When you walk into a bank to open an account, one of the first things they will ask you to do is something called “KYC.” This might sound complicated, but it’s just a way for the bank to get to know you better.

What is KYC?

KYC or Know Your Customer is a basic check to make sure you’re who you say you are, which helps keep your money safe and prevents people from using the bank for illegal activities like fraud or money laundering.

In Nigeria, for instance, a bank where you just want to open an account will ask you to provide a means of identity such as a Voter’s Card, National ID (NIN Card), driver’s licence, or international passport.

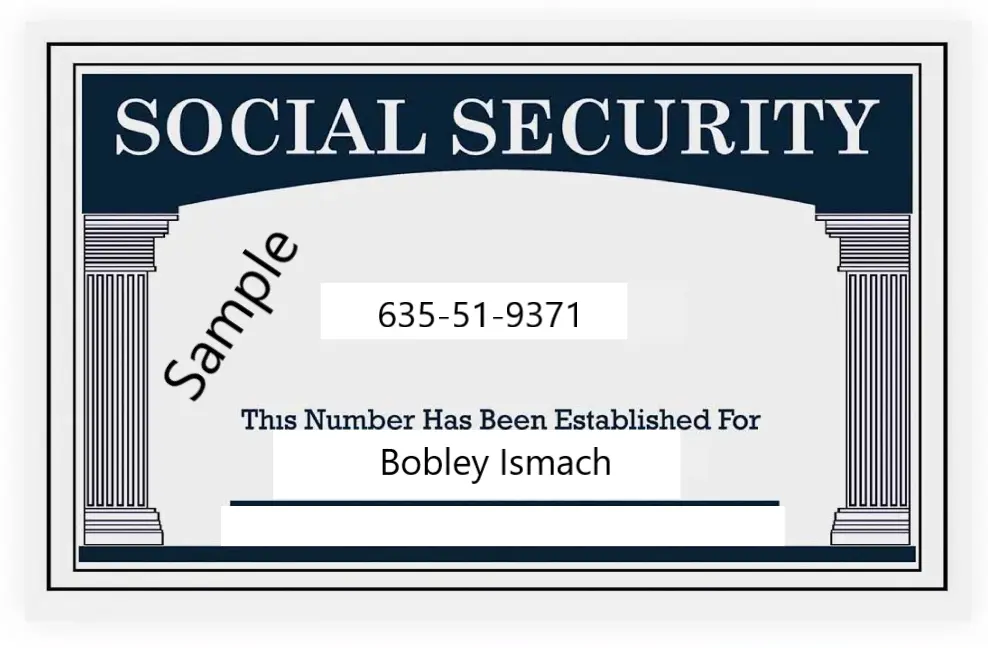

In the the United States, some financial institutions will ask you to provide your Social Security Number (SSN) plus a prove of residence in the country. Some banks may wave SSNs and ask for your Individual Taxpayer Identification Number (ITIN) instead.

Regardless of jurisdiction and what you’re asked to provide for the KYC, it boils down to the customer identity verification process necessary to safeguard your money from fraud.

Why KYC is important

It’s about security: KYC protects you by making sure only genuine people can use the bank. This reduces the risk of anyone pretending to be you or trying to steal your money.

Simple information: All you need to do is provide basic documents like an ID card, proof of address, and maybe a few other details. The process is straightforward, and bank staff will guide you through it.

Necessary for opening your account: The bank is required by law to follow KYC steps. This isn’t to make things harder for you but to ensure they follow strict rules meant to protect you and everyone else using the bank.

KYC may seem like an extra step, but it’s just a smart way to ensure that when you open a bank account, your money and information are kept safe. It’s simple, secure, and one of the first steps to getting started with banking.