The forex allocation for students studying abroad is $15,000 per semester, so what happens if a student exceeded the allocation and needs to meet personal upkeep?

We will share with you several alternatives to forex allocation by the Central Bank of Nigeria (CBN). You can use any of the available means to meet your forex needs.

Before Seeking Alternative Means: There are guidelines on how to access the forex to settle foreign school fees in Nigeria.

In the past, Form A could only be obtained at designated banks across the country, but Nigeria’s apex bank moved the application process online which can be done through CBN Trade Monitoring System Portal (TRMS).

The aim of the CBN’s TRMS is to completely eliminate racketeering of the foreign exchange among the bank officials and to ensure a faster application and approval process.

Unfortunately, TRMS hasn’t completely addressed the problem that has persisted for years in accessing forex for students and others who need dollars, Pounds, and Euro to pay for invisible services abroad.

For instance, there is still dollar scarcity in Nigeria, though the apex bank would accept this, parents whose children are in foreign institutions are frustrated any time they tried to send maintenance allowance to them abroad.

The problem of forex scarcity is comprehensively captured in 2016 The Punch report when parents lamented over what they face in accessing forex.

So, follow our guide on how to apply for Euro, dollars, and GBP on the trade monitoring system before using the alternative means that are listed here.

The Need For Alternatives To Access Forex

Some of the reasons that make it imperative to seek alternative means of accessing dollars in Nigeria include:

1) If your application for forex remains unattended, it could take up to 30 days or more

2) If your application experiences persistent rejection (on your side, please ensure you’ve uploaded the required documents for education fees

3) If you have exhausted the dollar allocation for a semester (You can’t apply more than $15K per semester, the alternative becomes unavoidable when this happens)

4) If you’re unable to access TRMS account or it’s been blocked by the authority due to violations

NB:

Any violation on the TRMS portal can be resolved amicably by contacting customer support.

Four out of the alternatives discussed here allows you to seamlessly get things done when you have a dollar debit card.

So…

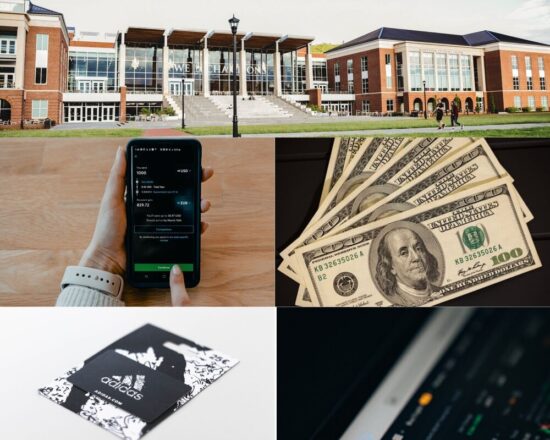

What Are The Alternatives To CBN’s Form A Forex Allocation?

As earlier discussed, you don’t want your children to be stranded in a completely strange land where they have no family members or helpers. And we believe that you want to ensure your child’s comfort.

Here are the six ways to send maintenance allowance to your kids if you have exceeded the CBN’s $15,000 dollar allocation per semester for each student

P2P Crypto Platform

Caution: You must be familiar with cryptocurrency before using this option because the price of bitcoin, ethereum or any currencies can drop within a blink of an eye.

If you’re ready to use cryptocurrency to send funds to your children schooling abroad, here is how to do it:

1) Your kid checks his country of residence for the supported crypto exchange

2) Create an account

3) Choose the popular coin that can easily be sold (Bitcoin, Ethereum, Binance Coin, Litecoin are the most popular ones you can choose)

4) The student sends their BTC wallet (or whatever crypto they choose) to his parent back home in Nigeria

On the part of the parent or guardian:

1) Set up an account on any of the P2P crypto platforms that support the Nigerian community

The popular ones in Nigeria are:

- Remitano

- Paxful

- Localbitcoin

- P2P.binance.com

- Buycoins Africa

- Cryptolocally

Advice: Use the same crypto platform to send and receive the coin. That is to find out the platform that supports Nigeria and the country where the student is schooling. You can check our guide on how Nigerian residents can purchase cryptocurrencies on P2P Platform

2) The student receives the coin and converts it into fiat currency

That’s solved!

Currency-exchange marketplaces

There are trustworthy forex exchange broker’s websites that offer quotes on exchange rates from partnering banks and exchange houses, you can use this to send money to your kids in foreign institutions without breaking Nigerian law.

However, you need to provide KYC documents to use currency exchange marketplaces for money transfers.

Dollar Cards

In Nigeria, there are banks that issue dollar cards. To use Dollar Card to fund your children’s maintenance in their foreign school, follow these steps:

1) Set up a domiciliary account for your yourself and kid because you’re going to need it for a dollar card application.

2) Apply for a dollar card in a Nigerian bank of your choice and do the same for him/her

3) Load the dollar card with foreign currency that you know will be sufficient to take care of his needs for the semester

3) Whenever, he needs more funds, you can easily fund the dollar card for him a any time

The card can be topped up electronically here in Nigeria whenever he runs out of cash

Domiciliary Account

1) Setup a domiciliary account, most times they come from three dominant currencies: Great Britain Pound, US Dollar, and Euro

2) Source forex independently

3) Deposit the funds in your dom account in whatever currency your kid needs abroad

4) Grant your kid access to the account for him to make a withdrawal

Using a dorm account is one of the effective ways to ensure that your kid doesn’t run out of cash as he faces his studies in an overseas university or college

Gift Cards

A gift card is a prepaid stored-value money card that is used as an alternative to cash to make purchases or which can be converted to fiat currency and cryptocurrencies.

The popular ones include Google Play Store Gift Card, iTunes Gift Card, Amazon Gift Card, and eBay Gift Card.

Parents who are technologically young at heart can purchase any of the popular Gift Cards in Nigeria, send them to their kids abroad which they can, in turn, be converted to cash to boost their financial strength.

Note: Some platforms allow you to use Gift Cards to purchase bitcoin and vice versa. A few google searches will reveal the platforms. However, be wary of scammers online.

Money Transfer

Money transfer is another alternative parents can use to send funds to their kids in overseas institutions. Most times, the exchange rate on money transfers is higher than the foreign exchange market. Be ready for this and make an enquiry from your bank to be clear on the transfer fees.

If you’ve exceeded the dollar allocation by the apex bank, using a money transfer service is another effective alternative you can use to fund your kids feeding allowance while studying abroad.

There are more than two dozen of money transfer firms globally, only a few of them allow Nigerians to send money from home.

The supported ones you can use are:

- Skrill

- MoneyGram

- Neteller

- Western Union

How To Use Skrill To Send Money From Nigeria

With the Skrill Money Transfer, you are able to transfer funds to your own or someone else bank account or credit/debit card.

To use this method:

1) Fund your Skrill account from Nigeria

2) Enter the send amount, recipient location, and send currency.

3) Choose the delivery and payment method and click continue

4) You will be asked to select to whom you are sending funds

5) Enter details of the recipient

6) Review the transfer summary and Confirm

7) Choose the payment method and complete the transaction.

Using MoneyGram To Send Upkeep Fund from Nigeria

MoneyGram is supported in more than 170 countries around the world, as such, you can use it to send money to your children schooling abroad

Locate the MoneyGram agent nearest to you (most Nigerian banks support MoneyGram) and send either using the recipient address or transfer directly into their bank account or mobile wallet.

If you are sending to the recipient address, note your digit reference number which the recipient will need to claim the money in his/her destination country.

Neteller

With more than 100 supported countries, Neteller is another alternative to send money:

1) Login into your digital wallet

2) Select “Money In” tab

3) Choose “Deposit now” button in the International Bank Transactions menu

4) Enter the amount to load into your account click continue

5) When that’s done proceed to the transfer tab to initiate the transfer and complete the process

Western Union

With a partnership with almost all Nigerian banks, it’s easier to send money abroad

1) Have a valid means of ID

2) Obtain a transfer form and fill it with all the necessary information

3) Make deposit

4( The recipient receives the money

Note:

You need the correct banking details (names) of the recipient, bank code, full address, phone number, and the purpose of sending the money

Can I use TransferWise to send money from Nigeria to another country?

In an inquiry sent to Wise, the payment platform confirmed that it doesn’t support sending money from Nigeria to another country.

It says:

“We can’t accept payments in NGN for transfers, but you can pay with one of our global currencies, EUR, GBP or USD instead through SWIFT. Your bank might charge you extra to send money through this route”

NOTE: TransferWise doesn’t support Nigeria to send money abroad, Nigerians can only use it to receive money and the account holder must first fund its Wise Account with at least NGN10,000

How can I send money to my child studying abroad?

Can you send money to a minor studying abroad?

However, the best alternative to sending feeding allowance to a minor is to send the money to the bank account of their Guardian

How much can I send abroad?

Kindly check with your bank. However, there is no limit to the amount of money you send through cryptocurrencies, that’s one of the reasons, countries around the world are worried that crypto assets could be used to finance terrorism and other devastating activities without proper monitoring and checks.

What is the easiest way to send money internationally?

Is it illegal to send money abroad?

But you must be able to provide enough evidence, in some instances, that the money is legitimate and are not to finance illicit activities.

Recap:

Exceeding the CBN dollar allocation for the kids’ upkeep in foreign institutions shouldn’t expose them to avoidable difficulties

Using other alternatives like P2P cryptocurrency platform, dollar card and dom account among others can save you the headache of worrying about maintenance allowance for your kids.