What is Annual Return Filing?

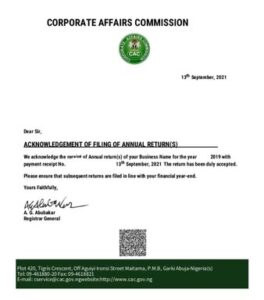

An annual return is a yearly update of a registered company or business in the Corporate Affairs Commission (CAC) database, indicating that the business is still active, operating, and in compliance with the law.

Filing annual returns in Nigeria is not about declaring a company’s profits, nor is it a financial document or a tax payment.

The annual filing fee for a Registered Company is ₦7,500 per year, while for a Business Name, it is ₦5,500 per year. Late filing attracts a penalty of ₦5,000 per year, excluding service charges by accredited CAC agents.

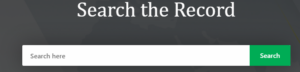

How to Know if a Company Has Defaulted in Filing Annual Returns

If a company’s name appears as “INACTIVE” on the CAC company register portal ( search.cac.gov.ng ), it has failed to file its annual returns for one or more years.

Importance of Filing Annual Returns

1) Ensures compliance with tax laws and regulations.

2) Allows businesses to claim deductions and credits where applicable.

3) Enables businesses to apply for government incentives.

4) Maintains a company’s “Active Status” on the CAC portal. If your company’s status appears as “INACTIVE,” your annual returns are not current.

Consequences of Failing to do so

1) Your company may be delisted after several years of non-compliance.

2) You will be required to pay a fine to reactivate your company name, which may exceed the actual return filing fees.

3) You may face difficulties applying for government contracts or credit facilities.

Legal Basis for Annual Return Filing

Chapter 16 of the Companies and Allied Matters Act (CAMA 2020) outlines the requirements for filing annual returns.

Section 418 of CAMA 2020 states:

Case Study

A Company That Defaulted on Annual Filing Mr. Yemi (not his real name) registered Orionate Solutions Limited in February 2008 but never filed an annual return. In 2025, he decided to rectify this and contacted a CAC agent.

Annual Filing Fee: ₦5,000 × 15 years = ₦75,000

Penalty: ₦6,500 × 15 years = ₦97,500

Total Amount Payable: ₦187,500 (excluding agent service charges)

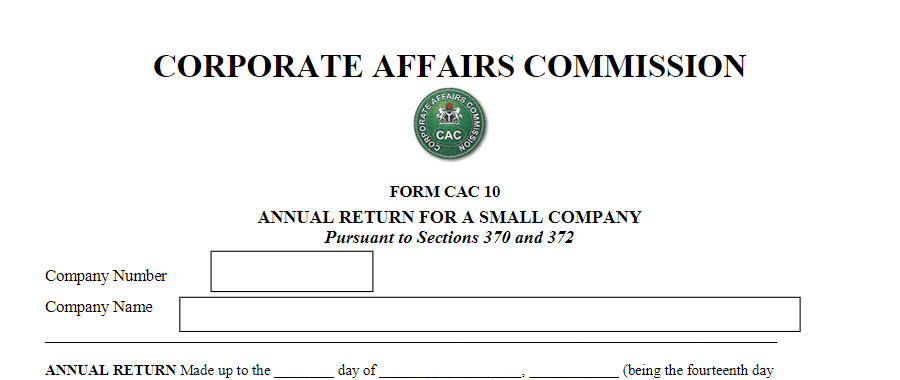

| Limited Company | Business Name | |

| Annual Return | N5,000 | N5,000 |

| Late payment | N6,500 | N5,500 |

| Total | N11,500 per year | N10,500 per year |

When to File Annual Returns

All Limited Liability Companies (LLC), Business Names, and other registered businesses in Nigeria must file their annual returns with the CAC no later than June 30 each year.

The only exception is if the business was registered later in the year (after December of the previous year).

When Should a New Business Start Filing Returns?A newly incorporated company has a grace period of 18 months before its first annual return filing.

A Business Name has 12 months before filing.

For older companies, annual returns must be filed within 42 days after their Annual General Meeting (AGM).

Can a Company Be Exempted from Filing Annual Returns?

No. All registered businesses must file annual returns. While import duty waivers exist, exemptions from filing annual returns do not.

How can I file it?

Individuals can register their business or company on the CAC portal but cannot file annual returns themselves. Only accredited CAC agents can handle post-incorporation issues.

Need Assistance?

We can help you file your company’s annual returns seamlessly. Contact us at InfomediaNG Business Solutions or send us a WhatsApp message at +2348027024054.

Do you need our assistance?

We will effectively assist you in filing your company’s return without any glitches. Talk to us at InfomediaNG Business Solutions or send us a message on WhatsApp: +2348027024054

Kindly give a guide on how an individual can do it without an agent. I registered the company myself so I have a login details.

Thank you in anticipation of your kind response

Business owners could file annual returns without passing through agent in the past. But the post incorporation dashboard can only be accessed by an accredited agent now. So, you can’t do it without agent. If there is any change to that, we’ll let you know.

can someone with a pharmacy shop pay annual fee under cac

INFORMATIVE , USEFUL AND HELPFUL.

My company was registered in September 2018, when do I commence filing of the annual returns to CAC, 2019 or 2020?

Thanks elucidated questions and answers

Can a company file CAC online without using an agent

Yes, provided you abide by the guideline set by the commission.

Does an exisiting company need to register on the CAC portal to be able to make annual returns filing?

No. You can do the filing through an accredited CAC Agent, Check more about how you can file annual returns through an agent. We are one and you can send a message via the contact us page

Thanks for the information sir.

I operate a bookshop business, selling stationeries. If l register my business (BN), I’m l going to pay annual tax to FIRS or any tax authority apart from yearly filing of return cost of #3,000 ?

Again, what is the importance of registering such business (bookshop) with CAC ?

Thanks.

You are not going to pay tax for your business name. However, you will only be entitled to Personal income tax to the SBIR which is a general tax on anyone getting income.

The importance of registering your business is that it saves the name of your business and gives you advantage when transacting business amongst your competitors

I registered in 2020,how much will I pay to reactivate my business name

I registered a business name in 2012, and I left Nigeria now; I want to start using this business, which is ten years of annual returns and a penalty, which is 80k plus.is there no way to appeal my case with CAC

No, there is no way to appeal. It is based on CAC directives and procedure

My company has been inactive. can I pay for 5years out of 10years? Will my company be activated?

how do i file annual returns for a company that was registered i 2008 and ha never filed ?

Hey Ogbeni,

Please contact the Federal Inland Revenue Service (FIRS). You can reach on Twitter @firsNigeria. facebook.com/F.I.R.S.naija on Facebook for more

Do one file the annual return with FIRS or CAC. from you write up you say you can pay for it on the CAC website, then why are you referring FIRS?