The recent guideline by the Central Bank of Nigeria (CBN) says your bank account will be blocked if you fail to link it to your National Identification Number (NIN).

Even though you already have your Bank Verification Number (BVN), the apex bank is saying your NIN and BVN have to be linked to your financial transactions.

Some banks are not only complying, but they are making it easier for their customers to handle the process by themselves through the online banking platform. One of them is Zenith Bank.

If you are already using Internet banking, you may not necessarily need to visit your bank’s branch to get this process done.

Zenith Bank

Via the Internet banking method

- Use the zenith internet banking URL at ibank.zenithbank.com/internetbanking/App/Security/login and enter your username and password.

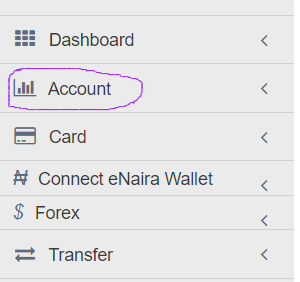

- From the menu, select “ACCOUNT”

- Then select “Update Account NIN”

- Enter your NIN

- Enter your Date of Birth. The date of birth must be the same DOB you filled out when setting up your bank account.

- Click the validate button

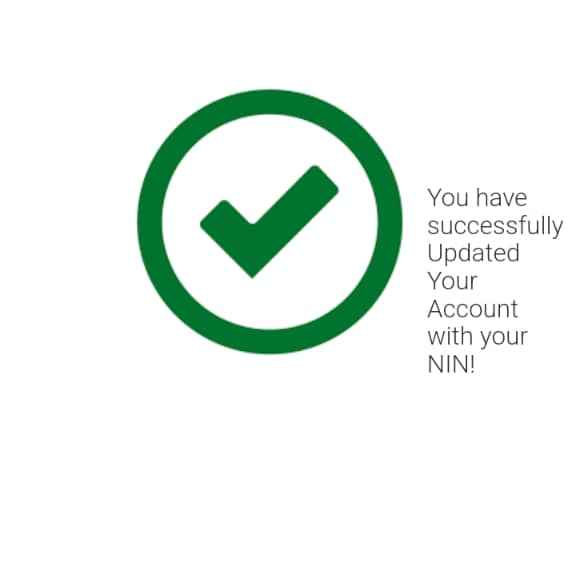

If it’s successful, you will see a message, “You’ve successfully updated your account with your NIN!”

Via USSD code

- Dial *966*your NIN#

- If it’s your BVN you want to link, dial *966*your BVN#

- Follow the prompts and submit for validation

Via manual method

If none of the methods above worked for you, you can use the manual method:

- Walk into any branch of your bank

- Pick up the NIN-BVN linking form from the customer service desk

- Fill out the form and submit it on the same desk

You can do the same with your bank if Zenith isn’t your bank.

GT Bank

- Login to the Internet banking platform

- Click “MY ACCOUNTS”

- From the dropdown menu, select “BVN-NIN LINKER”

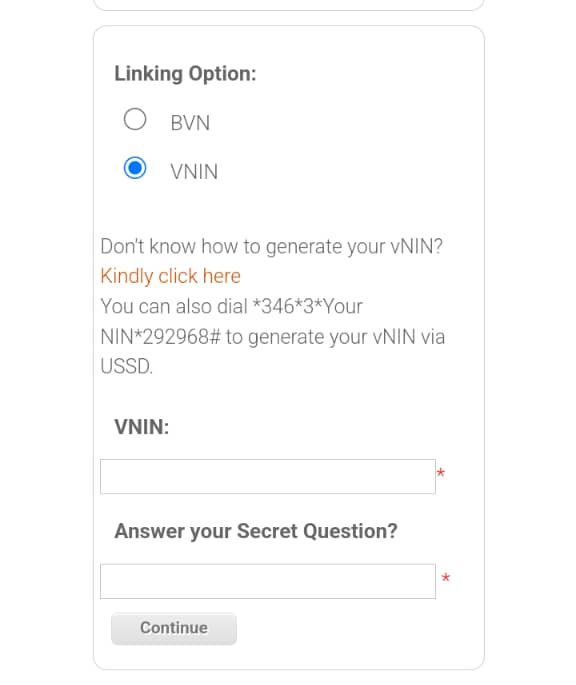

- There are two linking options 1) BVN, 2) Virtual National Identification Number (VNIN)

- If the VNIN is your option we have a guide on how to generate it here, you can proceed to the NIMC app to generate your VNIN.

- Enter your VNIN

- Enter your Internet banking secret question

- Click to validate

Note: All banks have a unique enterprise code associated with them, in case you want to generate VNIN to link your bank account.

Alternatively, you can use the GTBank USSD code to link your BVN to your bank account

From the phone number linked to your account, dial *737*20*Your BVN#

Code to generate your NIN and BVN

- For BVN: dial *565*0#

- For NIN: dial *346# to retrieve your NIN

You should receive a message that your BVN has been successfully linked to your account number.

If it’s already linked, the prompt you’d get is “your BVN is already linked”.

If yours shows an error, visit any of the GTB branches nearest to you for the manual linking as described above.

Ecobank

Ecobank has directed its customers to follow these steps to link their NIN with their bank accounts:

- Click on the customer update link customerupdate.ecobank.com/ciu/login

- Enter your account number

- Agree to terms and conditions box

- An OTP will be sent to your registered email address

- Enter the OTP and submit

- Click on Request

- Select statutory ID or identification update and upload a copy of your NIN document.

- Tick the acceptance box and submit

Access Bank

Via Internet Banking

- Login on the Internet Banking platform

- Select the Service Requests Menu

- Select Initiate Service Request

- Select Link BVN

- Enter your bvn and submit

Via SMS

- Text BVN LEAVE A SPACE your account number LEAVE A SPACE BVN number AND send as SMS to 20121

Sample:

BVN 0688889890 22333330000 SEND TO 20121

USSD CODE

- Dial *901*11# from your registered phone number.

- Follow the prompts on the screen and enter your NIN and BVN when requested.

- Confirm your details and submit.

You will receive confirmation that your NIN has been successfully linked to your Access Bank account.

United Bank for Africa UBA

- UBA says their customers can send Hi to their chatbot called ‘Leo’ on Facebook, WhatsApp, Instagram and Apple Messages at: ubagroup.com/leo

- Then select NIN updates

Manual linking

- Visit UBA branch

- Request for NIN linking form

- Fill out the form and submit it for validation.

How to check if your NIN is already linked to your bank account

- Login to your Internet banking platform

- Before worrying about this, there is a simple way to check if your NIN and BVN are already linked to your bank account.

- If you can see your NIN and BVN, especially on GTB, it means both data is linked to your bank account. In this case, you don’t need to take further action.

Background:

The directive to link BVN and NIN to all bank accounts in Nigeria is from Nigeria’s apex bank.

Sources say more than 70 million bank account holders were yet to abide by the directive, meaning those who failed to comply would have their bank account blocked if the CBN begins the implementation process.

Linking NIN and BVN to bank accounts isn’t a new directive, but the apex bank on December 1, 2023, threatened to enforce a ‘Post No Debit’ (find the meaning here) restriction on accounts that failed to follow the order by March 1, 2024.

The circular which was signed by two top executives of the CBN, Chibuzo Efob, Director, Payments System Management Department and Haruna Mustapha (Director, the Financial Policy and Regulation Department) states that:

“It is mandatory for all Tier-1 bank accounts and wallets for individuals to have BVN and/or NIN. It remains mandatory for Tiers 2 & 3 accounts and wallets for individual accounts to have BVN and NIN.

Due to security concerns and a move by the CBN to fully exercise its monetary and financial activities monitoring roles, it says Know Your Customers (KYC) is mandatory for all banks and account holders, including tier-1 bank accounts.

The apex bank also warned banks that failure by banks to do so would be met with appropriate sanctions.

Subsequently, all banks started sending out messages to their customers to do so at their branches across the country.

I did a modification on my date of birth on my MTN line last week. But before then I went to link my bvn to my nin. But the virtual nin was carry a wrong age. So I went and corrected it.will the correction reflect on thee bank virtual nin when I dial it again and how long will it take

Yes, it will reflect.