Do you know that you can lose a multi-million naira or dollar contract simply by failing to file annual returns? Organizations abroad take business records seriously before signing any contract.

Filing annual returns for your company or business is not only a way to generate revenue for the government, but it is also proof of compliance—especially if you offer services that extend beyond Nigeria’s borders.

For example, if you want to partner with companies in the Americas or Europe, you will often be instructed to submit a Company Information Sheet (CIS). The CIS is used for identity verification and contains all the information that confirms your business is legitimate and operates as claimed, which is similar to CAC annual filing record.

This article highlights what you will gain from keeping your business records up to date on the CAC (Corporate Affairs Commission) database.

What the Law Says

Section 370 of the Companies and Allied Matters Act (CAMA) 2020 stipulates that a company or business must file annual returns within 42 days after its Annual General Meeting (AGM) with the CAC. Failure to comply attracts penalties.

So, what are the benefits of filing annual returns in Nigeria?

Avoidance of Bulky Penalty Fees

The cost of filing annual returns is N5,000 for both Business Name (BN) and Limited companies. However, the penalty fee for late filing is higher: N5,500 for BN and N6,500 for Limited. Now, imagine you failed to file your company’s annual returns for 10 years—you’d be paying significantly more in penalties than the actual filing fees.

Preventing Removal from the CAC Database

In some cases, the CAC may strike off a Business Name or Limited Company that has defaulted on annual filing for 15 years or more. While this is redeemable by paying the outstanding fees, it can damage your business reputation.

If a potential partner—whether local or international—checks your compliance on CAC Search Portal and sees you’re a defaulter, it could hurt your chances of closing a deal.

Such prolonged defaults could amount to penalties of N500,000 or more, depending on how many years are involved. Regular filing ensures compliance and minimizes this risk.

Protecting Your Corporate Image

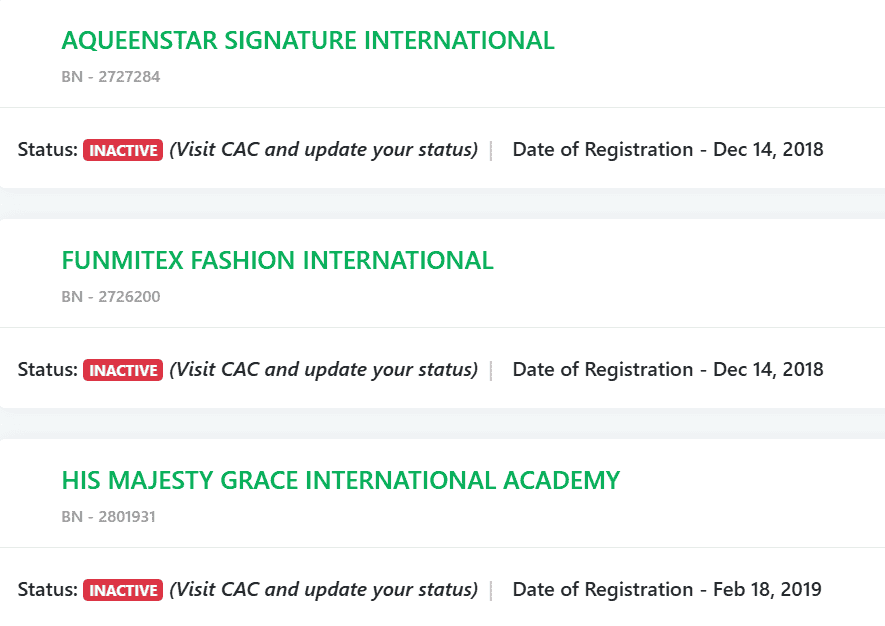

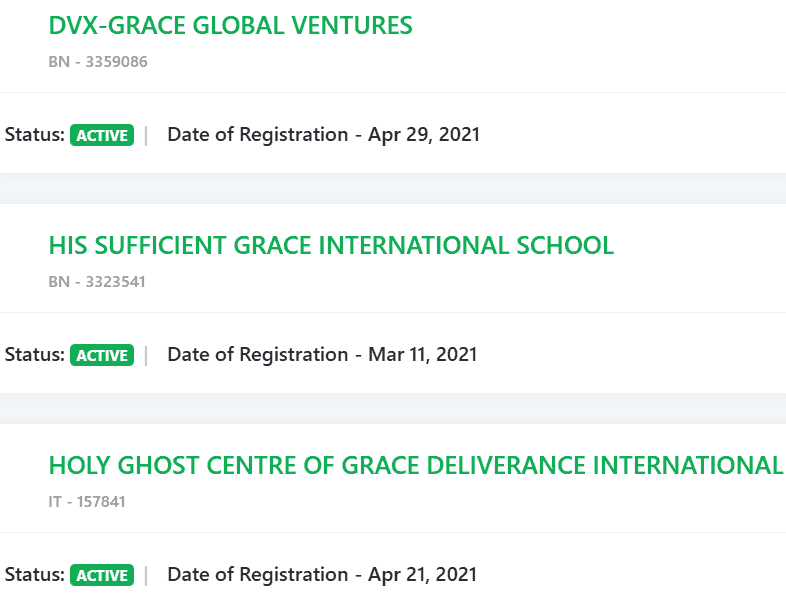

Stakeholders and potential partners don’t take defaulters seriously. When they check your business record and find it marked as “INACTIVE” or “STRIKE OUT,” it creates a negative impression. It signals that you or your company may not be serious or trustworthy.

You might ask: Why do people check your CAC status? It’s part of their due diligence before signing any deal with you.

Ensures Smooth Business Transition

There are cases where a Business Name wants to upgrade to a Limited Company. Such a transition cannot proceed smoothly if annual returns are not up to date—unless all outstanding returns are cleared.

The same applies to Limited companies wanting to change directors or restructure into a group of companies. Up-to-date filings are a prerequisite for such corporate changes.

Access to Government Tenders

Many government contracts and tenders require proof of compliance with statutory obligations, including annual returns. Timely filing enables your business to participate in government procurement processes and expand market opportunities.

Enhances Access to Credit Facilities

Another benefit of filing annual returns is that it boosts your business’s credibility. For instance, if a financial institution is reviewing loan applications and sees that one applicant is “STRIKE OUT” while another is “ACTIVE” on the CAC portal, it might assume the former is no longer in operation. Regular filing improves your chances of loan approval.

Conclusion

Filing annual returns is not just a legal requirement—it’s a strategic move that can save your business from unnecessary penalties and lost opportunities. It also prepares you for emergencies. Imagine needing to submit up-to-date company records for a billion-naira bid within 48 hours. You can’t cut corners when it comes to statutory compliance. Do it as and when due—the penalties are avoidable.

Do you have questions about the status of your business name or company on the CAC portal? Drop your question in the comment section or message us on WhatsApp for assistance.