The article explores the largest cryptocurrency hacks since MT Gox became the major victim of a crypto attack in 2011.

Africrypt Hack

On April 13, 2021, two brothers and also the founders of Africrypt Ameer Cajee and Raees Cajee informed their investors that the Africrypt Bitcoin Investment platform had been hacked.

Subsequently, a group of 20 investors on April 26, approached a South African court Gauteng South High Court asking the court to liquidate Africrypt against their owners.

Although the presiding judge gave the founders of the questionable BTC investment platform until July 19 to argue against the liquidation order, they would not appear till now. They sent a lawyer to represent them.

After announcing the attack on their security protocol, the South African-based Africrypt founders didn’t disclose the gravity of the theft.

The huge number of investors who wanted to rake in millions of Rand or USD (as 2021 was the best performing year for cryptocurrency) lodged complaints about how much they invested in bitcoin, the total Bitcoin invested amounts to about 69,000 coins, according to Bloomberg.

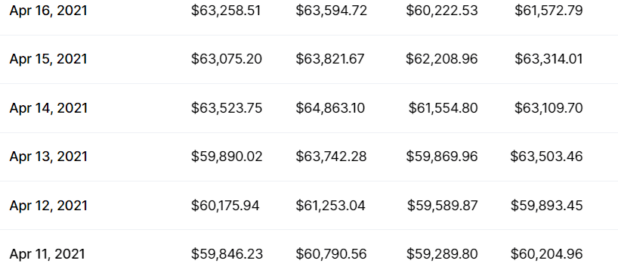

In April 2021, the lowest price of BTC was $47K while $64,863.10 was the All-Time High for Bitcoin in April 2021.

On the day Ameer and Raees Cajee announced hacking of their platform, BTC closed at $63,503.46., which translates to $4.3 billion using the number of bitcoins that went missing.

In what some analysts described as an exit scam, Raees and Ameer commissioned their lawyer, John Oosthuizen, to deny the brothers’ involvement in what is now known as the largest cryptocurrency scam/hack in the history of blockchain technology.

The two brothers by June 2021, vanished and shut down their company’s domain. One would have expected the two brothers to disclose the enormity of the hacks, but they disappeared and left behind the most questionable history.

If our estimation of $4.3 billion is correct, then Africrypt remains unbeaten as the biggest crypto theft in history.

Bybit

On February 21, 2025, attackers broke into Bybit ETH cold wallet, moving ETH estimated at $1.4billion. The hackers started moving the funds in batches and to different addresses.

MT GoX hack

Described as the first major cryptocurrency hacks, a Tokyo-based and the largest cryptocurrency during its reign MT.GOX remains the most vulnerable exchange in the history of cryptocurrency as the bad guys continually exploited several loopholes in the company’s code.

It was hacked in 2011, one would have thought that the MT GOX team would fix the vulnerability, they did though, and the security measures put in place by the company would not stop the hackers from gaining access to the company system.

At a time, the bad guys manipulated the price of Bitcoin on the firm’s exchange website to buy at their manipulated price, before the web security of the MT GOX know what went wrong, several bitcoin had been transferred to another address without a trace.

Mt.Gox was rated as handling over 70% of bitcoin transactions during its reign, but crypto hacks pushed the crypto exchange company out of the market.

The amount stolen from Mt.Gox is difficult to quantify at the time it went out of the market, however, when the company filed a form of bankruptcy protection in February 2014, it was reported that it had lost customers’ digital assets worth 750, 000 BTC while the management said 100, 000 bitcoin asset of the company went missing as a result of the theft that which went undetected for almost four years.

The estimated value of Bitcoins that were stolen on Mt.Gox was 850,000 BTC. In January 2014, Bitcoin was around $7740.44, according to data by Ian Webster on its data analysis website.

By that calculation, Mt.Gox lost at least $658,274,000 USD to crypto theft. In today’s BTC market value at $21,455.24, that is worth over $18 billion USD.

On February 24, 2014, Mt. Gox officially came to a close, when it suspended all transactions including withdrawals and by the second day (February 2), its website showed a blank page.

Apart from going offline, the Mt.Gox theft also led to the crash of bitcoin during the time. Some key figures were accused of involvement in the calamity that befell the exchange firm.

Ronin Network (Axie Infinity)

The top leading and the most recent crypto hack is the Axie Infinity hack. The company took to its page to release an official statement of a security breach that was carried out on the company’s platform leading to a total loss of about $625 million.

Ronnie network is a crypto gaming network with a distinguishing factor of converting images and creatures to NFTs.

This hack was carried out by the hackers exploiting the company’s validator’s node thereby draining the company with about $630m in just two transactions.

Further investigation was launched to ascertain the level of damage and theft, the United States o America Treasury department traced this hack to North Korea’s Lazarus group.

Ronnie network intrusion was named the cryptocurrency’s greatest hack and it happened on March 23, 2022, but the hack was made public on March 29.

The hack may have put the crypto/NFT games firm in huge financial trouble, but thanks to the largest cryptocurrency exchange firm Binance that to the rescue by supporting Ronin Network with $150 million USD, according to Sky Mavis, a Vietnamese games developer that runs the Ronin Network as well as Axie Infinity.

Even with the injection of millions of USD by Binance to restore hopes in investors, the hackers were already gone. The good thing is that it didn’t end the operation of Ronin Network in the crypto sector.

Poly Network Exploit

One of the most dramatic crypto hacks was the exploitation of Poly Network vulnerability by a group of hackers which occurred in August 2021.

At first, they gained access to crypto assets valued at over $600million and locked about $200million in a private network which requires the Poly network validation and the hacker’s password validation.

What actually made the hack dramatic was the announcement by the hackers on August 21, 2021, that they were out to exploit the vulnerability in the poly network system that is aimed at keeping the firm on its feet to do more to further secure its system.

Poly Network Team would later address the hackers “Mr White Hat” and promised to reward them with $500,000 as a token of discovering the platform vulnerability, which raised a lot of mixed reactions among white hackers around the world.

The best part of the Poly Network drama was that some of the ‘stolen’ tokens were intercepted while the hackers returned the remaining tokens that were said to have been stolen for fun.

It was rumoured that hackers were persuaded to join the Poly Network team, but we can’t confirm whether they were able to strike a deal.

Coincheck Hack

Based in Shibuya district of Tokyo, Japan, Coincheck Exchange had its website security exploited by hackers, leading to at least $560 million worth of XEM (NEM) coins being stolen.

The loop exploited by these hackers was the fact that the company hosted its coin online which is known as the hot wallet.

Most of the coins stolen from this bounty were sold on the dark web.

Founded in 2012 as one of the earliest crypto exchanges, the chief operating officer of the company, Yusuke Otsuka, admitted the vulnerability, claiming that Coincheck already investigated and knew where the stolen coins were moved to.

BBC quoted him as saying, “We know where the funds were sent. We are tracing them and if we’re able to continue tracking, it may be possible to recover them.”

Considered as one of the cryptocurrency heists, at the time the Tokyo-based crypto firm confirmed the hack, it reported that cryptos worth $534m were stolen, further findings showed that it was worth $560 million USD.

Though one of the steps the company did was to freeze all deposits and withdrawals to mitigate the damages, the bad guys had already wired the coins and were selling them on the darknet marketplace.

CoinMarketCap described the Coincheck hack as one of the largest crypto hacks, saying the exchange, in an analysis, failed to secure the funds of its customers.

Nemesis would later catch at least 30 of the hackers who were arrested in 2021, according to Japan-based news platform Mainichi.

They were said to have converted their illicit traded cryptocurrencies for fiat currency at various legal exchanges across Japan to rake in billions of yen (Japanese official currency), Crypto-based online news reported.

Warmhole Hack

One of the earliest cryptocurrency heists in 2022 occurred on Warmhole in February 2022, decentralized finance (DeFi) platform that allows the transferring, saving, and lending of crypto assets without passing the conventional financial system.

Certus One is the developer of Wormhole which was acquired by Jump Trading

The DeFi platform allows the crypto assets between layer-one blockchains like Solana, Avalanche, Terra, Ethereum, Binance Smart Chain (BSC), and Polygon

In a tweet, warmhole says, “The wormhole network was exploited for 120k wETH.”

The hackers first shut down the platform, then exploited about $120k wEth worth over $320 million. This attack was the first successful cyberattack that was launched on the crypto network in 2022.

It’s noteworthy to note that one thing that made the warmhole hack dramatic is that the security team made fixes to its GitHub repository to wade off the bad guys, unfortunately, they didn’t apply them to the live application giving space for the hackers to penetrate.

Thankfully, the platform swung into action immediately after the loopholes were discovered and announced that it would restore the stolen crypto in a tweet:

“All funds have been restored and Wormhole is back up,” the platform said on Twitter after earlier saying on its channel that “all funds are safe.”

DragonEx

Founded on November 2, 2017, DragonEx is one of the victims of cyber-attacks in March 2019, leading to a loss of at least $7million.

“It’s estimated that the value of the funds stolen is around 7 million $, after tracking and investigation, DragonEx found that part of the funds has flown into other exchanges.

“DragonEx has been working on retrieving back more assets and communicating with the leaders of those exchanges for more support,” it says on a messaging app Telegram.

The exchange team said police were informed of investigations, but till today, no report of recovery of the stolen coins.

Kucoin

In September 2020, the KuCoin in an official announcement made it public that there was a complex APT attack on its system by some bad guys who had been lurking to tap on its vulnerability.

By the time they launch the attack, internal network of the crypto platform was affected, leading to loss of cryptos valued at $285 million at the time.

Information has it that the Kucoin attack led to the theft of almost 10 cryptos including Litecoin, Ethereum, Bitcoin (BTC), Stellar Lumens (XLM), and Tron (TRX) among others.

The good part was that KuCoin was able to bounce back from the attack, thanks to the efforts of the team to recover 84% of the $285 million of stolen cryptocurrency while the hackers went away with over $45 million, the cryptocurrency exchange firm covered its losses through insurance fund.

Upbit

Within two years of its establishment, a South Korean-based crypto exchange was hit in 2019, resulting in a loss of 342, 000 ether valued at $49 million at the time of the attack. It was a single transaction.

The exchange firm said users’ funds were not affected. But to protect funds or further attacks, the Upbit suspended all functions for at least two weeks.

Cryptopia

Founded in 2014 by Rob Dawson and Adam Clark with headquarters in Christchurch, New Zealand, Cryptopia experienced a terrible attack two weeks into the new year (2019).

Cryptopia was one of the promising crypto exchange platforms in NZ before the attack which led to crypto theft estimated at $16 million USD.

The NZ-based crypto firm was unable to bounce back from the attack as it reported that over 9% of its total holdings were stolen. It reported the attack to NZ police and an investigation was launched.

It shut briefly and tried a come-back in March, but it doesn’t have the financial strength, it would later file for bankruptcy. That’s how the cryptocurrency heist ended the big dream and vision of Cryptopia.

PancakeBunny Attack

PancakeBunny is decentralized finance (DeFi) with a protocol that allows farmers the opportunity to reap the benefits of auto compounding.

The attacker exploited PancakeBunny ecosystem to mint millions of Bunny tokens and sold most of the dubiously minted tokens for BNB. The loss was valued at $45 million.

Besides, 2021 wasn’t a good year for the company as another of its project PolyBunny was also hit on July 16 with another flash loan attack minting PolyBunny valued at $2.1 million.

Both hits tanked its tokens: PancakeBunny crashed from $220 to $10 while PolyBunny fell from $10 to $2.

It was a devastating year for Bunny Finance, we hope the team have learnt their lessons.

Binance

As large as Binance is, it didn’t stop crypto hackers from carrying out their audacious security breach in May 2019, and stole 7,000 bitcoins from the company’s hot wallet which was estimated at $40.7 million.

In an update, the largest crypto exchange stated that the attack only affected a single account where a single transaction was executed.

Binance CEO Zhao Changpeng in a blog post revealed several techniques the crypto heist used to carry out the attack.

“The hackers used a variety of techniques, including phishing, viruses and other attacks. We are still concluding all possible methods used. There may also be additional affected accounts that have not been identified yet,” he said.

The company later announced that the only affected account was reimbursed through its Secure Asset Fund for Users (SAFU).

No doubt, Binance was the biggest victim of cryptocurrency hacks in 2019. There are reports that the exchange platform is a hub for attackers and scammers because of its size.

But the exchange continues to assure its users that it will continue using the best powerful security measures to secure customer’s funds

Bitfinex

One of the leading digital asset trading platforms Bitfinex was hit in August 2016 – that’s four years after its establishment in Hong Kong – leading to the loss of 119,754 Bitcoins.

The Bitfinex hack was one of the largest crypto hacks in 2016. How the hackers penetrated the firm’s system was able to make a series of unauthorized withdrawals from users’ wallets was unimaginable.

At the time of the attack (August 3, 2016), Bitcoin was $573.36, according to the historical data on CoinMarketCap, which means the value of the stolen BTC at the time was over $68 million.

In today’s BTC value at $21,33.84, it’s worth over $2.5 Billion USD.

Owned by iFinex Inc., Bitfinex launched an investigation and kept tracking the movement of the fund by involving experts and security authorities in the United States and other blockchain-sophisticated countries around the world, it made a seemingly breakthrough six years after.

The US Department of Justice in a publication announced the arrest of two suspects who were making attempt to launder the $4.5 Billion linked to Bitfinex.

The US authorities intercepted $3.6 billion out of the said amount which is linked to the account.in cryptocurrency linked to that hack.

Deputy Attorney General Lisa O. Monaco described the seizure as the largest financial seizure ever and expressed optimism that, “cryptocurrency is not a safe haven for criminals”.

Another hack attempt was made on the crypto exchange platform yet again on June 5, 2018, in what analysts described as DDOS attack or distributed denial-of-service

“Bitfinex is currently under extreme load. We are investigating the issue and will keep you all up to date as we learn more,” the exchange announced in a tweet.

Bitgrail attack

An Italian-based exchange platform Bitgrail was attacked on February 11, 2018, leading to the loss of 17 million coins, valued at $170 million.

Bitgrail is not a popular platform as such but was one of the prominent exchange platforms in Italy that traded in lesser-known cryptocurrencies, such as the Nano token and XRB.

Just as the price of NANO went up from a few cents to $33 in February 2018, the exchange was breached and the cryptocurrency was stolen by hackers.

The theft was recorded to have caused the company about 17 million coins (equal to approximately $150 million) from nano wallets.

Prior to the attack, a number of users began to express their displeasure with the swapping itch observed on the platform which is lower withdrawal limits and transaction problems.

Additionally, the monies were taken from cold wallets rather than hot wallets, pointing to an insider breach.

In recent years, investigations have continued, and Italian authorities reportedly accused the owner of Bitgrail Francesco Firano of being behind the attacks either directly involved or not.

The general belief was that he was aware of the incidents and took no action to prevent further theft once the first attack had been carried out.

Beanstalk DeFi Attack

There was a breach in the security protocol of the Ethereum-based DeFi platform Beanstalk on April 17, 2022, in another flash loan, amounting to loss of at least $182 million.

The hacker was able to steal $80 million in cryptocurrency, but the platform’s losses totalled more than $180 million.

One funny thing about this saga is the kind gesture of the attackers, according to reports, donating $250,000 USDC to Ukraine relief funds from their theft. They sent the amount by using a cryptocurrency donation wallet to support Ukraine against Russia’s invasion.

The decentralized credit-based stablecoin confirms the exploit in a tweet, promising to investigate

Bitpoint

In July, a Japan-based cryptocurrency exchange Bitpoint disclosed that it had lost 3.5 billion yen (estimated at $32 million) worth of cryptocurrency assets of its customers and the exchange in a hack that occurred in July 11.

In an announcement, it suspended all deposits and withdrawals to give room for the investigation, “

“Today, we have stopped the remittance (sending) and receiving (depositing) services from 6:30, but we will stop all services including transactions and remittances from around 10:30. We apologize for any inconvenience caused and appreciate your understanding and cooperation,”

bitpoint.co.jp

Bitmart attack

Bitmart’s hot wallet was hacked in December 2021, stealing about $200 million. $100 million was initially thought to have been taken from the Ethereum blockchain, but a subsequent investigation found that an additional $96 million had been taken from the Binance Smart Chain blockchains. At least a dozen altcoins and tokens went through the back door, including BNB, Safemoon and BabyDoge tokens.

Bitmart attack was one of the major crypto hackings in 2021. Most of the victims are still waiting for refunds no one knows when they will come.

Bithumb

Since its launch in 2014, the South Korean-based cryptocurrency exchange platform Bithumb has experienced more cyberattacks than any other exchange.

From 2017 to 2019, cryptocurrency heists penetrated the security protocols of S/Koran-based exchange, amounting to over $90 million accumulatively.

At least four crypto attacks were made public by the Bithumb team. With more than five million App downloads on Google Playstore, the goal of the exchange firm to be one that serves the global market is being threatened by several attacks.

Apart from attacks, the exchange company has been subjected to several scrutiny and investigations by authorities in South Korea.

Below is the timeline of attacks on Bithumb:

February 2017

It first experienced a successfully executed major attack in February 2017 carried out by an unknown criminal group. The hacking of its system led to the loss of cryptocurrencies worth over $7 million. The withdrawal of the stolen funds had no trace.

June 20, 2018

The exchange beefed up its security protocol after the 2017 attack, but 16 months, the bad guys came lurking again and succeeded in gaining access to Bithumb yet again.

Its team in a deleted tweet said $30 million worth of cryptos were stolen, but further revelation put the figure at $32, 000, 000 USD.

The attack backfired, Bithumb lost some users on grounds of credibility which affected trading volume. It had no other choice than to cut the number of employees, at least 8% of its workers were sacked

March 29, 2019:

Two months after the sacking of at least 30 members of its workers, the South Korean-based exchange was compromised on March 29, 2019. Major coins that were stolen include EOS and Ripple estimated at $20 million.

The company’s wallet was the point of attack. The exchange in a statement assured users that their funds were safe.

June 19, 2019:

South Korea’s largest cryptocurrency exchange was in the news for a hacking report on June 19, 2019, when it directed its customers to not deposit any funds into their Bithumb wallets following another security breach.

It also suspended all deposits and withdrawals,s for the time being, promising to change its wallet system to avoid further damage.

The attack led to over $31 million. While the attackers were not unknown at the time of the incident, it raised security concerns among blockchain security in the country.

The last hacking on Bithumb caught the attention of South Korean Ministry of Science and Technology (MIC). Their aim was to identify the reason behind the stolen cryptocurrencies.

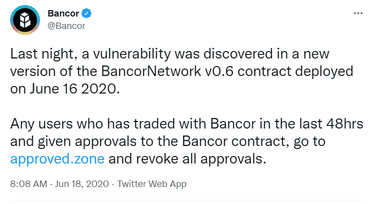

Bancor

Bancor DeFi trading and staking platform on July 9, 2018, publicly declared that its security protocols have been breached and moved to maintenance.

In the end, it was reported that the attackers had moved crypto assets estimated at $23.5 million. The firm discovered a similar vulnerability on its system in 2020 and hacks itself to prevent theft. And fixed the loopholes.

Coinrail

Coinrail joined the likes of BitGrail, Bithumb, and Coincheck to be one of the victims of cryptocurrency heists in 2018.

The South Korean-based exchange halted services immediately in what it described as “cyber intrusion” on its security protocols, leading to an estimated $40,000,000 loss.

Two major cryptos: Bitcoin and Ethereum plummet after the attack. Coinrail exchange is no longer active.

ZAIF Crypto Hack

Founded by Takao Asayama on June 16, 2014, Zaif cryptocurrency exchange claimed to be one of the trusted crypto trading platforms until September 14, 2018, when that was put to test.

Cryptocurrency hackers gained access to the Zaid hot wallet and transferred several coins, estimated at $60 million USD. It was one of the largest biggest crypto hacks of 2018.

It took tech bureau up to three days to notice the security breach, the bad guys had implemented their evil did as of September 17, when the case was reported to the police and the Japanese Financial Services Agency (FSA).

To return to business, Zaif management signed a deal with another Japanese investment firm Fisco who made raised over $40 million USD to cover the losses.

Today, fisco is the majority shareholder of the exchange.

BiTrue

On June 27, 2019, a Singapore-based trading platform BiTrue suffered an attack, XRP and ADA were stolen, estimated at $4.5 million.

CoinBene

Users reported an unusual activity related to hacking on a Singapore-based crypto exchange CoinBene on March 26, 2019, instead of the crypto exchange being sincere with its users, it denied the attack, rather it switched to maintenance mode.

It is one of the biggest cryptocurrency hacks of all time largely due to denial, giving cyber criminals more time to operate.

The attack caused Coinbene over $100 million loss as the attackers moved the stolen coins to different exchanges. Up till today, CoinBene has not recovered from the attack and it has been delisted from coinmarketcap.

Recap:

In summary, crypto hacks, dates of attacks, and the amount that was stolen can be seen in the table below:

| Affected Exchange | Value of assets lost in USD | Date of Attack |

| Africrypt | *$3.6 billion* | April 13, 2021 |

| MT GoX | $725 million | 2011 to 2014 |

| Ronin Network | $625 million | March 23, 2022 |

| Poly Network | $610 million | August 10, 2021 |

| Coincheck | $560 million | January 26, 2018 |

| Warmhole | Over $320 | February 2, 2022 |

| Kucoin | $285 million | September 25, 2020 |

| Bitmart | $200 million | December 4, 2021 |

| Beanstalk | $182 million | April 17, 2022 |

| BitGrail | $170 million | February 10, 2018 |

| Bithumb | $7 million $30 million $20 million $30 million | February 2017 June 20, 2018 March 29, 2019 June 19, 2019 |

| CoinBene | Over $100 million | March 26, 2019 |

| Bitfinex | Over $78 million | August 2, 2016 |

| Zaif | $60 million | September 14, 2018 |

| Upbit | $49 million | November 26, 2019 |

| PancakeBunny | $45 million | May 19, 2021 July 16, 2021 |

| Binance | $40.7 million | May 7, 2019 |

| Coinrail | $40 million | June 10, 2018 |

| Bitpoint | $32 million | July 11, 2019 |

| Bancor | $23.5 million | July 9, 2018 |

| Cryptopia | $16 million | January 14, 2019 |

| DragonEx | $7 million | March 24, 2019 |

| BiTrue | Over $4.5 million | June 27, 2019 |

| PolyBunny | $2 million | July 16, 2021 |

Cryptocurrency exchanges are today most targeted by hackers since they know dubious ‘success’ access could net them assets worth billions of US dollars.

Most importantly, under-18 crypto lovers who might be interested in investing small portions of their savings must carefully pay attention to crypto trading security tips.

I hope that blockchain experts and crypto exchange owner step up their game to make the crypto and the decentralized finance industry more secure for users.