What are SG&A?

Selling, General, and Administrative expenses also known as operating expenses includes all of the costs associated with a company’s daily operations that are not directly linked to the production of goods or services.

In simple terms, SG&A are the costs of doing business which include marketing and advertising, rent and utilities, management and administrative salaries, and sales and accounting.

This definition may sound easy and simple, but going into details may not really be simple as it seems because SG&A can encompass a wide range of costs from advertising expenses and sales commissions, to office supplies and salaries of non-production employees.

SG&A vary from company to company, this can be seen in the 2022 SG&A expenses of the four biggest American companies (by market cap):

- Apple’s SG&A for 12 months ending June 30, 2023 were $25.221Billion

- Microsoft’s operating expenses for the same year were $114.887Billion

- As for Amazon, its annual SG&A expenses for 2022 were $138.428Billion.

- Alphabet spent more on operating expenses in 2022 than 2021. Its 20222 SG&A expenses were $42.291B, a 16.11% increase from 2021.

- Amazon accounted for $501.735Billion of operating expenses the same year under review, according to stats from Macrotrends.

SG&A expenses can fluctuate greatly depending on a host of factors, ranging from the nature of the business to strategic decisions taken by the management.

For instance, a company in the growth phase might see a higher proportion of selling expenses as they invest heavily in advertising and marketing. Conversely, an established business may have larger administrative expenses, including higher salaries and office costs.

Understanding these nuances is vital when comparing SG&A expenses across companies or sectors. It’s crucial to compare similar businesses to gain meaningful insights.

The lower the SG&A expenses in relation to revenue, the more effectively a business is operating which is a positive indicator of future profitability.

It’s a critical indicator of a company’s operational efficiency, with its careful management often being the difference between healthy profitability and financial struggle.

Let’s break down the three components of SG&A:

- Selling expenses

- General expenses

- Administrative expenses

What are selling expenses?

These are costs associated with the sales process such as expenses for advertising, marketing, sales salaries, commissions, travel costs for the sales team, and freight or shipping charges.

These expenses are categorized as indirect expenses on a business’ income statement because they do not contribute directly to the making of a product or delivery of a service.

Selling expenses are usually considered to be semi-variable because some components are not fixed, they can change as sales increase or decrease, while others remain stable.

What are general expenses?

General expenses encapsulate costs that maintain the overall functionality of a business. These expenses are directly related to the overall operation of a business such as utilities, supplies, rent for office space, and equipment costs.

What are administrative expenses?

Administrative expenses refer to costs tied to the administration or general operations of a business. Key expenses in this category include salaries of non-production personnel, legal costs, and expenses associated with maintaining a corporate office.

Operational efficiency

Operational efficiency is one of the key drivers of a company’s financial health. It shows how well a company transforms its resources into profits. This is where SG&A comes into play. By analyzing SG&A expenses, we get valuable insights into a company’s operating performance and efficiency.

A low SG&A to revenue ratio can often indicate a company’s efficiency. It signifies that the company has successfully leveraged its resources to generate high revenues while keeping its operational costs in check. Conversely, a high ratio may suggest inefficiencies that the company needs to address.

However, it’s vital to note that context matters. Some businesses, like those in the retail or technology industry e.g Amazon, Alphabet, and Apple might naturally have higher SG&A expenses due to heavy marketing or research and development costs.

SG&A in EBIT calculation

SG&A is an integral component of Earnings Before Interest and Taxes (EBIT), a popular indicator of a company’s profitability. EBIT is calculated by subtracting operational costs, including SG&A, from a company’s total revenue.

EBIT is considered an important financial metric as it focuses solely on operational performance. By excluding interest and tax expenses, EBIT provides a clear picture of a company’s profitability from its core business operations. Hence, a careful analysis of SG&A becomes crucial to understand EBIT and thereby, a company’s operational profitability.

Impact of SG&A on Net Income

Net income, often referred to as the “bottom line,” is the ultimate measure of a company’s profitability. It represents what remains after all costs and expenses, including SG&A, are deducted from the total revenue. As a part of operational costs, a significant change in SG&A expenses can materially impact a company’s net income.

For example, an increase in SG&A expenses, without a corresponding growth in revenue, could lead to a reduction in net income. Conversely, if a company manages to reduce its SG&A costs while maintaining or growing its revenue, the net income is likely to improve.

How to use SG&A to boost profitability

Strategically managing SG&A expenses can have a positive impact on a company’s profitability. Here are the ways businesses can effectively manage their SG&A expenses to enhance profitability:

Cost efficiency:

Companies can implement cost-cutting measures, like streamlining processes or automating tasks, to reduce SG&A expenses.

Negotiation:

Companies can negotiate better contracts and terms with service providers to reduce administrative expenses.

Expense prioritization:

By focusing resources on high-return activities, such as targeted marketing, companies can optimize their selling expenses.

Performance monitoring:

Regular monitoring of SG&A expenses can help identify inefficiencies and potential areas for cost reduction.

How to analyze SG&A in the income statement

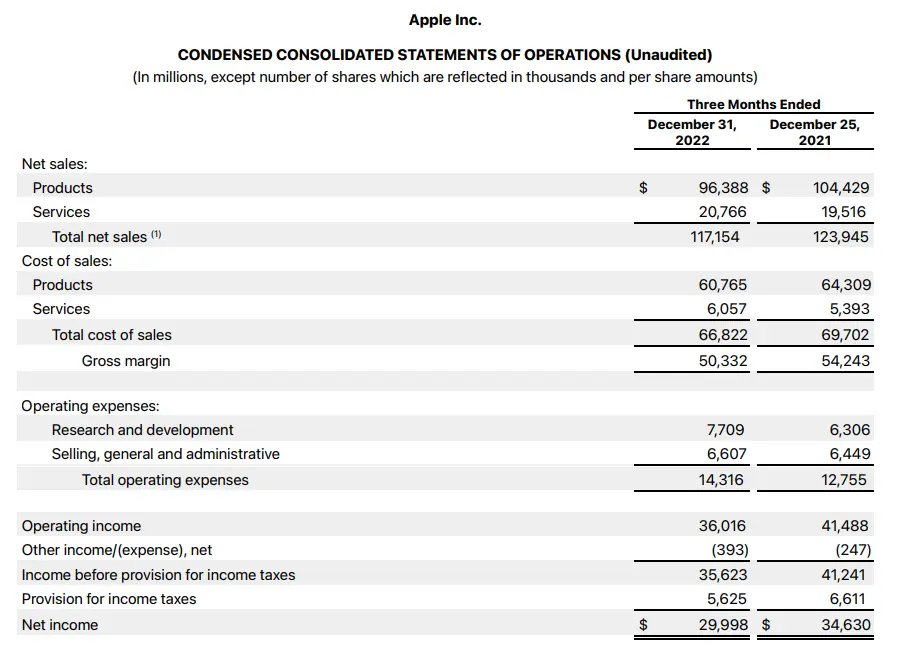

An income statement, also known as a profit and loss statement, outlines a company’s revenues, costs, and expenses during a particular period. SG&A is usually reported as a separate line item under operating expenses as it can be in Apple’s FY23 Q1 condensed consolidated statements of operations.

Once you’ve located the SG&A expenses, here are some key steps to analyze them:

Calculate the SG&A to Revenue Ratio:

Divide the SG&A expenses by the total revenue and multiply by 100 to get the percentage. This ratio indicates what portion of the company’s revenue goes towards SG&A.

Compare the Ratio Over Time:

Look at this ratio over several periods. An increasing ratio may indicate escalating operational costs, while a decreasing ratio might suggest improving efficiency.

Industry comparison:

Compare the company’s SG&A ratio with industry averages or with direct competitors. This can provide insight into the company’s efficiency in managing its operational expenses relative to others in the industry.

Understand the composition of SG&A:

Review the company’s annual report or SEC filings for a breakdown of SG&A expenses. This will help you understand whether selling, general, or administrative costs are driving changes in the total SG&A.

Useful financial ratios involving SG&A

Several financial ratios incorporate SG&A, providing a comprehensive picture of a company’s financial health. They include:

Operating Margin:

This is calculated by subtracting SG&A and other operational costs from revenue, and then dividing by revenue. A higher operating margin indicates greater operational efficiency.

EBIT Margin:

As stated earlier, EBIT (Earnings Before Interest and Taxes) is calculated by deducting operational costs, including SG&A, from total revenue. The EBIT Margin is the EBIT divided by total revenue.

Takeaways:

A high SG&A to revenue ratio might not all the time be negative; it might indicate a strategic investment for future growth.

Regular monitoring of SG&A expenses and their impact on profitability is crucial. This helps a company adjust its strategies as needed and ensures the optimal allocation of resources.

SG&A encompasses a range of operational costs, from advertising and marketing to office rent and legal costs. These expenses play a pivotal role in assessing a company’s operational efficiency and profitability.

Financial metrics like EBIT and net income are important to understand SG&A expenses.