From $1.72 on August 1, 2019, to an All-Time High of $85.02 three years after (September 9, 2021), the sudden collapse of FTX token (FTT), remains a mystery in the cryptocurrency market.

Barely 14 months after its ATH, the price of FTX tokens is nearly back to where it started. It can be described as one of the most disastrous collapses of a crypto asset.

The FTX native tokens FTT which was once described as promising by crypto enthusiasts has now found itself in Terra LUNA position, a failed crypto asset founded by Do Kwon.

In this post, Actionable Info outlines the historical data of FTT from the first day it was captured by the World’s largest crypto price-tracking website CoinMarketCap (CMC) on August 1, 2019 till November 11, 2022 when the Alameda Research founder Sam Bankman-Fried announced the official filing for bankruptcy of the company that powered FTX token.

For FTT, it was backed by some of the largest crypto traders in the industry and its glorious moment was unequalled.

At a time, the FTX founder Sam Bankman-Fried or SBF, a Physics graduate at Massachusetts Institute of Technology (MIT), became the second largest individual donor to Joe Biden of the Democratic Party, committing $5.2 million to that course.

He embarked on another political donation to the Democratic Party during the 2022 US midterms elections, committing $40 million to the course, little did investors and traders know FTX and FTX US was near collapse.

Brief History of FTT

FTT is the native cryptocurrency token of the crypto derivatives trading platform FTX. FTX crypto exchange was launched on May 8, 2019, by SBF.

The company is backed by trading firms e.g Almeda Research, Coinbase Ventures, Sequoia Capital, BlackRock, and Temasek among other prominent players in the industry.

Some of the features of FTT is that it only requires one universal margin wallet and also allows a trader to put leveraged positions without having to trade on margin.

Before the parent company collapsed, FTT was ERC20-compatible and could be listed on any spot exchange.

It was initially offering BNB, XRP, TRX, BTC, ETH, USDT, EOS and LEO leveraged tokens until November 11, 2022, when the founder filed for bankruptcy.

FTT Token use cases:

FTT was initially created as a reward for exchange transactions, but its functions grew bigger to include:

1) One-third of the commissions received from transactions on FTX are used to buy back FTT and are burned.

2) Users can stake FTT to benefit from discounts and blockchain fee waivers.

3) The tokens are used to secure futures positions.

4) They are used to reduce trading fees.

5) It also enables members to pay a low fee while obtaining tighter spreads.

6) Above all, traders who are FTX exchange and use FTT as collateral see percentage differences of up to 60%.

Price Historical Data of FTT

Through 2019 when CMC started tracking the market value of FTT, the highest it ever pulled was $2.36 on August 7, 2019. It opened trading in the year at $1.72 with $1,604,662 volume on August 1, 2019.

There were no data for its FTT market capitalization until August 9, 2019, with a market cap of $47,106,797 and closing 2019 at $2.14

January 1 to December 31, 2020

From January towards the end of April, it maintained the $2 mark except for a few days where it dipped below $2 and for the first time since its launch, it crossed $3, closing the day’s trading at $$3.15 on April 29, 2020.

With a little slide below $3, FTX token continued to show some promising features of crypto, it traded above $4 and closed the day at $4.21 on August 30, 2020.

The price of Bitcoin has a major influence on the price of other crypto assets, we saw that playing out on December 17, 2020, when FTT traded briefly at $5.05 during the day and closed the day at $4.87.

Though it pulled back, the $5 mark was a fantastic test that it could actually do better in the crypto market. And it did, closing the 2020 trading at $5.77 with $10,061,941 volume and $544,636,796 market cap.

January 1 to December 31, 2021

Generally, 2021 was a major significant year in the history of cryptocurrency due to a large growing institutional interest in cryptocurrency, especially Bitcoin.

That was when Bitcoin reached its All-Time High, specifically in November 2021. It did influence the prices of other coins and FTX token was no exception as it reached an ATH of $85.02 on September 9, 2021.

The table below shows the highest price of FTT in each month of 2021

| Month | Highest Price for the month |

| January 30, 2021 | $11.98 |

| February 20, 2021 | $34.81 |

| March 15, 2021 | $43.43 |

| April 14, 2021 | $59.56 |

| May 12, 2021 | $63.03 |

| June 3, 2021 | $36.84 |

| July 31, 2021 | $35.62 |

| August 13, 2021 | $54.11 |

| September 9, 2021 | $85.02 |

| October 26, 2021 | $69.66 |

| November 9, 2021 | $65.73 |

| December 1, 2021 | $51.66 |

FTT Price from January 1, 2022 To Date

While 2021 could be described as the breakthrough for FTT, 2022 wasn’t a rosy one. Other cryptos were also not left out.

The infamous collapse of the Terra token around May 2022 compounded the situation across the crypto market. The year seemed like crypto investors were jinxed to lose what they gained in 2021.

FTT price opened the year at $38.31, closing the day’s trading at $40.20 with $104,359,675 trading volume and $5,585,195,041 market cap.

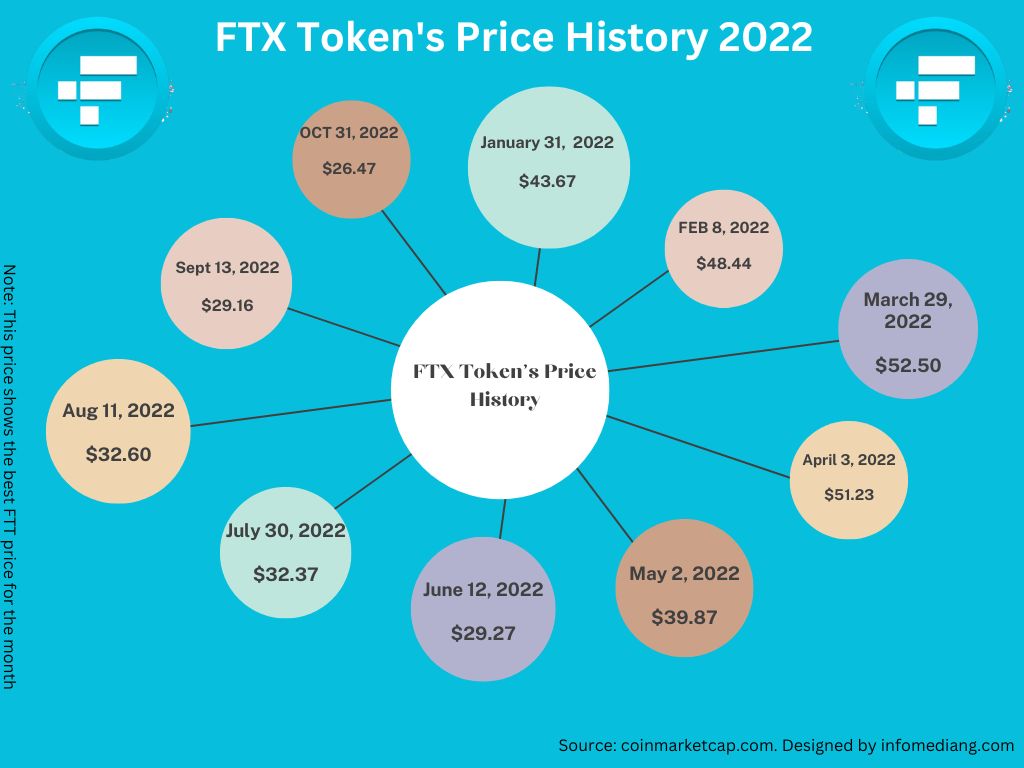

What’s the highest price for FTT in 2022?

A check on the price history of FTX token in January showed that $49.85 was the highest and closing the month at $43.67 as can be seen in the table below:

| Month | The highest price for the month |

| January 31, 2022 | $43.67 |

| February 8, 2022 | $48.44 |

| March 29, 2022 | $52.50 |

| April 3, 2022 | $51.23 |

| May 2, 2022 | $39.87 |

| June 12, 2022 | $29.27 |

| July 30, 2022 | $32.37 |

| August 11, 2022 | $32.60 |

| September 13, 2022 | $29.16 |

| October 31, 2022 | $26.47 |

FTX Token Price in November 2022

| Date | Open | High | Close |

| November 1 | $26.11 | $26.40 | $25.87 |

| November 2 | $25.87 | $26.22 | $25.03 |

| November 3 | $25.03 | $25.33 | $24.36 |

| November 4 | $24.36 | $25.80 | $25.47 |

| November 5 | $25.47 | $25.81 | $24.06 |

| November 6 | $24.06 | $24.83 | $22.27 |

| November 7 | $22.26 | $23.15 | $22.14 |

| November 8 | $22.14 | $22.14 | $5.52 |

| November 9 | $5.52 | $6.25 | $2.30 |

| November 10 | $2.29 | $4.20 | $3.52 |

| November 11 | $3.52 | $3.68 | $2.59 |

| November 12 | $2.59 | $2.61 | $2.09 |

| November 13 | $2.09 | $2.17 | $1.49 |

| November 14 | $1.49 | $1.74 | $1.47 |

| November 15 | $1.47 | $1.99 | $1.84 |

The LUNA Case

In May 2022, Luna was connected to TerraUSD (UST), the algorithmic stablecoin of the Terra network, thereby leading to a crash of its coin.

By May 7, over $2 billion worth of UST was taken off the Anchor Protocol while hundreds of millions of it were quickly liquidated and trouble set in.

Those who envisaged the collapse of LUNA engaged in panic sales of their LUNA coins, thereby crashing the price of UST to below $1 prompting several exchanges to delist LUAN and UST pairings from their platforms.

LUNA was abandoned and never recovered to date. At the time of publication, it is worth $1.65.

Although, the original Terra has re-branded to Terra Classic and a new chain is created with the existing Terra name.

FTX Collapse

In a similar collapse, FTX tokens crumbled like the Wall of Jerico partly following a tweet by Binance CEO, CZ, that the largest crypto trading platform would be exiting from FTX equity by selling off its FTT tokens.

Though Coindesk had earlier published a report that most of Alameda’s holdings were in FTT, CZ’s announcement seemed to have triggered a massive sell-off leading to declining in FTT token price, pushing FTX to insolvency.

And by November 8, Binance announced that it considered bailing out the troubled FTX, but made a surprising U-turn the second day after looking at the ‘red’ books.

Several online publications including Coindesk reported that FTX was “run by a gang of kids in the Bahamas” and its founder Bankman-Fried aka SBF allegedly dated Alameda CEO.

In quick succession, allegations rolled in about how Bankman-Fried secretly moved $10B in customer funds from FTX to Alameda. At least $1B of that is missing, due to the secrecy of the transfer.

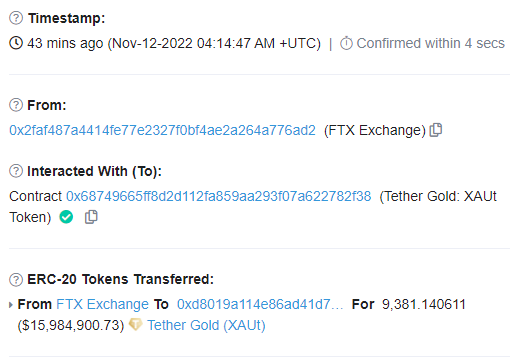

A few minutes after, it was reported that millions of dollars started moving from FTX to anonymous wallets in what the new CEO John Ray called it an overnight hack which has some similarities in the manner Mt.Gox ended.

And by Tuesday, November 8, 2022, the price of FTT had collapsed from $22.14 to $5.52.

The heat and the damning revelations around the operations of FTX and its coin FTT were too enormous prompting SBF to announce the bankruptcy of FTX and FTX.US on November 11, 2022.

An irreparable collapse set in immediately after SBF filed chapter 11 of bankruptcy, pushing down the price of FTT tokens even further. At the time of publication, the price of FTX token $1.46

Bloomberg says the entire $16 billion fortune of SBF was wiped out, describing it as “one of history’s greatest-ever destructions of wealth.”

What impact will FTX bankruptcy have on the crypto industry?

There are fears that the collapse of FTX token might put pressure on other cryptos and spark disastrous withdrawals in the days ahead.

According to the Senior Group Product Manager at Reddit Peter Yang, “It will be a long time (maybe never) before people will trust this industry again.”

Final thought:

The price of FTX token doesn’t look like there is ever going to be any hope for a recovery, will it rebrand like Do Kwon’s Terra?

Will crypto investors trust any future crypto product by these young guys alleged to have secretly disappeared?

Will it be easy for anyone to predict FTX token price?

References:

- Coinmarketcap. “Historical Data for FTX Token”. coinmarketcap.com

- Forbes (September 20, 2022). “What Really Happened To LUNA Crypto?”. forbes.com

- Tracy Wang (November 10, 2022). “Bankman-Fried’s Cabal of Roommates in the Bahamas Ran His Crypto Empire – and Dated. Other Employees Have Lots of Questions”. coindesk.com

- Peter Yang (November 12, 2022).” Who is SBF and how did he go from being crypto’s savior to the man that brought a trillion-dollar industry to its knees?”. linkedin.com

- Whitepaper: “FTX Token”. whitepaper.io