Are you in Nigeria or resident in the United States, Canada, or United Kingdom or anywhere around the world and you want to start trading stocks on the Nigerian Exchange?

This article outlines the procedure of buying shares on the secondary market. You don’t have to lament if you missed Public Offer of a prominent firm that sold out.

Buying and selling of shares at the stock market are facilitated by certified stockbrokers and jobbers.

To avoid scams and any form of fraudulent activities, the Securities and Exchange Commission doesn’t allow just anyone or organisation to trade directly on the exchange.

In the stock market, the dealer of securities, specialise in stocks while brokers act as agents for potential buyers.

Usually, the broker will approach the jobber with the intention of knowing the price. Two prices are quoted by the jobber: 1) higher price as the selling price, 2) the lower price as the buying price.

The difference (margin) is the jobber’s turn. As such, when the broker signifies interest to buy, the jobber prepares the necessary documents.

Note:

With the digitalisation stocks and the documentation process, the above procedure may not be visible to the general public.

Process of Buying Stocks in Nigeria:

The Stock Exchange Market isn’t like Yaba market where you can walk straight to a seller, choose what you want and begin negotiation.

The stock exchange market is a secondary market, where you can buy stocks from existing shareholders who want to sell, that’s why is called a meeting place for buyer and seller.

Just anyone can’t walk into the Stock Exchange building to buy stocks. The process has been made easier.

1) Check the list of stockbrokers in Nigeria, you can get the list on the Nigerian Exchange on the trade page or on SEC website.

Most times, you’ll get the list of quoted companies on their portfolio. You’d be guided on how to create an account

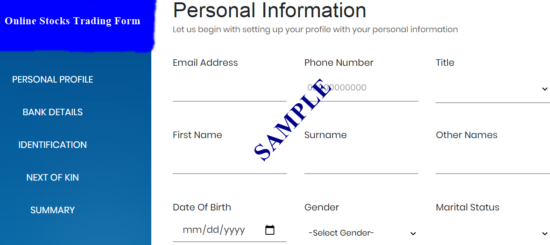

2) After account creation, wait for further instructions from the broker. Most times, your broker will contact the registrar of an issuer (quoted company) to create a CSCS account and Clearing House Number (CHN) for you.

3) When your account is activated, you can log in, fund your account to buy shares.

4) Choose from the list of quoted firms and the number of units you want to buy, the cost will be deducted from your account.

Note: The processes described above require the signing of documents: 1) Contract note and transfer form. They are two important documents to facilitate stock exchange transactions

Requirements for Stock Trading Account in Nigeria

a) A recent passport-sized photograph

b) Proof of Address. The proof of address can be any of the following:

- Valid utility bill in your name within the past 3 months(i.e. a pre-paid meter ticket, water bill, waste bill, land use charge or fixed-line telephone bill).

- Recent bank statement bearing current and properly captured residential address.

- Tenancy agreement with valid rental receipt

- Valid driver’s license

- Permanent Voters Card (PVC)

- National Identification number (NIN) Slip

c) Means of Identification. This could be any of the following stated below:

- Valid International passport

- Valid Driver’s Licence

- Permanent Voters Card

- National ID Card or slip

d) Signature specimen

Note: Most times, the maximum size for each document or image should not exceed 2 megabytes (MB).

How can I open a brokerage account from outside Nigeria?

From the list of reliable stock brokerage firms that are certified by SEC, choose the one that has activated online stock trading and register with them. Fund your account and start trading when registration is completed.

In case you want to trade Nigerian stocks from the United States, London, China, Canada or wherever you are around the world, you will need the following documents:

- Photocopy of your International Passport or Driver’s License or Permanent Voter’s Card or a National Identity Card

- Your Passport Photograph

- Proof of Address

- Foreign Account Tax Compliance, especially for USA resides

Stocks Trading Investment Advice

Endeavour to follow trends around performances of listed companies in the stock market before making buying decisions.

Some firms on the Nigerian Exchange (NGX) reneged on the payment of dividends. For instance, a company like Daar Communications (owners of AIT and Raypower) has never declared dividends since it was listed.

You should look out for such companies so as o avoid regret that might arise from pumping your hard-earned money into such companies.

On the other hand, you might want to ask: why are investors “crazy” about MTN Nigeria shares, Dangote Cement Shares, Airtel Shares among others.

If you’re a big investor, you shouldn’t ignore the firms on the premium board of the NGX. They meet global standards.

The fact that you’re a Nigerian or based in Nigeria doesn’t limit you. For instance, there are trustworthy apps that allow you to invest in U.S. stocks right on your smartphone.

Which brokers have online stocks trading platforms?

Other are: Stanbic IBTC Stockbrokers Limited, Chapel Hill Denham Securities Limited, Investment One Stockbrokers, Cardinalstone Securities

How much do I need to start trading in stocks?

I need a reliable stockbroker, where can I find one?

1) Chapel Hill Denham Securities Limited

2) Stanbic IBTC Stockbrokers Limited

3) Meristem Stockbrokers Limited

4) CardinalStone Securities Limited

5) CSL Stockbrokers Limited

6) FBNQuest Securities Limited

7) Investment One Stockbrokers Int’l Ltd

8) Sankore Securities Limited

9) Coronation Securities Limited

10) Anchoria Investment & Securities Ltd

11) ARM Securities Limited

How many companies can I buy shares from?

However, it isn’t about the number of companies you have shares in, but the value your investment is bringing every year.

You don’t want to buy stocks of a company that never paid dividends, but post a deficit every year

Recap:

Buying stocks from the secondary market (stock exchange market) is the alternative to an individual who missed the opportunity to buy directly from a company that announced Public Offer.

While investing in stocks come with many benefits, you can check the financial statements of the company or check the forum for reviews.

The updated list of Nigerian stocks to buy can be found on the website of the Nigerian Exchange (NGX)