Most times, claiming the investment holdings, including stocks, bonds, and other securities of a deceased family member involves a tedious legal process, especially if the deceased died intestate (without a Will).

So, if your parent, grandparent, spouse, or any family member has passed away without leaving a will, you might have a backlog of unclaimed dividends sitting idle somewhere.

Background

Sometimes, parents bought shares worth millions of naira and passed away without informing you. You’ll need to engage investment managers and lawyers to facilitate the transfer of such stocks into your name.

If your parents purchased stocks and securities in your name without your knowledge, intending not to distract you, you only need to check the unclaimed dividends portal, as detailed in our guide.

How to check if your late parents have unclaimed dividends

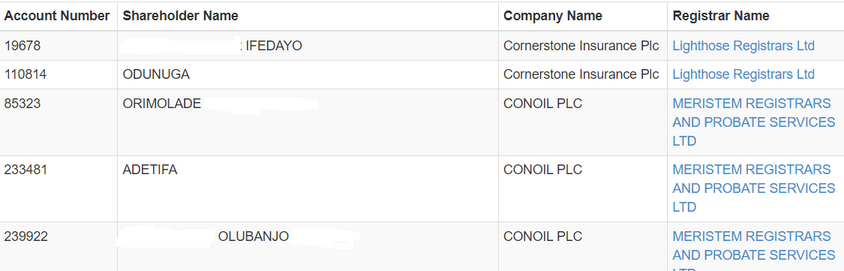

- Go to the non-mandated list on the portal of SEC

- Enter your parent’s first name and last name and hit the search button.

- Check the displayed names. Pay attention to the names because there may be similarities.

- Use variations because your parents may have written their names in the old version. For example, in the southwest, some people use ‘Buraimoh’ instead of ‘Ibraheem’, or they might have used ‘Ibrahim’ instead of ‘Ibraheem’.

- When you’re able to confirm that the unclaimed dividends belong to your parents, you can contact your lawyer or investment managers such as Afrinvest and Apel etc.

Documents for transferring your parent’s shares to your name

So, we asked an investment management holding firm based in Lagos, Nigeria, what the claimant must provide to inherit their late parent’s shares:

- 2 copies of the letter of administration/probate (original required for sighting) if he died intestate.

- 2 copies of the will where applicable or a certificate of additional assets obtained from the probate division of the High Court if the letter of administration does not indicate that the deceased acquired shares in any company.

- Open an estate account with a bank.

- Open an account with a licensed stockbroker, who would assign a Clearing House Number (CHN) to you.

- 2 copies of the death certificate.

- All original share certificates and dividend warrants are still in your possession.

- Original Banker’s Confirmation of signature of the administration (s) duly authenticated by the bank.

- Valid identification of the administrator(s)

- Newspaper publication or Gazette.

- You must have a means of Identification such as a marriage certificate or birth certificate or driver’s license or international passport

Note:

If you cannot take the above documents to your stockbroker office, you can send an authority letter to your stockbroker to submit the documents on your behalf which must be sighted and stamped by the broker.

If you’re reading this as a parent and you would like to transfer your shares to your child, talk to your stockbroker about what to do.

Takeaway

Claiming the dividends of a deceased family member requires a lot of legal papers. But if you are the next of kin of the deceased, you only need the deceased death certificate and a proof that truly you’re the next of kin.

Featured image

- David Hodgson