You will need a CSCS account if you want to invest or trade in shares, stocks, bonds, and other securities traded on the Nigerian capital market.

What is CSCS?

It means Central Securities Clearing System, which is the Central Depository for the Nigerian capital market with the responsibility for storing, clearing and settlement of securities transactions.

The Central Securities Clearing System Plc started operations in 1997 as the major financial infrastructure for the Nigerian capital market. It is a subsidiary of the Nigerian Exchange Limited (NGX).

Types:

- Individual account

- Corporate account

Requirements:

- Brokerage Account Opening Forms

- A CSCS Account Opening Form

- A Passport Photo

- Utility Bill

- A means of Identification (either of National ID, Drivers’ License, or International Passport).

- Incorporation documents of the company (for corporate).

- A board resolution approving the opening of the investment account will be required (for corporate).

You can’t independently open cscs account, follow this process to get an account for trading stocks:

- Reach out to a registered and active stockbroker, you can find the list on the official website of NGX or check them here.

- Deposit a certain minimum amount for trading stocks.

- Your CSCS account will be processed after supplying the required documents (whether as an individual or corporate account, see below.)

- Your stockbroker examines and forwards the documents to CSCS.

- You will receive details of your CSCS account, including a trading account number and a Clearing House number (CHN).

NOTE: The CHN links your account to the stockbroking house.

Reasons for the establishment CSCS Plc

1) To aid in strengthening the capital market and ensure investors have a better investing experience.

2) Before the establishment of the CSCS, there were inadequacies in the system which discouraged investors from investing. For example, the delivery of share certificates may typically range from 3 to 12 months, and settlement of transactions could take several weeks.

3) Verification of signatures was an enormous task and was one of the reasons why transactions were not enabled easily.

4) There were also cases where certificates were misplaced, lost and even stolen.

5) The total market risk was very high due to undue delays in processing trades. These delayed transaction cycles gave opportunities for manipulations by operators.

6) There was a general lack of transparency and trust in the market.

How Will I Get a Clearing House Number?

A Clearing House Number (CHN) will be assigned to you after a successful setup of your CSCS account.

With this unique account number, you can acquire more shares, trade what you already have, or even transfer ownership to your dependent as you deem fit.

Importance of CHN

- It makes it easier to monitor your investment portfolio.

- You can track your dividends with it.

- With CHN, you to make faster investment decisions at the point of sale/purchase of stock.

- It gives you online access to stock position irrespective of location

- It improves inter-house stock transfer.

- It is necessary for the processing of e-dividend, e-bonus and e-ipo, which is now the global best practices, thereby eliminating the problem of the manual process of sending dividends.

- With an account number, you qualify for a quarterly official cscs statement that will be sent to your inbox.

- It is more time-saving for you when you want to check updates on your investment.

- It enables you to gain access to cross-dealing.

- The issue of misplacement that is associated with a physical certificate is eliminated by having a CSCS account.

How To Prevent Fraud on Your CSCS Account

Subscribing to the CSCS Trade Alert is one sure way to stay informed about activity on your account. With this service, you will receive notifications whenever a transaction occurs in your account. This will help you monitor any suspicious activity by your broker.

Questions and Answers

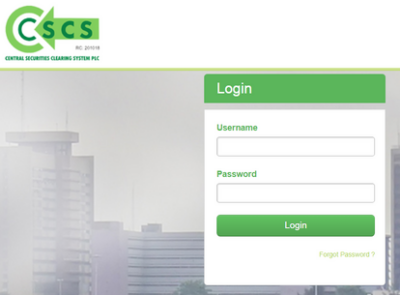

How can I login to my CSCS account?

Use portal.cscs.ng/home/login to access your cscs account, if you don’t have the details, contact your stockbroker.

Can I use my CSCS account holdings and stocks for expression of financial worthiness at embassies and foreign universities?

Embassies often require evidence of financial stability or sufficient funds to cover expenses during a visit or study period.

Providing documentation of assets, including holdings and stocks in a CSCS account, could demonstrate financial capacity, especially if the value of those assets meets or exceeds the requirements set by the embassy.

How can I update my details?

To update your account, send an email to your stockbroker. You need to pass through your stockbroker for security reasons.

What do I need for CSCS biometric capture system?

- Any of the following means of ID: National ID Card, or International Passport, Driver’s License, Voter’s Card

- Your CHN (Clearing House Number)

- Name of Stockbroker

- Your BVN

- Investor’s Bank account number.

How can I claim my dividends?

Check our guide on recovering abandoned dividends or contact the registrar managing the shares of the company you bought.

What’s the cost of getting CHN?

Opening a CSCS account is generally free but your stockbroker may charge you a small amount to cover the administrative cost or deposit a certain amount for trading.

Takeaway

It isn’t like a bank account account where you can walk into a banking hall, you need to first open an account with an accredited and active stockbroker before you can open a CSCS account.

Thanks for the wonderful and detailed write up .

I am an investor of 25 years . I used to teach it at NYSC orientation camp but Nigerians cheat themselves with road side gossip on Capital market and a few bad eggs of stockbrokers .

Thanks so much .

Hello Mr. Ilesanmi. Hundreds of Nigerians need more enlightenment about the capital market and investing. Thanks for the kind words.