Following the unification of the exchange rate by President Bola Tinubu, $/NGN is now determined by the prevailing to unify the prevailing market exchange rate.

What does it mean to float the naira?

Floating the naira means that the Central Bank of Nigeria is no longer controlling or fixing the value of the Nigerian currency in exchange for other currencies. It allows the market forces to determine the exchange rate.

If you are a forex trader, floating the naira means buyers and sellers of FX will determine what the price will be.

By floating the naira, it means its value would go up and down, depending on the market on a daily basis, meaning the market rate is said to be a “willing buyer, willing seller” arrangement.

Concerns by the former regime

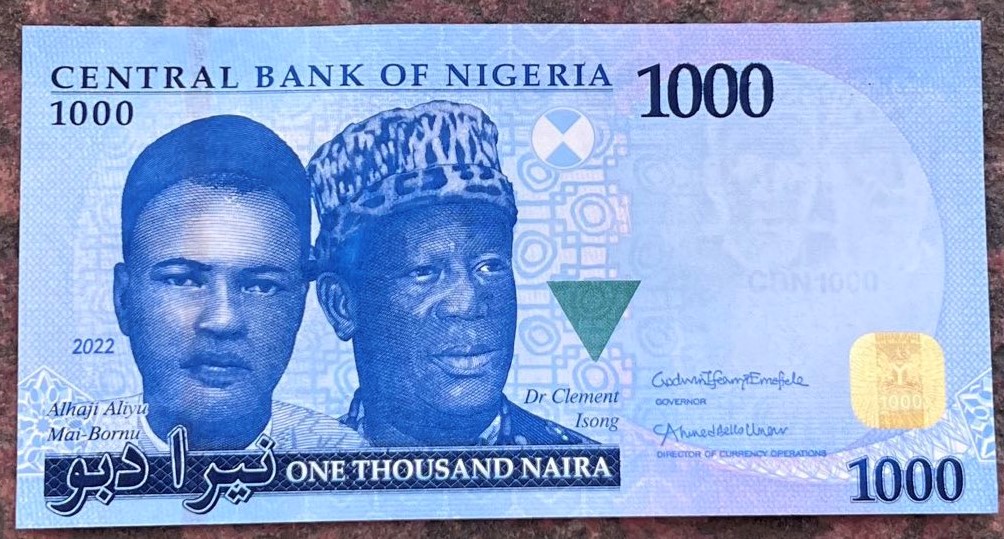

During the reign of the suspended CBN governor, Godwin Emefiele, he feared that floating the naira might force it to depreciate.

At the time, CBN through its spokesman, Mr. Isaac Okoroafor, said floating the naira might force it to depreciate to NGN3,000 against the US Dollar.

“We believed that floating the currency would have destroyed our economy because from our own calculations, if we had floated the naira when it was N525, the next thing would have been N700, N1,200, maybe N3,000 and it goes; it would go to haywire,” he said during the Capital Chapter Congress/Dinner of the Nigerian Institute of Public Relations (NIPR), FCT chapter, in Abuja, in 2018.

Tinubu’s FX Policy

During his inauguration on May 29, 2023, Bola Tinubu said unifying the exchange rate was the best way to encourage investment and boost the economy.

Tinubu’s second major action was sacking Emefiele and directing one of his deputies in charge of operations Folashodun Adebisi Shonubi to act till investigations into the financial activities of Emefiele is concluded.

What are the benefits of floating the Naira?

1) Because it is an open market, international investors can now access FX freely because Deposit Money Banks can now buy FX from their customers who have FX funds in their domiciliary accounts.

2) If monitoring measures are put in place, you don’t have to lobby the CBN again to get the most favourable rate unlike before when the difference between the CBN rate (which isn’t accessible) and others was wide.

3) Profits of foreign investors like foreign airlines will no longer be held by the Nigerian government.

4) Everyone will now be allowed to source for dollars.

5) Floating the naira will encourage the market economy. For instance, if Mallam Ismail’s rate is NGN780/USD ; Mr Sikiru’s rate is NGN770/USD, and Mallam Subeiru’s rate is NGN757, it is obvious that Subeiru will get more customers. Use BOVAS Petroleum as a typical example.

6) It means that Nigeria’s apex bank can choose to sell at NGN755, provided they have dollars to sell

7) It also means no one needs to lobby the CBN or the president anymore to get special consideration.

8) It will boost private-sector investment

9) It will boost the confidence of foreign investors

10) Market forces determine the price of FX and NOT the statist policy of Buhari/Meffy

11) Above all, floating the naira means there will be a focus on legitimate business deals.

Conclusion:

While there are many benefits of floating the naira, including the abolishment of Naira 4 Dollar Scheme, the government needs to boost power generation to encourage local production so the demand for FX will reduce, providing security for farmers and the country.