There are three major ways to fund your opay account, but without an agent, you should be able to top up your account with an agent:

- Through your bank App

- Through your wallet using ATM card

- Via agent

After downloading the App from Google Play Store if you use an Android Phone, fund your account either using your ATM card, and bank app thus:

- Step 1: Go-to balance

- Step 2: Click on Add Money

- Step 3: Select Add new payment options

- Step 4: Click on the card icon

- Step 5: Input your card details

- Step 5: You’ll be redirected to the authorization page for you to input OTP and you’ll be credited.

Via your bank app

- Step 1: Open your bank app

- Step 2: On the list of banks, select paycom or OPay.

- Step 3: Input the amount you want.

NOTE: Your account number is the phone number you used in registering your opay app minus the first zero. For instance, if your phone number is 07056767676 then your account number will be 7056767676

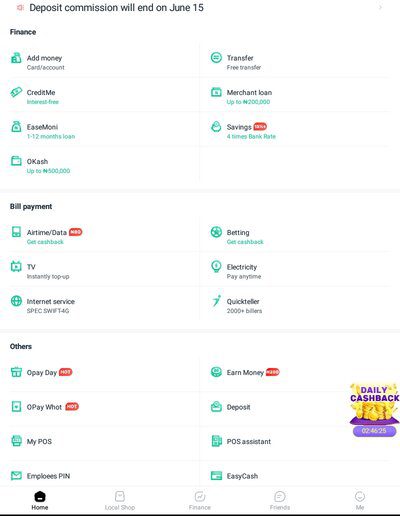

What you can do on your OPay Account

Some of the transactions you can perform on the mobile money app include:

- buying airtime

- subscription for data such as MTN, Airtel, and Glo

- making payments for PayTV such as DSTV, Startimes, Showmax,

- Buying electricity bills, and

- Making payment for your favourite betting services such as iLOTBet, SportyBet, BetKing etc.

- Ability to save money and even lock your money on the app for later withdrawal

- Buying airtime E-Pin etc

There are many products under the brand Opay, they include ORide (defunct), OBus, OFood (defunct), OKash, Owealth, EasyCash, OCar (defunct), and Airtime, Mobile data purchase and bill payment.

“You can now transfer money directly from any bank in Nigeria into your OPay balance using your phone number,” the company says. However, you remove the first digit. For instance, if your phone number is 070876543280, then your OPay account number will be 70876543280.

Great article! This is really helpful for those looking to fund their OPay account without an agent in Nigeria. Thanks for sharing this information with us.

Apply for the Android or Traditional POS for as low as 20,000 for the POS Terminal and 5,000 for Network registration fees.

Promo materials coming with the POS are free mini POS, a chair, table, banner, agent polo and 12months free internet subscription, This Offer is open to all new and exiting customers.

Please I found it difficult to make a transfer from my Opay account please I am a new customer and I don’t understand what is going on

I was robbed and I lost my sim I use to sign up my Opay account and now I got a new phone but it’s hard for me to sign in with my password because I forgot it and the phone number is not with me anymore,please any help because I have some money in it

Contact the customer support on WhatsApp at +234 (01) 8888329 or send a complaint with your details to ng-support at opay-inc dot com

Opay headquarters in Nigeria is at Alexander House, Otunba Jobi Fele Way. Ikeja. Lagos, Nigeria.

Type here..since am using it I never use b4 I just want to start now

what and what can I use to deposit in my ATM

Please I transfer 200 to my betting site msport the money fail to enter my betting account I contact there customer care they told me the money has been reverse but I can’t see it my opay account 7062224313

hello please can we talk ?

I wanted to transfer money to bank account but it turn to phone which is incorrect number

Opay froze my account which is not fair I really need my money please I really need it please

I love this app but that cashback I can’t use to buy data and airtime