bank to authorised dealers.

Surprisingly, the authorised dealers hit the black market with their portion of forex. Apart from these sects of dealers, political heavyweights who could access forex through the official rate by what is now known as Personal Travel Allowance (PTA) chose the dealers in the black market to sell some of the unspent currencies in their purse.

They made a huge profit from the difference, though there were penalties, the sharp practices continued, and looked like the defaulters were ready to face the consequences.

During the free-float regime, authorised dealers were buying and selling forex freely which led to the depreciation of the naira from N10.55 to N18.00 per US dollar at the time.

Foreign Exchange Policy Under Godwin Emefiele

Since the end of military rule on May 29, 1999, heads of the Nigerian apex bank have taken different directions through their policies aimed at: 1) strengthen the value of the naira, 2) strengthen the Nigerian economy.

One of the significant policies of Godwin Emefiele since the assumption of office on June June 3, 2014, was what could be described as a move to salvage the naira. USD to Naira in 2014 when Emefiele took over was N166/$1.

One of the moves was to pump in billions of dollars into the foreign exchange market and multiple exchange rate was introduced.

During this time, more Bureau De Change operators obtained licences, they bought and traded forex in the market. More people patronised them including political office holders.

CBN was selling $20,000 to each of the 5,500 BDC operators across Nigeria until July 27, 2021, when the apex bank announced sales of FX to them had been stopped.

Abokifx was born

The black market was flourishing, those who patronise them needed a real-time rate to make decisions, and before the end of 2014, according to an official statement from the platform, Olusegun Oniwinde Adedotun founded abokifx and a foreign exchange market tracking website.

abokiFX was established in 2014 as a research and information service company, to conduct market research and gather data on the parallel market rates.

We also wanted to provide some transparency around the parallel market with the availability of information technology.

abokiFX purely provides benchmark parallel rate information which helps guide our users in almost 200 countries across the world, the statement says.

But a data we obtained from the Corporate Affairs Commission (CAC), a government agency that registers and monitors activities of companies in Nigeria says that Oniwinde incorporated Abokifx Limited on October 13, 2016, a year after it began operation.

According to CAC search portal (https://infomediang.com/check-cac-database-if-company-is-registered-nigeria), it is a Private Company Limited By Shares with a share capital of N1,000,000

As of the time of this update, abokifx limited status shows inactive on the CAC portal.

Why an incorporated company or business may show inactive

A registered company or business name may inactive if the RC or BN failed to file its annual returns or it failed to update its business activities at the commission office.

The Influence Of Abokifx On Forex In Nigeria

The fx tracking website became so powerful that BDC operators in Nigeria depend on the rate on the website while a prospective seller of dollars or any other foreign currencies hardly makes sales until they check the rate on abokifx.

As the value of the naira continued to drop following the announcement of the CBN to stop the sales of forex to BDCs operators, abokifx continued to update the black market rate on its platform. In fact, there was a morning rate, afternoon rate, and evening rate.

The parallel market rate continued to have an edge over the official rate through its competitive price.

Since its establishment, the fx tracking website enjoyed more patronage in terms of search from Nigerians and on September 17, 2021, CBN pointed an accusing finger at the founder of aboki that he manipulated the rate to his favour and made millions from such manipulations

Allegation of FX Manipulation

Emefiele, the CBN governor stated that Adedotun, a UK-based Nigerian was using his platform to engage in illegal forex trade.

He further stated that the apex bank had been monitoring the activities of abokifx since 2019, during the Monetary Policy Committee meeting.

“Mr Oniwinde is an illegal fx dealer that have inflow and sold tens of millions of fx to several Nigerian companies in contravention of the fx law, he directly benefits from the rates he quotes daily on his website,” Premium Times quoted the former head of Zenith Bank as saying.

Multiple Bank Accounts Traced To Oniwinde – CBN

The apex also revealed that up to eight bank accounts have been traced to Oniwinde and his private incorporated forex tracking website.

Specifically, Emefiele confidently revealed that Oniwinde and his company have over 25 bank accounts with about 8 banks both in naira and dollar with significant turnover, “milking the system and collecting cash through Automatic Teller machines in London.”

The four account details traced to him, according to PM News Nigeria, are:

- 0633366932

- 0230068879

- 0230068886

- 0633366949

Three accounts traced to aboki include:

- 0650969295

- 0650969271

- 0232578174

Consequences:

Quoting the section of CBN Act, Emefiele disclosed that the apex bank is the only institution empowered to determine the value of the naira, according to the CBN Act, section 2, saying Oniwinde’s action is against the National Intelligence Committee Act of 2004.

This means that abokifx could have its certificate of incorporation revoked while the owner could face jail term or fine or both.

Our Hand Are Clean – AbokiFx

Meanwhile, the foreign exchange tracking firm has denied all allegations leveled against it by the CBN, saying it doesn’t trade in forex either manipulate rates in its favour.

“All rates published are randomly sourced daily from various market locations in Lagos only. And our rates align with the market, as the market is the source of the rates,” it said in a disclaimer.

It also says its legal team would be responding appropriately when it receives a formal letter from the apex bank.

Can Abokifx Manipulate Black Market Rate?

The system created room for abokifx to operate in the first place. In the United Kingdom where Oniwinde is based, there is no multiple exchange rate.

Parallel market exchange is most peculiar to developing economies or intentionally created by the oligarchy to manipulate the system.

The multiple exchange rate created a few years ago gave the platform an edge and trust when it gave users the real price on the streets.

In less than six years of establishment, it ranked top 100 most visited websites in Nigeria. That means a lot in terms of advertising and influence.

The site has risen to a stage whereby Nigerians believe that it shows the true reality of exchange rates.

CBN Fighting The Wrong Battle

Of course, CBN could be right about the allegation, but targeting abokifx at this time is like fighting the wrong battle.

Why can’t the CBN or Emefiele expose those involved in using the forex for illegal activities as he claimed on July 27?

Why can he name those who dubiously obtained PTA and failed to return the unspent amount, but preferred to sell the unspent PTA at black market rate?

For how long would the authorities continue to chase shadows?

Of course, some financial expert and economists have added their voices, describing Emefiele’s action as a wasted effort.

One of them is Prof Pat Utomi, describing abokifx planned sanction as a deviation from the major problems.

Utomi said, “for a number of years, policymakers were the biggest problem with the forex market” saying that the current order has ruined the forex market.

The Puch quoted him as saying, “for those who made such decisions to now complain, I think it is uncharitable. If they continue to clamp down on this and that, then the market would collapse and we will return to where we were in the 1980s.”

Recall, in February 2021, Emefiele “ban” cryptocurrency traders in Nigeria, but crypto enthusiasts resorted to Peer-To-Peer Crypto platforms to carry out their trading.

Within a short period after the ban, Nigeria rose to the top 10 countries in the adoption and use of cryptocurrency.

Knowing the influence and the global acceptance of crypto, CBN incredibly announced that it would be creating a Central Bank Digital Currency (CBDC) dubbed eNaira, which is ready for launch on October 1, 2021.

At the time of publication, abokifx.com was still active. It hasn’t been banned by the CBN, but the platform says it would temporarily suspend its daily black market rate

Would the suspension allow the naira to regain its value and strength against other currencies?

Would the value of naira return to 2014 rate when $1 was below N166 when the leadership at the apex changed?

References:

- premiumtimesng.com/news/top-news/485449-why-we-are-after-abokifx-cbn.html

- Mawuli, Agogo. “FOREIGN EXCHANGE MANAGEMENT POLICIES IN NIGERIA: 1962 – 1992.” Transafrican Journal of History, vol. 22, Gideon Were Publications, 1993, pp. 24–34, http://www.jstor.org/stable/24328634.

- punchng.com/naira-crisis-pursuing-aboki-fx-a-waste-of-efforts-utomi-tells-cbn