Last updated on March 1st, 2024 at 07:14 pm

Some of the licensed Bureau De Change (BDC) operators in Nigeria use unbelievable and ridiculous names to obtain operating licenses from Nigeria’s apex bank, a list on the website of the Central Bank of Nigeria has revealed.

Among the funny business names used by the operators include Deadlist BDC LTD, Ephesians-three-twenty BDC LTD, and Deep Freezer BDC LTD.

One of them used a branded name such as Disney BDC LTD. Disney is associated with an American multinational mass media and entertainment conglomerate based in California.

Here is the list of embarrassing business names used by some BDC operators:

- Deep Freezer BDC LTD

- Rice and Beans BDC LTD

- Cream BDC LTD

- Couple BDC LTD

- Slow Down BDC LTD

- Decorum BDC LTD

- Ephesians-three-twenty BDC LTD

- Deluge Gain BDC LTD

- Young Free & Single BDC LTD

- Face To Face BDC LTD

- CCTV BDC LTD

- Exotic Tourist BDC LTD

- Chelsea BDC LTD

- His grace BDC LTD

- Fullmoon BDC LTD

- Cruising BDC LTD

- Day by day BDC LTD

- Deadlist BDC LTD

- Home alone BDC LTD

- Happy Ends LTD

- Fourteen February BDC LTD

- Lake Chad BDC LTD

- 10-20 Times BDC LTD

- You and Me BDC LTD

- Hourglass BDC LTD

- JJC BDC LTD

- Divine Focus BDC LTD

- Four to five BDC LTD

- Go-well BDC LTD

- Honeymoon BDC LTD

- In to in BDC LTD

- Looking and seeing BDC LTD

- Gucci BDC LTD

- Lovers BDC LTD

- Pros and Cons BDC LTD

- Select and Pay BDC LTD

- Set up BDC LTD

- SIX Six Six BDC LTD

- Zero to Ten BDC LTD

- Zuma Rock Global BDC LTD

- Everlasting Glory BDC LTD

Are they registered?

A check on the Corporate Affairs Commission (CAC), an agency of government that registers businesses in Nigeria, shows that the names used by these operators could not be found on the database of registered businesses in the country.

Officially, it is extremely difficult to get a ‘contract’ from the government without being registered, but the ones on this list are among FX firms that would get $20,000 weekly allocation from the CBN.

According to Companies and Allied Matters Act 2020, CAC certificate is an essential requirement in setting up a business in Nigeria.

Proliferation of BDC operations

In 2006, there were less than 100 of them with operating licenses, they all got about $30 million from Nigeria’s apex bank.

In 2009, the number has grown to at least 1,147 with $200 million allocation from the CBN and two years after (2021), the number of BDC grew astronomically to 5,500 with $110 million weekly allocation.

At some point the former governor of CBN Godwin Emefiele discontinued the sales of weekly forex to BDCs, stating that some of them were being used as a conduit of money laundry and for illegal activities.

But that would not stop the apex bank from even issuing more BDC operating licenses.

At the time of publication, the number of BDCs on CBN portal was 5,687, each of them would get a $20,000 allocation from the CBN, translating to $113,740,000 weekly purchase from Nigeria’s apex bank.

But the Yemi Cardoso-led apex bank, which scrutinized the operators before activating sales of FX to them, has revoked the operational licenses of over 4,000 of them in a new update.

As of February 27, 2024, about 1,373 dollar sellers/buyers have been screened to get the allocation.

Earlier, the CBN promised to sell dollars to the BDC at N1,301/$, meaning BDCs will buy at N1,301 and sell at ₦1,314.01.

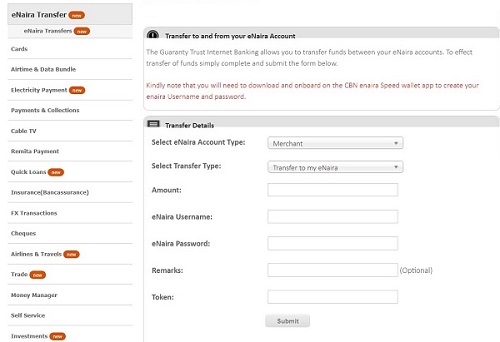

“To this end, the CBN has approved the sale of foreign exchange to eligible Bureau De Change to meet the demand for invisible transactions. The sum of $20,000 is to be sold to each BDC at the rate of N1,301/$- (representing the lower band rate of executed spot transactions at NAFEM for the previous trading day, as of today, 27th February 2024).

“All BDCs are allowed to sell to end-users at a margin NOT MORE THAN one per cent (1 percent) above the purchase rate from CBN,” according to a circular by the CBN.