You might be among the owners of over N190 Billion in unclaimed dividends if you purchased shares from a company many years ago and haven’t checked back since then.

You or your family member could have millions or billions of naira sitting dormant somewhere, waiting to be claimed. This guide will show you how to recover such unclaimed dividends.

What is an Unclaimed Dividend?

When dividends are paid by a company to its shareholders, but the shareholder (investor) fails to claim it, it becomes an unclaimed dividend. Usually, a separate account is created for an unclaimed dividend which is properly monitored by the SEC (if it’s in Nigeria).

Difference Between Unclaimed Dividend and Unpaid Dividend

An unpaid dividend occurs when a company declares profit and dividends but has yet to distribute them to its shareholders. On the other hand, an unclaimed dividend occurs when shareholders abandon the dividends accrued to them.

What the data says

Between 2019 and 2023, the unclaimed dividends at Nigeria’s capital market grew from N158.44 Billion to N177 Billion between 2019 to March 2023, according to Futureview Asset Management.

The latest data from the Securities and Exchange Commission (SEC) shows that it has grown to over N190 Billion by the end of 2023. Abandoning dividends is not peculiar to Nigeria.

Steps to recover dividend from a company

- Go to the list of unclaimed dividends on Nigeria’s Securities and Exchange Commission at: sec.gov.ng/non-mandated/

- Type your name in the search bar and hit the search button

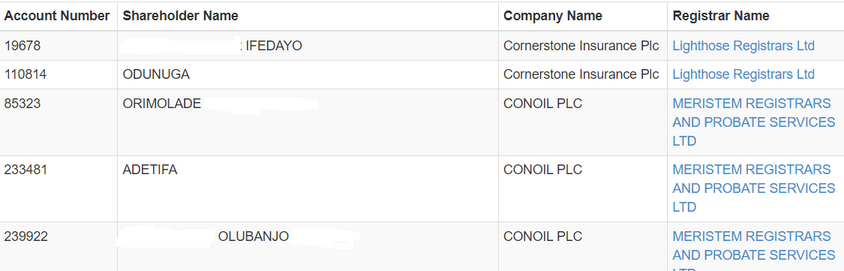

- When your name comes up, which is on the second column, take note of your share account number and the company where your backlog of unclaimed dividends are domiciled.

- On the fourth column, click the registrar name, which will take you to the e-dividend management portal managed by the NIBSS

- Fill out the form, including your BVN, Your bank, account number, last name, and date of birth

- And finally, hit the submit button.

You can begin by compiling the yearly dividends declared by the company. This will help you calculate your accrued dividends.

Copy the company’s name and search for its registrars through Google or any of your favorite search engines. For instance, you can search for “registrars for Tantalizers PLC”, Meristem Registrars Limited is for Tantalizers.

Check the official website of the registrars, download the e-mandate form from there and send the completed copy back to them. If you can’t find it, send an email requesting it.

The details you will need to fill in the form include: Bank Name, Bank Address, NUBAN Account Number, Your Full Name, Your address, email and phone number, CSCS CHN, and CSCS Account No (if you don’t have CSCS account leave this space) and contact an accredited stockbroker.

If you don’t have a CSCS account and Clearing House Number, your stockbroker would guide you on the application process for you to start receiving an electronic dividend straight into your account.

Note:

The online form should be filled out and sent online. Download the e-mandate form. Some of the online tools you can use to fill form online include: sodapdf, docfly.com/pdf-form-filler, form filler etc

That’s all, you will be contacted if they need more details from you.

One might ask: Why would an investor abandon their dividends?

Cases of unclaimed dividends keep in rising in Nigeria because of the following reasons:

Lack of awareness

Awareness and enlightenment are key. Without them, you may not even realize that your parent, grandparent, or spouse has secured your future through investments in stocks.

Multiple subscriptions

This is a situation where an investor creates multiple subscriptions for themselves, either for more than one product or for different variants of the same product.

False names

This occurs when individuals who have amassed wealth through illicit means utilize the names of family members and relatives to purchase shares.

In the past, Nigeria’s anti-graft agency has investigated numerous cases of money laundering, often uncovering schemes where corrupt public officials opened multiple bank accounts to launder funds. The case of former Pension Reform Task Team chairman, Abdulrasheed Maina, serves as a typical example of such practices.

On the issue of the unclaimed dividends, the SEC boss was quoted as saying,

“There is a problem with us too as people because if you are buying securities using your own wealth; why will you use another person’s name, why will you use a name that will not be traceable to you?

Identity management

The rising concern regarding identity management is another issue highlighted by the SEC. The commission stated that challenges with identity management in the Nigerian capital market pose a significant obstacle, which they are actively addressing as one of the agencies under the Federal Ministry of Finance.

With the harmonization of BVN in tracing owners of shares, this problem has reduced drastically.

Fear of being investigated

Research by the regulatory authority reveals that the number of unclaimed dividends began to rise with the introduction of the Bank Verification Number (BVN), which is linked to only one individual’s name.

Those who previously used family members’ names as proxies for investments may abandon such investments due to the fear of being investigated.

Forgotten investments

People often invest in the stock market and then either relocate or perceive the process of recovering their dividends as tedious. In such cases, they fail to track these investments.

If the unclaimed dividends belong to your late parents, you must provide a letter of administration and other documents.

Questions and Answers

I purchased shares at the former Oceanic Bank. How can I receive my dividend?

If you bought Oceanic Bank shares before its acquisition by Ecobank Transnational Incorporated (ETI), you should have received a new share certificate from ECOBANK.

Regarding ECOBANK, in March 2016, it announced a change in its Registrars from EDC Registrars Limited to a newly appointed Registrar, GTL Registrars Limited. The transfer was completed on Thursday, March 31, 2016.

Therefore, you can send a message to the registrars requesting a mandate form to begin the process of activating e-dividend for you.

What does Nigeria’s Law say about Unclaimed Dividends?

According to the Laws of the Federation of Nigeria, shareholding companies are required to publish the names of shareholders who are yet to claim their dividends or whose addresses can’t be traced.

The unclaimed dividend portal is displaying a message stating, “Site can’t be reached.”

This issue is likely due to high traffic, causing the portal to become overwhelmed. I suggest trying again in a few minutes.

Alternatively, you could attempt accessing the portal early in the morning or late at night when traffic may have subsided.

I bought shares from various companies during a period when many were selling. How can I identify my own shares when there are many other similar names?

If you remember the companies you bought from, you will know which shares are yours. Alternatively, you can reach out to the registrar for each company or use one of the trusted stockbrokers to assist you in tracing your shares.

If the shares purchased for me when I was younger have my name misspelt, how can I claim the dividend with this kind of issue?

The authorities are aware of the problem of misspelt names. You can address the issue by visiting or sending a complaint to the appropriate registrar along with proof, including your BVN, to resolve the issue.