Exactly a year ago (June 19, 2022) the price of a bitcoin was $35,854.53 and ending the year at $47,169.37 with over $875 billion market capitalization. On Saturday, June 18, 2022, the most capitalized cryptocurrency dipped below $20K for the first since late 2020.

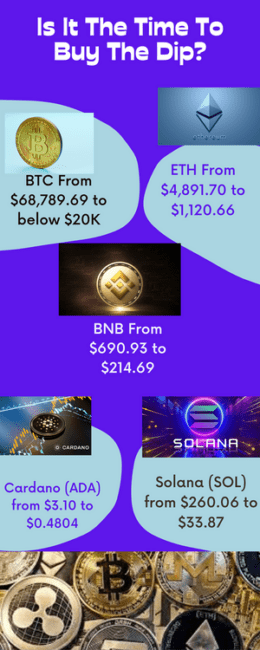

After Bitcoin achieved its All-Time High of $68,789.69 on November 10, 2021, $70K has been elusive to the most popular crypto, it went from its ATH to below $50 and even below $40K, and those who saw it skyrocket to nearly $70K literally blamed themselves why they didn’t join earlier.

But when it went down, it is time to buy the dip became a popular crypto terminology among crypto lovers. Even before then, it is a regular crypto jargon among crypto investors to encourage traders to buy when the price declined.

What is a dip in cryptocurrency?

A dip is when the price of cryptocurrencies – Bitcoin, Ethereum, Litecoin, Solana, Binance Coin etc – experiences a monumental fall or a decline in price than what it used to be.

For instance, if the price of Bitcoin falls from $69, 000 to $20,000 or less, that’s a dip for crypto enthusiasts who are motivated to buy at a lower rate with the hope that they would make huge returns when the price bounces back.

The term, “I just bought the dip” has also been used several times by President Nayib Bukele of El Salvador, the first country to adopt cryptocurrency. For instance when the BTC price dipped from $68K to below $31 on May 9, 2022 in a tweet, when Bukele said, “El Salvador just bought the dip!”

State of Cryptocurrency today

The latest crypto crash has resulted into loss of several billions of USD. For instance, the entire market capitalization of cryptocurrency at the time of filing this report stands at over $866 billion USD, that’s below the market cap of only Bitcoin (over $875 billion) a year ago, data obtained on coinmarketcap reveals.

After its all-time high in November 10, 2021, psychologically, some analysts submitted that it was impossible for it to trade below $20K again.

From what I see in the crypto market since crypto bloodshed began some months ago, Bitcoin has lost more 70% of its value after its ATH.

Why Is Cryptocurrency Crashing?

Severally, crypto investors were warned about the volatility of BTC and other altcoins, but the returns remained unavoidable for some who had seen it jumped from a valueless coin to the most valuable coin in the world.

Why crypto crash remains debatable among financial analysts, but it’s commonly agreed among crypto critic is a bubble that ready to boast any time.

And worth of note recently is the turbulent financial market. For instance, the past days was the worst for Wall Street since 2020 and some big economies around the world as investors continue to sell off some of the assets.

Their action was prompted by central banks that increased interest rates as one of the inflationary measures.

Though, high-interest rates have their advantages. One of such is that it can help bring down inflation, but that doesn’t happen without some drawbacks.

One of the cons of high interest rates is that it can push an economy towards a recession which can increase borrowing costs for consumers and businesses and push down prices for other investments including cryptocurrencies.

And we’ve seen this played out in recent crypto crash as the overall market value of cryptocurrency assets went from over $3 trillion USD to $861,231,436,336 on Sunday, June 19, 2022.

And it’s important to point out bitcoin isn’t alone in the recent crypto crash, the second most capitalized cryptocurrency Ethereum is also a victim.

After the Terra Luna terrible crash, some investors have lost confidence in the crypto market, prompting a selloff which has also contributed negatively to the ‘stability’ (if there has ever been one) of the crypto asset.

The recovery plan which contained three amendments for the LUNA recovery leading to another project has also found itself in the crypto bloodbath

For the record, Do Kwon Terra Luna founder was accused of selling off some of his Luna assets worth $80,000,000 a month before the collapse of the Terra coin.

So…

When is the best time to buy the dip?

First, there is a possibility that an asset from fell from nearly $69k to below $20 could fall nearly $0, conversely, an asset that rose from basically nothing to the most valuable asset, though most volatile asset, I can confidently say that there is no appropriate time to buy the dip.

In 20019, no one accepted BTC as a medium of exchange, fans were only sending Bitcoins for hobby purposes, and they were only fans.

In 2010, 10,000BTC was auctioned for just $50 by a user by the name “SmokeTooMuch” and unfortunately, no buyer showed up.

Whenever your mind is made to buy the dip, ensure that it’s something you can manage psychologically in case the worst happen in the crypto sector. Invest wisely in cryptocurrency