Stamp duties are taxes paid on written and electronic instruments or documents relating to an act performed or required to be performed in Nigeria.

In Nigeria, stamp duty is backed by law which is called the Stamp Duties Act (SDA) Cap. S8 LFN 2004. In this article, we’ll also discuss the process of paying stamp duty online at the comfort of your home.

History of Stamp Duty in Nigeria

The origin of stamp duties can be traced to Spain in the early 17th century. Back then, a physical stamp was used on documents as a piece of evidence that such documents had been recorded and tax liability paid on them, that’s how the name, “stamp duties” came about.

In Nigeria, law and regulations surrounding stamp duty can be traced to the 1893 Stamp Duties and Stamp Duties Management Acts which was passed by the British Parliament. It was enacted and came into force on April 1, 1939.

Nigeria also adopted the Acts because Nigeria was a former colony of Britain. It has, however, undergone amendments to reflect the present-day economic reality.

Under the Act, stamp duties may be levied either at an ad valorem or flat rate depending on the type or nature of the instrument.

Ad valorem means “according to value” as such, ad valorem rate is based on the value of the transaction.

What the Finance Act 2019 Says About Stamp Duty

Section 52, of the Finance Act 2019 (“the FA 2019”), specifically captures capture electronic transactions.

Section 54 which amended section 89 of the SDA imposed stamp duty on bank deposits and transfers. It was replaced by an Electronic Money Transfer Levy (‘EMTL”) which can be found in section 89A of the SDA (amended by section 48 of the Finance Act, 2020 (‘the FA 2020”).

Nigerian banks are already complying with the new law, which means cash deposits of NGN10,000 and above are required to charge a one-off NGN50 levy.

Why do governments impose stamp duty?

It is of the ways through government raises money to fund its activities and projects.

Controversies over Stamp Duty Collection in Nigeria

The debate over which government agencies have the legal backing for stamp duty collection has been on for some time. Specifically, the controversy is between the Federal Inland Revenue Service (FIRS) and the Nigeria Postal Service (NIPOST).

While FIRS is an agency of the Federal Ministry of Finance, NIPOST is one of the agencies of the Federal Ministry of Communications and Digital Economy.

Until President Muhammadu Buhari signed The Finance Act in law, the collection of stamp duties charges was the responsibility of NIPOST.

Upon the signing of the bill into law, the responsibility was stripped of the NIPOST from further collection. FIRS now has the legal backing to collect stamp duties on behalf of the federal government.

“You can’t take the statutory function of NIPOST and give to another agency in the disguise of Finance Act, we can’t accept it,” a member of Trade Union Congress (TUC) was quoted as saying.

Vanguardngr

Although the House of Representatives had on December 1, 2021, adopted the report by its Committee on Communication on the Nigerian Postal Service Act (Amendment) Bill to retain the NIPOST to continue with the collection of stamp duties, according to a report by The Punch.

We’ve also seen officials of the two government agencies call each other out on Twitter.

In reaction, FIRS described the claim by NIPOST as “ignorant” in a tweet:

“Our attention was drawn to the tweet by Mrs Abubakar. Her indecorous tweet would not have deserved any response but for the sensitive nature of the issue at stake, which if not sensibly treated and promptly corrected would likely mislead the public.

@firsNigeria

Whether there is a power tussle between NIPOST and FIRS, the fact is that there is a bill that was signed into law by the President which empowers the Federal Inland Revenue Service to collect stamp duties in Nigeria.

As such, FIRS has a dedicated portal for individuals and organisations to pay their stamp duty online at stampduty.gov.ng)

How To Pay Stamp Duties Online In 7 Easy Steps

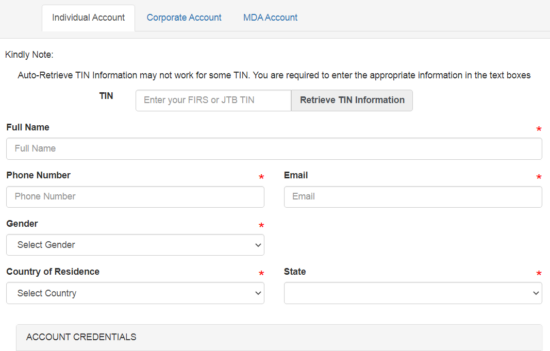

1) Head straight to the Integrated Stamp Duties & Levies Services (ISDS) portal of the FIRS at https://stampduty.gov.ng/registration?id=

to create an account. Three types f accounts are available:

- Individual

- Corporate account

- MDA account

Alternatively, you can use an existing account if you already have one

2) Your email is your username

3) Search the stamp duty instrument from the SERVICES menu and select

4) You have to provide details of the transaction. Do this by completing the relevant fields including your Tax Identification Number (TIN) and transaction amounts.

5) View the summary page, ensure that all fields are correctly filled.

6) Choose your preferred payment option from any of the available ones: Debit cards, Credit cards, or USSD option

7) Upon completion of payment, you’d receive the electronic copy of the Stamp Duty Certificate in your inbox (email of the user)

That’s all.

Solving The Issue of Missing RRR for Stamp Duty

We’ve discovered that many people face challenges getting RRR when they get to the payment option.

RRR on any payment platform in Nigeria means Remita Retrieval Reference Number (RRR), here is how to avoid the issue

Note: You need RRR to resolve a payment issue

1) Choose USSD as a payment option.

2) Select your bank from the drop-down menu.

3) Click “Continue”

For instance, if your bank is Zenith bank, a code like this will pop up: *966*000*160613451672#

The last 12 digits (160613451672) is your RRR, copy it out and keep it somewhere. The essence of this is to enable you to swiftly resolve payment problems if any issues arise

4) In case you made a payment, you’re debited and you see “Stampduty not activated”, you visit the stamp duty portal, click on Support Ticket at the top right corner of the portal

5) On the complaint ticket, specify your Company Name, RRR (the 12 digits you jotted above), Amount and date and time payment was made

6) An official of the FIRS will get your issue resolved through the Integrated Stamp Duties & Levies Services

That’s all.

Who can use the FIRS Stamp Duty Portal?

How do I get a stamp duty certificate after making payment?

What agency collects stamp duties in Nigeria, NIPOST or FIRS?

Section 4(1) of the Stamp Duties Act says that FIRS shall be the only competent authority to impose, charge and collect duties

What statutory law governs stamp duties in Nigeria?

When is stamp duty payable?

What is ad valorem stamp duty?

These include taxes such as those based on the value of a property transfer or loan agreement.

Sources:

- Featured Image: Screenshot on ISDS

- PWC Nigeria. “A Guide to Stamp Duties in Nigeria PDF”. Pwc.com. Retrieved March 1, 2022